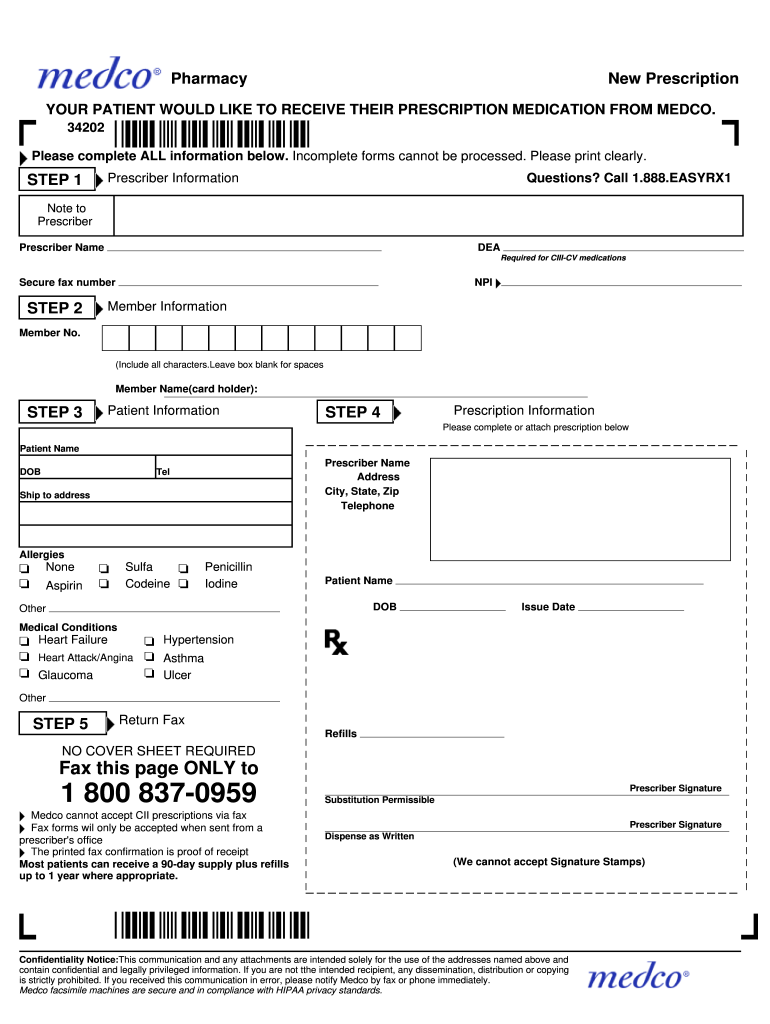

Medco Prescription Fax Form

What is the taxctr1 ird gov hk Form?

The taxctr1 ird gov hk form is a specific document used for tax-related purposes in Hong Kong. It is essential for individuals and businesses to accurately report their income and comply with local tax regulations. This form serves as a declaration of income, allowing the Inland Revenue Department (IRD) to assess the correct amount of tax owed. Understanding the purpose of this form is crucial for ensuring compliance and avoiding potential penalties.

How to use the taxctr1 ird gov hk Form

Using the taxctr1 ird gov hk form involves several steps to ensure that all required information is accurately provided. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form with accurate details regarding your income sources and any deductions you may qualify for. It is important to double-check all entries for accuracy before submission. Finally, submit the completed form to the Inland Revenue Department by the designated deadline to avoid any late fees or penalties.

Steps to complete the taxctr1 ird gov hk Form

Completing the taxctr1 ird gov hk form requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents, such as W-2s, 1099s, and receipts for deductible expenses.

- Begin filling out the form by entering your personal information, including your name, address, and tax identification number.

- Report your total income from all sources, ensuring that you include any additional income streams.

- List any eligible deductions or credits you wish to claim, providing necessary documentation where required.

- Review the completed form thoroughly to ensure accuracy and completeness.

- Submit the form to the appropriate tax authority by the deadline.

Legal use of the taxctr1 ird gov hk Form

The taxctr1 ird gov hk form must be used in accordance with local tax laws to ensure its legal validity. This includes accurately reporting all income and claiming only legitimate deductions. Failing to adhere to these regulations can result in penalties, including fines or additional taxes owed. It is advisable to consult a tax professional if there are any uncertainties regarding the proper use of this form.

Filing Deadlines / Important Dates

Filing deadlines for the taxctr1 ird gov hk form are critical to avoid penalties. Typically, the form must be submitted by a specific date each year, which is set by the Inland Revenue Department. It is important to stay informed about these deadlines, as late submissions can incur fines. Marking these dates on your calendar can help ensure timely filing.

Required Documents

To successfully complete the taxctr1 ird gov hk form, certain documents are required. These may include:

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Any previous tax returns that may provide relevant information.

- Identification documents, such as a tax identification number or Social Security number.

Having these documents ready will facilitate a smoother completion process.

Quick guide on how to complete medco prescription fax form

Complete Medco Prescription Fax Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents promptly without any hold-ups. Manage Medco Prescription Fax Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Medco Prescription Fax Form with ease

- Find Medco Prescription Fax Form and click Get Form to begin.

- Use the tools we offer to complete your form.

- Mark pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to apply your changes.

- Select your preferred method to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Modify and eSign Medco Prescription Fax Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the medco prescription fax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is taxctr1 ird gov hk and how can airSlate SignNow help?

Taxctr1 ird gov hk refers to the Hong Kong Inland Revenue Department's online tax services. airSlate SignNow streamlines the process of signing and sending tax documents electronically, making it easier for businesses to comply with tax regulations outlined on taxctr1 ird gov hk.

-

How much does airSlate SignNow cost for businesses in relation to taxctr1 ird gov hk?

airSlate SignNow offers competitive pricing plans tailored for businesses to efficiently manage their document signing needs. These plans are cost-effective, aiding businesses in staying compliant with the requirements presented on taxctr1 ird gov hk without breaking the bank.

-

What features does airSlate SignNow provide that support taxctr1 ird gov hk compliance?

airSlate SignNow includes features such as customizable templates, audit trails, and robust security measures. These features ensure that businesses can seamlessly prepare and sign documents in line with compliance mandates from taxctr1 ird gov hk.

-

Can airSlate SignNow integrate with software used for tax regulations like those on taxctr1 ird gov hk?

Yes, airSlate SignNow seamlessly integrates with various software applications that businesses commonly use to manage their tax obligations. This integration aids in ensuring that documents related to taxctr1 ird gov hk are efficiently handled, improving overall workflow.

-

What are the benefits of using airSlate SignNow for tax documents related to taxctr1 ird gov hk?

By using airSlate SignNow, businesses benefit from enhanced efficiency, reduced turnaround times, and improved accuracy for their tax documents. This directly supports compliance with processes and regulations outlined on taxctr1 ird gov hk, ensuring peace of mind.

-

Is airSlate SignNow suitable for small businesses needing to comply with taxctr1 ird gov hk?

Absolutely, airSlate SignNow is designed to be user-friendly and cost-effective, making it an excellent choice for small businesses. It helps them manage their tax-related documents in line with taxctr1 ird gov hk's requirements, without the need for extensive resources.

-

How does airSlate SignNow ensure document security for tax forms submitted to taxctr1 ird gov hk?

airSlate SignNow employs advanced encryption and secure storage solutions to protect sensitive information. This level of security is particularly essential for businesses dealing with tax documents, ensuring compliance with standards set by taxctr1 ird gov hk.

Get more for Medco Prescription Fax Form

- Kentucky kentucky tax registration application and instructions form

- Irs e file signature authorization for form 1120

- Bank deposits tax return formalu

- 42a809 commonwealth of kentucky department of revenue 3 form

- Tax law section 606ggg form

- Net profit tax forms boone county ky

- 740 v department of revenue form

- About form 1041 us income tax return for estates and trustsincome taxes taxanswers kentuckyincome taxes taxanswers

Find out other Medco Prescription Fax Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors