Commercial Farmer Affidavit Form

What is the Commercial Farmer Affidavit

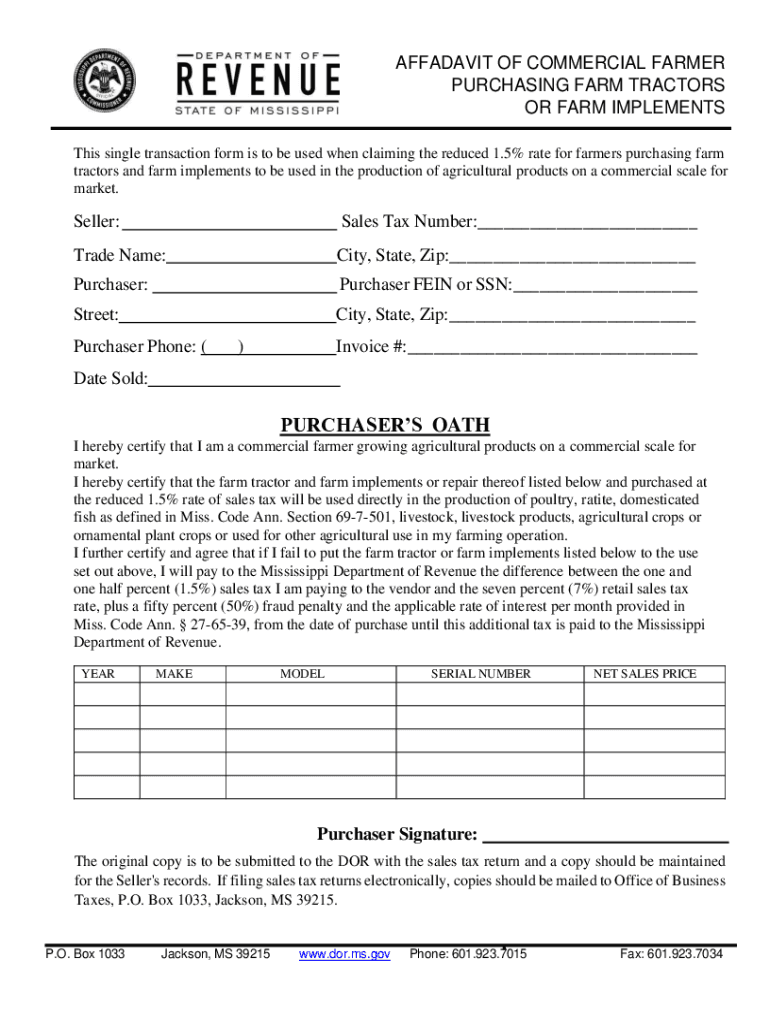

The Commercial Farmer Affidavit is a legal document that certifies an individual or entity as a commercial farmer in Mississippi. This affidavit is essential for farmers seeking certain tax exemptions and benefits related to agricultural operations. By completing this affidavit, farmers can affirm their status and eligibility for various programs, including tax relief on equipment purchases and other agricultural-related expenses.

Steps to complete the Commercial Farmer Affidavit

Completing the Mississippi farm tax affidavit involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including personal identification details, farm location, and types of agricultural products produced. Next, accurately fill out the affidavit form, ensuring all sections are completed. It is crucial to review the document for any errors before signing. Finally, submit the completed affidavit to the appropriate state department or agency, either electronically or via mail, as specified by local regulations.

Legal use of the Commercial Farmer Affidavit

The legal use of the Commercial Farmer Affidavit is primarily to establish a farmer's eligibility for tax exemptions and benefits. This affidavit must be completed in accordance with state laws to be considered valid. It serves as proof of the farmer's operational status and can be used in various legal and financial contexts, including tax filings and applications for grants or loans. Ensuring compliance with all legal requirements is vital to avoid penalties or denial of benefits.

Required Documents

To complete the Commercial Farmer Affidavit, certain documents may be required. Typically, these include proof of identity, such as a driver's license or state ID, and documentation of agricultural operations, which may consist of tax returns, business licenses, or records of agricultural sales. It is advisable to check with local authorities for any additional documentation that may be necessary to support the affidavit submission.

Eligibility Criteria

Eligibility for the Commercial Farmer Affidavit generally requires the applicant to be actively engaged in farming operations within Mississippi. This includes individuals or entities producing agricultural products for sale. Specific criteria may vary based on local regulations, but applicants typically need to demonstrate their farming activities and provide evidence of their commercial status. Understanding these criteria is essential to ensure successful completion and acceptance of the affidavit.

Form Submission Methods

The Mississippi farm tax affidavit can be submitted through various methods, depending on local regulations. Common submission methods include online submission via designated state portals, mailing the completed form to the appropriate agency, or delivering it in person. Each method may have specific requirements and processing times, so it is important to verify the preferred submission method for your locality to ensure timely processing.

Quick guide on how to complete commercial farmer affidavit

Complete Commercial Farmer Affidavit effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed paperwork, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Handle Commercial Farmer Affidavit on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and electronically sign Commercial Farmer Affidavit without stress

- Obtain Commercial Farmer Affidavit and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive data using tools specially provided by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to finalize your modifications.

- Select your preferred method for sending your form, be it by email, text (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that require new document copies to be printed. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Commercial Farmer Affidavit and ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the commercial farmer affidavit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Mississippi farm tax affidavit?

A Mississippi farm tax affidavit is a legal document used by farmers to claim exemptions from certain taxes. This affidavit certifies that the individual qualifies for agricultural exemptions based on their farming operations. Understanding this document is crucial for managing tax liabilities effectively.

-

How can airSlate SignNow help with my Mississippi farm tax affidavit?

airSlate SignNow streamlines the process of sending and eSigning your Mississippi farm tax affidavit. Our platform allows you to easily create, manage, and securely sign documents from anywhere, saving you precious time and effort on compliance matters. With user-friendly features, it's designed for both individuals and businesses.

-

Is there a cost for using airSlate SignNow for my Mississippi farm tax affidavit?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including features necessary for handling your Mississippi farm tax affidavit. We provide a cost-effective solution that ensures you get the most value for handling your documents efficiently. Explore our plans to find one that suits your budget.

-

What features does airSlate SignNow offer for agricultural professionals?

airSlate SignNow includes features like reusable templates, document tracking, and secure document storage, which are beneficial for agricultural professionals handling Mississippi farm tax affidavits. These features simplify the process of managing multiple documents while ensuring compliance and security. This functionality makes it easier to focus on your farming operations.

-

Can I integrate airSlate SignNow with other tools for managing my taxes?

Absolutely! airSlate SignNow integrates seamlessly with various platforms, enabling you to manage your taxes and documentation, including the Mississippi farm tax affidavit, efficiently. This integration means you can synchronize data between tools for streamlined operations, saving you time during the tax season.

-

What are the benefits of using airSlate SignNow for tax affidavits?

Using airSlate SignNow for your Mississippi farm tax affidavit provides benefits like enhanced efficiency and improved document security. By digitizing your paperwork, you reduce the risk of errors and ensure your documents are accessible from anywhere. This enhances the overall management of your farming documents.

-

How secure is my Mississippi farm tax affidavit with airSlate SignNow?

airSlate SignNow prioritizes your document security, ensuring your Mississippi farm tax affidavit is protected through encryption and secure cloud storage. Our platform complies with industry standards, providing peace of mind that your sensitive information is managed safely. This security feature is vital for maintaining your privacy and confidentiality.

Get more for Commercial Farmer Affidavit

Find out other Commercial Farmer Affidavit

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now