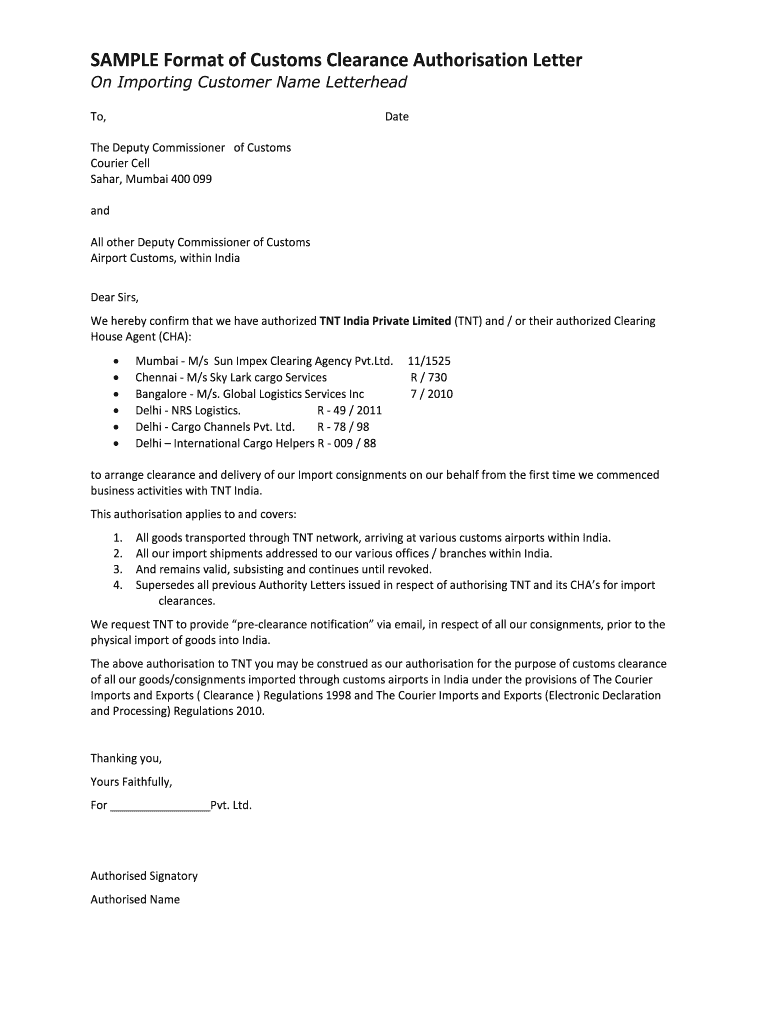

Letter for Customs Clearance Sample Form

What is the letter for customs clearance sample?

The letter for customs clearance sample is a formal document used to facilitate the customs clearance process for goods being imported or exported. This letter typically includes essential details about the shipment, such as the sender's and recipient's information, a description of the goods, and the intended purpose of the shipment. It serves as a declaration to customs authorities, ensuring that all necessary information is provided for the clearance process to proceed smoothly.

Key elements of the letter for customs clearance sample

When preparing a letter for customs clearance, several key elements must be included to ensure its effectiveness:

- Sender and recipient details: Full names, addresses, and contact information of both parties.

- Shipment description: A detailed description of the goods, including quantity, value, and any relevant product codes.

- Purpose of shipment: Clearly state whether the goods are for personal use, resale, or other purposes.

- Customs declaration: A statement confirming that all information provided is accurate and complete.

- Signature: The letter should be signed by the sender or an authorized representative to validate its authenticity.

Steps to complete the letter for customs clearance sample

Completing a letter for customs clearance involves a systematic approach to ensure all necessary information is accurately captured:

- Gather information: Collect all relevant details about the shipment, including sender and recipient information.

- Draft the letter: Use a clear and professional format to outline the necessary elements, as mentioned above.

- Review for accuracy: Double-check all information for accuracy, ensuring there are no discrepancies that could delay clearance.

- Sign the letter: Ensure that the letter is signed by the appropriate individual to confirm its legitimacy.

- Submit to customs: Provide the completed letter along with any other required documents to customs authorities.

Legal use of the letter for customs clearance sample

The letter for customs clearance sample must adhere to legal standards to be considered valid. It should comply with the regulations set forth by the U.S. Customs and Border Protection (CBP). This includes providing accurate and truthful information, as any misrepresentation can lead to penalties or legal consequences. Additionally, using a compliant digital signature solution, like signNow, ensures that the letter is legally binding and recognized by authorities.

How to use the letter for customs clearance sample

Using the letter for customs clearance sample effectively involves understanding its role in the customs process. This letter should be included with other documentation, such as invoices and packing lists, when submitting goods for clearance. It acts as a formal declaration to customs officials, providing them with the necessary information to assess the shipment. Ensure that the letter is easily accessible and presented in an organized manner to facilitate a smooth clearance process.

Required documents for customs clearance

In addition to the letter for customs clearance, several other documents are typically required to complete the customs process:

- Commercial invoice: A detailed bill outlining the goods being shipped, their value, and terms of sale.

- Packing list: A document that details the contents of the shipment, including weights and dimensions.

- Bill of lading: A legal document between the shipper and carrier that outlines the terms of transport.

- Import/export permits: Any necessary licenses or permits required for specific goods.

Quick guide on how to complete sample format of customs clearance authorisation letter

A concise manual on how to prepare your Letter For Customs Clearance Sample

Finding the appropriate template can prove difficult when you need to deliver official foreign documents. Even if you've got the necessary form, it may be cumbersome to swiftly prepare it according to all the criteria if you rely on printed copies instead of managing everything digitally. airSlate SignNow is the online eSignature service that aids you in overcoming these hurdles. It enables you to acquire your Letter For Customs Clearance Sample and promptly complete and sign it on-site without needing to reprint documents if you make a mistake.

Here are the steps you must follow to prepare your Letter For Customs Clearance Sample with airSlate SignNow:

- Click the Get Form button to import your document into our editor immediately.

- Begin with the first empty field, enter details, and proceed with the Next option.

- Complete the blank fields using the Cross and Check options from the toolbar above.

- Choose the Highlight or Line features to emphasize the most important information.

- Click on Image and upload one if your Letter For Customs Clearance Sample requires it.

- Utilize the right-side pane to add more fields for yourself or others to fill out if necessary.

- Review your entries and confirm the form by clicking Date, Initials, and Sign.

- Sketch, type, upload your eSignature, or capture it using a camera or QR code.

- Complete the form modifications by clicking the Done button and selecting your file-sharing preferences.

Once your Letter For Customs Clearance Sample is ready, you can share it in whichever way you prefer - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely store all your finished documents in your account, organized in folders based on your choices. Don’t waste time on manual form filling; experiment with airSlate SignNow!

Create this form in 5 minutes or less

FAQs

-

How do I mail a regular letter to Venezuela? Do I need to fill out a customs form for a regular letter or do I just need to add an international mail stamp and send it?

You do not need to fill out a customs form for a regular letter sent from the US to any other country. Postage for an international letter under 1 ounce is currently $1.15. You may apply any stamp - or combination of stamps - which equals that amount.

-

How should be the format of the employer reference letter to be provided for Canada immigration? Is there a sample template that works?

Hi, companions! Composing an immigration letter of recommendation may be hard sometimes, especially if you do not what to start with. But you should not worry about it. You should make an investigation and get to know as much as possible information about writing it. There is a list of requirements by which a future immigrant should be characterized such as responsible, law-obedient, hard-working. They should also tell about your experience and your good qualities.This arrangement will assist you with composing such a letter at the decent level:• find an example, it will give you the idea of the whole process• there are the templates for writing, but your letter would be more professional if you do it adhering to the requirements• you should understand that a letter of recommendation should be positiveIt is not so difficult to compose such a letter, you just have to follow the rules.

-

How do I get a good sample of people, only from specific cities like Los Angeles, New York, or San Diego, to vote on my online poll or fill out my short survey online?

What about posting in their local Craigslist?

-

What is the importer declaration document under a custom clearance of import cargo?

Documents required for import customs clearance in IndiaThis is one of the important articles in export and import trade –What are the documents required for Import clearance? One of frequently asked questions is ‘documents required for import clearance’Unlike other articles, I can not provide a ‘capsule’ solution on this article about documents required for import customs clearance. I will explain reason behind it. First of all, let me clarify: the documents required for import clearance under all products are not same. However, we can discuss about the common documents required for import customs clearance in importing countries. I will provide you a some general information on documentation of import customs clearance from which you can have a common idea on the subject. I hope, this information helps you a lot to know about documents required for import clearance generally.Since various types of commodities are imported from different countries, a complete list of documents for import customs clearance procedures can not be provided. More over, different countries have their own policies in turn different procedures and formalities for import clearance. Each product under import and export is classified under a code number accepted globally which is called ITC number.There may have bilateral import export agreements between governments of different countries. Imports and exports from such countries may have exemptions on documentation for export and import clearance.However there are legal documents, common documents and specific documents on commodity basis required to complete import customs procedures.Let us discuss some of the common documents required for import customs clearance procedures and formalities in some of the importing countries.Bill of Entry:Bill of entry is one of the major import document for import customs clearance. As explained previously, Bill of Entry is the legal document to be filed by CHA or Importer duly signed. Bill of Entry is one of the indicators of ‘total outward remittance of country’ regulated by Reserve Bank and Customs department. Bill of entry must be filed within thirty days of arrival of goods at a customs location.Once after filing bill of entry along with necessary import customs clearance documents, assessment and examination of goods are carried out by concerned customs official. After completion of import customs formalities, a ‘pass out order’ is issued under such bill of entry. Once an importer or his authorized customs house agent obtains ‘pass out order’ from concerned customs official, the imported goods can be moved out of customs. After paying necessary import charges if any to carrier of goods and custodian of cargo, the goods can be taken out of customs area to importer’s place. For further read: How to file Bill of Entry online? How to file Bill of Entry manually? Can Bill of Entry be filed before arrival of goods at destination?Commercial Invoice.Invoice is the prime document in any business transactions. Invoice is one of the documents required for import customs clearance for value appraisal by concerned customs official. Assessable value is calculated on the basis of terms of delivery of goods mentioned in commercial invoice produced by importer at customs location. I have explained about the method of calculation of assessable value in another article in same web blog. The concerned appraising officer verifies the value mentioned in commercial invoice matches with the actual market value of same goods. This method of inspection by appraising officer of customs prevents fraudulent activities of importer or exporter by over invoicing or under invoicing. So Invoice plays a pivotal role in value assessment in import customs clearance procedures. Read more: How to prepare Commercial Invoice? Contents of Commercial Invoice. Difference between proforma Invoice and Commercial Invoice. Howmany types of Bills of Entry in India?Bill of Lading / Airway bill :BL/AWB is one of the documents required for import customs clearance.Bill of lading under sea shipment or Airway bill under air shipment is carrier’s document required to be submitted with customs for import customs clearance purpose. Bill of lading or Airway bill issued by carrier provides the details of cargo with terms of delivery. I have discussed in detail about Bill of Lading and Airway bill separately in this website. You can go through those articles to have a deep knowledge about documents required for import customs clearance. Read more about:Different types of Bill of Lading When to release Bill of Lading? Importance of Bill of LadingImport LicenseAs I have mentioned above, import license may be required as one of the documents for import customs clearance procedures and formalities under specific products. This license may be mandatory for importing specific goods as per guide lines provided by government. Import of such specific products may have been being regulated by government time to time. So government insist an import license as one of the documents required for import customs clearance to bring those materials from foreign countries.Insurance certificateInsurance certificate is one of the documents required for import customs clearance procedures. Insurance certificate is a supporting document against importer’s declaration on terms of delivery. Insurance certificate under import shipment helps customs authorities to verify, whether selling price includes insurance or not. This is required to find assessable value which determines import duty amount.Purchase order/Letter of CreditPurchase order is one of the documents required for import customs clearance. A purchase order reflects almost all terms and conditions of sale contract which enables the customs official to confirm on value assessment. If an import consignment is under letter of credit basis, the importer can submit a copy of Letter of Credit along with the documents for import clearance. Also read How does Letter of Credit work?Technical write up, literature etc. for specific goods if anyTechnical write up, literature of imported goods or any other similar documents may be required as one of the documents for import clearance under some specific goods. For example, if a machinery is imported, a technical write up or literature explaining it’s function can be attached along with importing documents. This document helps customs official to derive exact market value of such imported machinery in turn helps for value assessment.Industrial License if anyAn industrial license copy may be required under specific goods importing. If Importer claims any import benefit as per guidelines of government, such Industrial License can be produced to avail the benefit. In such case, Industrial license copy can be submitted with customs authorities as one of the import clearance documents.RCMC. Registration cum Membership Certificate if anyFor the purpose of availing import duty exemption from government agencies under specific goods, production of RCMC with customs authorities is one of the requirements for import clearance. In such cases importer needs to submit Registration Cum Membership Certificate along with import customs clearance documents.Test report if anyThe customs officials may not be able to identify the quality of goods imported. In order to assess the value of such goods, customs official may draw sample of such imported goods and arranges to send for testing to government authorized laboratories. The concerned customs officer can complete appraisement of such goods only after obtaining such test report. So test report is one of the documents under import customs clearance and formalities under some of specific goods.DEEC/DEPB /ECGC or any other documents for duty benefitsIf importer avails any duty exemptions against imported goods under different schemes like DEEC/DEPB/ECGC etc., such license is produced along with other import clearance documents.Central excise document if anyIf importer avails any central excise benefit under imported goods, the documents pertaining to the same need to be produced along with other import customs clearance documents.GATT/DGFT declaration.As per the guidelines of Government of India, every importer needs to file GATT declaration and DGFT declaration along with other import customs clearance documents with customs. GATT declaration has to be filed by Importer as per the terms of General Agreement on Tariff and Trade.Any other specific documents other than the above mentionedApart from the above mentioned documents, importer has to file additional documents if any required as per the guidelines of government / customs department under import of specific goods.I hope, I could explain you a general idea on documents required for import customs clearance procedures and formalities.

-

Does GST need to be charged for exporting software services to an Australian-based client?

All About GST on Export of Software ServiceGoods & Services Tax (GST):GST is the complete mechanism to bring in numerous indirect taxes under one umbrella and thus rationalising the whole tax system. GST engulfs Central Goods & Services Tax (CGST), Integrated Goods & Services Tax (IGST), State Goods & Services Tax (SGST), Union Territory Goods & Services Tax (UTGST). When any sales are made within a state, then CGST & SGST/ UTGST are applied as GST taxes. When Purchase/ Sales cross the border of a state, then IGST is applied.Zero- rated supplyZero-rated supply meansExport of goods or services orSupply of goods or services to Special Economic ZoneTypes of Business OrganisationsBusiness organisations & operations can be of different types. One, which we are covering here specifically are those which are captive unit. Captive units are those which are controlled and governed by parent company which is located abroad. Whatever the Indian unit does, it is for the foreign parent only. All the services of Indian company are consumed by parent company. Thus operating as a backend office and hence termed as captive unit.Another form of organisation being dealt here is an independent organisation which exports software services to its clients who are located abroad.The difference is that such independent organisations do not cater to only one parent company and is not operating as a backend office for only one client.Taxable Event / Time of SupplyTaxable event means the point of time when provision of service will be taxed. In case of such service exporter, the point of taxable event will be:Place of SupplySince the service is being exported out of India, here the supply will not be the place of consumption of service, rather it will be the place of actual provision of service i.e. India. E.g. Service is being provided from Delhi office and is exported directly to parent company located in USA, or client located in USA, the place of supply will be Delhi.If multiple locations in India are being used to supply such service to foreign company, the point of provision of service will be the place from where invoice is raised. In case the place of supply is not identifiable then place of supply will be the place which is most directly related with such supply.Registration RequirementIf the Indian service provider is already registered under Service Tax, migration is to be done before 30.06.2017 or from 01.07.2017 as per the provisions or arrangements made by Govt.If there is more than one place of such service provision, all of them are to be registered under GST having same PAN but different state GSTIN. IEC (Import Export Code) is to be mentioned while taking registration under GST. Such place of provision of service must be having reasonable permanent establishment from where services can be provided. Registration is required only for the places from where supplies are being made.Export of Software service is not covered under composition scheme, hence, regular registration is to be done. Compulsory registration is required for exporters under GST even if the turnover is less than Rs.20 Lakhs.Value of SupplyValue of supply is the transaction value on which the bills are raised. This transaction value can include incidental expenses like packing, commission, interest or late fee/ penalty for late payment or subsidies but not to include GST. Also, discount in invoices decided after the supply is made cannot be reduced from transaction value.If the transaction value is not determinable, specifically in the case of providing software export service to foreign parent company, Transfer Pricing provisions have to be referred. Hence, Transfer Pricing Study plays an important role and is to be conducted in time with the help of proper consultation.Consumption of ServiceConsumption of outward service here will be in foreign territory. Consumption which actually is to be considered would be inward supplies which will act as input and input tax paid can be claimed as refund. Inward supplies means supplies of goods or services received from vendor for executing software export service.What is INPUTInput means all those services and materials used directly for the purpose of rending the service. In the present scenario, some of the examples of Input would be:Internet facility, Stationery, ConsumablesManpower, Security Guard, Annual MaintenanceComputer maintenance services, Insurance of employeesIt is important to mention that there are various inputs on which input credit is not available. Such inputs include:Motor Vehicles, Food & Beverages, Outdoor Catering, Beauty treatment, Health Services, Cosmetic & Plastic SurgeryMembership of Club, health & fitness centre, Rent-a-cab, life insurance and health insurance.Travel benefits extended to employees on vacation such as leave or home travel concessionWorks contract services for construction of immovable property (except plant & machinery)Supplies received for construction of immovable property (except plant & machinery) taken up on own.Taxes paid to suppliers who are under composition levy scheme., any goods or services used for personal consumptionGoods lost, stolen, destroyed, written off or disposed of by way of gift or free samples.Taxes paid on account of order by department for wilful default, confiscation or detention in transit. Confiscation and detention in transit apply in case of goods, hence, it is not applicable on present scenario of export of software services.It is to be noted that input tax credit will be allowed before 20th October after the end of financial year to which such input tax credit pertains or filing of annual return, whichever is done earlier. Last date for furnishing annual return under form GSTR -9 is 31st December after end of Financial Year. It is hereby suggested to file annual return by 20thOctober so that there is no accidental chance of losing any credit.Apportionment of Credit:If input goods or services are used partly for the purpose of providing such software export service and partly for other purposes, credit of input tax will be available only for portion actually used for such service export business.If input goods or services are being used for exempted goods or services, then such portion will not be allowed as input credit. In the present scenario, software export services are Zero Rated, not exempt, hence, input portion on these Nil rated services will be allowed for set-off from output tax liability. However, since there is no output tax liability, such input will be refunded.Input of Capital GoodsCapital Goods are those which are capitalised in the book of accounts and are not short-term in nature. When such capital goods are purchased, the buyer pays excise/ VAT on them. In the present law, the credit of such taxes or duties paid is available in two years at 50% each. The whole amount of duty/ tax paid is booked in full, however, while discharging output tax liability, 50% of input credit on capital goods is available for set-off.However, in GST 100% credit is allowed at the time of purchase. If depreciation has been claimed on the tax component of capital goods, input tax credit of such tax component is not allowed.Reverse Charge Mechanism (RCM)Reverse Charge Mechanism is applicable to all persons registered under GST. Any person registered in GST takes services or materials from an unregistered person, then such registered person has to pay applicable GST on such input or input services. Such reverse payment of taxes by receiver of supply is called Reverse Charge Mechanism. The payer will get credit of such tax paid on reverse charge. In present scenario, since the supply is Zero Rated, hence, tax paid under reverse charge will be refunded.Services imported which are utilised for the purpose of rendering software export service are covered under reverse charge mechanism, indicating that GST on import service is to be paid under reverse charge. If tax on such import services have been paid in full before the implementation date of GST, then no tax is to be paid after GST date. However, if no or part payment has been paid, then any payment paid after implementation of GST will be taxed under GST provisions.Input Service Distributor (ISD)There are situations when the business is operated from different locations. However, only one office receives all the invoices of input goods & services. The tax paid on such services by the said office is then distributed to other working offices according to their contribution in providing the software export service. This office which distributes Input Tax Credit (ITC) is called Input Service Distributor (ISD).Points noteworthy for ISD:For distributing such credit, it is necessary that all the offices are registered under same PAN and ISD is to be registered as ISD while taking registration under GST.Mandatory registration of ISD is required under GST regime.GST Return of ISD will be GSTR-6 which is to be filed by 13th of the next month.Other office to which ISD distributes credit has to accept or reject such credit between 15th – 17th of the next month.Input credit available from services received prior to the day of implementation of GST and invoices received after the date, such input credit shall be eligible for distribution.Conditions for distribution of credit by ISD:The ISD can distribute credit against a document.Excess credit is not to be distributed.Credit attributable to a particular office to be distributed to that office only.If there are more than one office to whom credit is to be distributed, then, pro- rata distribution to be done based on turnover.InvoicingInvoicing for Software Export service providers is not a very big concern as the provisions are same, however, only format has been changed. For understanding purpose, a draft format is being enclosed at the end of this book. Only few major parts to be understood:Service Accounting Code (SAC): This is the code that is assigned to each type of services. Depending upon theexact classification of the service, it is to be mentioned on the invoice.Type of GST: The invoice format has CGST, SGST and IGST as separate columns to be filled for tax portion. Here, nothing will be mentioned as software export services are Zero Rated.The text to be used is: “Supply Meant For Export On Payment Of IGST” – if IGST has been paid on the exports. “Supply Meant For Export Under Bond Or Letter Of Undertaking Without Payment Of IGST”– if IGST has not been paidPayment of TaxesThough, output tax liability is disregarded in this scenario as Software Export service is Zero Rated, however, tax payments may arise on account of:Interest, late fee or any other paymentTax, interest, penalty as awarded by GST Department officerReverse ChargeRefundUnderstanding refund mechanism is important in export service business. The reason being such services are zero rated, however, tax is paid on inputs which is refundable. Proper method has been devised for claiming refund for every month. Following points are worth understanding for smooth flow of refund:Electronic cash or credit ledger contains details of taxes, interest, penalty, fees etc. paid or to be paid. The balance after netting off payable and paid tax maybe payable or refundable.Refund can be claimed by furnishing returns as specified.Documents specifying that pa yment of such input have been made and such tax burden has not been passed on to the customer.If such refund is less than Rs. 2 Lakhs, a declaration in place such documentation would be sufficient for this purpose.The Departmental Officer referred to as Assessing Officer, will refund 90% of the total refund, on a provisional basis until clearance of complete refund based on assessment of documents. Such complete assessment will be done in 60 days from the date of receipt of application by the officer.The order will be passed for this refund in FORM GST RFD -04.Such refund will be paid directly to the applicant by issuing a payment advice in FORM GST RFD -05.If default has been committed in filing of returns or payment of any tax, interest etc, the officer may hold the payment of refund and also can deduct any tax, interest, penalty from the refund amount before payment of such refund. The order will be in FORM GST RFD- 06.If the whole of refund is completely adjusted against such pending demands, such details will be made available in Part A of FORM GST RFD -07.If officer is of the view that refund is being claimed by fraud and the matter is under litigation at higher authorities, the whole amount of refund will be on hold. Such order will be made available in Part B of FORM GST RFD -07.If the matter after litigation results in granting of refund, the amount of refund held, will be paid with interest upto 6% maximum.The relevant date from where refund will be counted as eligible will be:The date of receipt of payment if services rendered before receipt of payment.The date of issue of invoice if payment is received as advance before issue of invoice.Where refund arises as a result of any order by authority or court and application for refund is filed after such order, the same shall be paid with interest upto 9% if refund is not paid within 60 days from such application.Where such services are exported, STPI certificate is to be obtained for proving export of service.Services given to units under Special Economic Zone are to be treated in similar fashion as exports. It shall be noted that when such service is given to SEZ, a specified officer of SEZ certifies receipt of services. That certificate is to be kept in record for refund purposes.Documents required for refund:A statement containing the number of and date of invoices, Bank Realisation Certificate or Foreign Inward Remittance Certificate.Services made to a Special Economic Zone – A statement containing the number and date of invoices, the evidence regarding endorsement and the details of payment, along with proof.A declaration that SEZ unit or SEZ developer has not claimed input tax credit of tax paid by supplier of such software services.A declaration to the effect that burden of Tax, interest or any other amount claimed as refund has not been passed on to any other person, where amount of refund is less than Rs.2 Lakhs.For the sake of knowledge of the reader :- A certificate from Chartered Accountant or a cost accountant is to be annexed in Form GST RFD – 01, which will signNow that burden of tax that has been claimed as refund, has not been passed on to any other person. Such certificate is required in case the refund amount is greater than Rs.2 Lakhs.However, in case of Zero Rated supplies, such certificate is not required to be furnished.When refund becomes due, resulting from order of authority or court, reference number of the order and a copy of the order.In case of supply without payment of tax under bond or letter of undertaking i.e. with or without payment of Integrated Goods and Services Tax, refund of input tax credit shall be granted as per the following formula:Refund Amount = (Turnover of zero-rated supply of services) x Net ITC ÷ Adjusted Total TurnoverWhere,-“Refund Amount” means the maximum refund that is acceptable;“Net ITC” means input tax credit availed on inputs and input services during the period;“Turnover of zero-rated supply of services” means the value of the software service rendered without payment of tax under bond or letter of undertaking, calculated in the following manner:-Zero-rated supply of services is the total of payments received during the period for such supply of services and supply of services completed for which payment received in advance in any period prior to the relevant periodSubtracted byadvances received for services for which the supply of services has not been completed during the relevant period;“Adjusted Total turnover” means the turnover of software services excluding any exempt supplies turnover.This definition of adjusted total turnover has been modified keeping in view limited scope of the topic.Acknowledgement of application for refund filed will appear in FORM GST RFD -02 on portal and will be available for viewing to the applicant within 3 to 15 days.If there are any deficiencies, such deficiencies will appear in FORM GST RFD – 03 on portal.The refund granting is subject to a condition of non- prosecution of applicant for evading tax of more than Rs.2.5 Crores in the preceding 5 years.Where the officer or authority is satisfied that no or part of refund is not allowable, a notice will be issued in FORM GST RFD -08 asking the applicant to furnish their reply in FORM GST RFD -09 within 15 days. Thereby making final order in FORM GST RFD -06.A Ledger is maintained on portal for payable or credit available to be utilised. Refund mechanism to operate by debiting or crediting the ledger balance.Maintenance of database, documents or records:Database needs to be maintained to ensure smooth data flow along with processing and feeding of any informationwhile complying with GST Law. Although complete database maintenance is case specific, however, major points have been highlighted:Vendor Details: Name, Address, PAN, GSTIN, HSN Code of goods being purchased, SAC (Service Accounting Code) of services.Buyer Details: Name, Address, PAN, GSTIN, SAC (Service Accounting Code) of services.Backup of all entries being feeded whether through accounting software or through maintenance of excel sheets.All bills of inward supplies being goods or services consumed, all invoices raised to customers, Credit notes, debit notes, receipt vouchers, payment vouchers, refund vouchersCalculation done for netting off output tax liability and input tax credit. In the present case, the output tax liability will be Zero.All applications for refund and their complete files for refund processing, all sorts of communication with GST department.Certificate from STPI (Software Technology Park of India) for approving Software Services being exported, Foreign Inward Remittance Certificate, all type of communication with customer with regard to rendering of service.IEC (Import Export Code) certificate, Bank StatementsAccounts Books to be properly maintained and kept upto date.Returns to be filed & their timing:S. No.GST ReturnPurposeDue Date1.GSTR – 1Outward Supplies being Software Services10th of Next Month2.GSTR – 2Inward Supplies received15th of Next Month3.GSTR – 3Monthly Return for netting off Output & Input tax20th of Next Month4.GSTR – 6Return for Input Service Distributor13th of Next Month5.GSTR – 9To be filed by all persons covered under GST31stDecember of Next Financial Year*Any Rectification/ omission can be taken care of only in next return.Credit of Existing InputsCredit of existing inputs lying as on 30.06.2017, will be carried forward and can be claimed by filing form GST TRAN -1 by 30.09.2017.How to integrate with GST ReturnsManual Feeding provisions have been made for filing GST Returns with some information being auto-populated. However, purchasing a recognised accounting software and hiring consultants for monthly review & filing is much favourable.Few Other important FactsDeemed Export means export to EOU/ STPI/ Consulate/ Embassy etc.Export, Supply to Special Economic Zone and Deemed Exports can be viewed under the same light with some particular differences.Once voluntary registration is taken it cannot be surrendered for 1 year.Once registration is taken, exemption limit of Rs.20 Lacs do not apply, i.e. all provisions are to be complied in totality.Business organisation must authorise a person for handling compliance for ease of use in terms of signatures and other verification part including dealing with GST department.Annexure – 1Form GST PMT – 01 is a liability register which will show liabilities in terms of tax, interest, penalty, late fee or any other amount payable.Form GST PMT – 02 will show input tax credit available.Form GST PMT – 03 will be used by GST Officer for making order of any rejection of refund.Form GST PMT – 04 will be used for communicating any discrepancy in tax liability data to the GST Officer.Form GST PMT – 05 is the cash ledger account which will depict tax, interest, penalty, late fee or any amount deposited or paid therefrom.Form GST PMT – 06 will generate challan for entering details of payment for tax, interest, penalty, fee etc. Such challan will be valid for 15 days.Form GST PMT – 07 where payment as per challan has been deducted from bank but challan identification number was not generated, this form will be used to show the initiation of payment.Annexure – 2Summary of Refund FormsSr. NoForm NumberContent1.GST RFD-01Application for Refund2.GST RFD-02Acknowledgement3.GST RFD-03Deficiency Memo4.GST RFD-04Provisional Refund Order5.GST RFD-05Payment Advice6.GST RFD-06Refund Sanction/ Rejection Order7.GST RFD-06Interest on delayed refund order (same as refund order)8.GST RFD-07Order for complete adjustment of sanctioned Refund/ order for withholding of refund9.GST RFD-08Notice for rejection of application for refund10.GST RFD-09Reply to show cause notice11.GST RFD-10Application for Refund by any specialize agency of UN or Multilateral Financial Institution and Organization, Consulate or Embassy of foreign countries, etc.Disclaimer : The above content was Reproduced from a Professional website , except with minor changes

Create this form in 5 minutes!

How to create an eSignature for the sample format of customs clearance authorisation letter

How to make an eSignature for your Sample Format Of Customs Clearance Authorisation Letter online

How to make an electronic signature for your Sample Format Of Customs Clearance Authorisation Letter in Google Chrome

How to generate an electronic signature for putting it on the Sample Format Of Customs Clearance Authorisation Letter in Gmail

How to generate an electronic signature for the Sample Format Of Customs Clearance Authorisation Letter straight from your smart phone

How to generate an eSignature for the Sample Format Of Customs Clearance Authorisation Letter on iOS devices

How to make an electronic signature for the Sample Format Of Customs Clearance Authorisation Letter on Android OS

People also ask

-

What is customs clearance and how does airSlate SignNow facilitate it?

Customs clearance is the process of passing goods through customs so they can enter or exit a country. airSlate SignNow simplifies this process by allowing businesses to sign and send essential clearance documents electronically, ensuring swift and efficient customs processing.

-

How can airSlate SignNow improve my customs clearance process?

With airSlate SignNow, you can streamline the customs clearance process by reducing paperwork and enhancing communication. Our platform allows for real-time collaboration and electronic signatures, ensuring that all necessary documents are completed accurately and promptly, which speeds up clearance times.

-

Are there any additional costs associated with customs clearance when using airSlate SignNow?

Using airSlate SignNow does not incur additional costs for customs clearance specifically; instead, we offer transparent pricing plans based on usage. This cost-effective solution eliminates the need for paper-based transactions, which can lead to hidden fees often associated with traditional customs clearance methods.

-

Is airSlate SignNow compliant with customs regulations for document signing?

Yes, airSlate SignNow is designed to comply with all e-signature laws and customs regulations. Our platform ensures that all electronic signatures are legally binding and accepted by customs authorities, making the customs clearance process smoother and more secure.

-

What features of airSlate SignNow aid in customs clearance documentation?

AirSlate SignNow offers features such as customizable templates and automated workflows that are ideal for customs clearance documentation. These tools help users prepare necessary documents quickly and accurately, minimizing the risk of delays during the customs clearance process.

-

Can I integrate airSlate SignNow with other tools used for customs clearance?

Absolutely! airSlate SignNow integrates with various tools and platforms, enhancing your customs clearance workflow. By connecting our e-signature solution with your existing systems, you can automate data sharing and streamline the documentation process.

-

How does using airSlate SignNow enhance security for customs clearance documents?

Security is a top priority with airSlate SignNow. We use advanced encryption and secure cloud storage to protect all customs clearance documents, ensuring that sensitive information remains confidential and compliant with international trade regulations.

Get more for Letter For Customs Clearance Sample

Find out other Letter For Customs Clearance Sample

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online