480 6A Rev 08 19 480 6A Rev 08 19 Form

What is the 480 6A Rev 08 19?

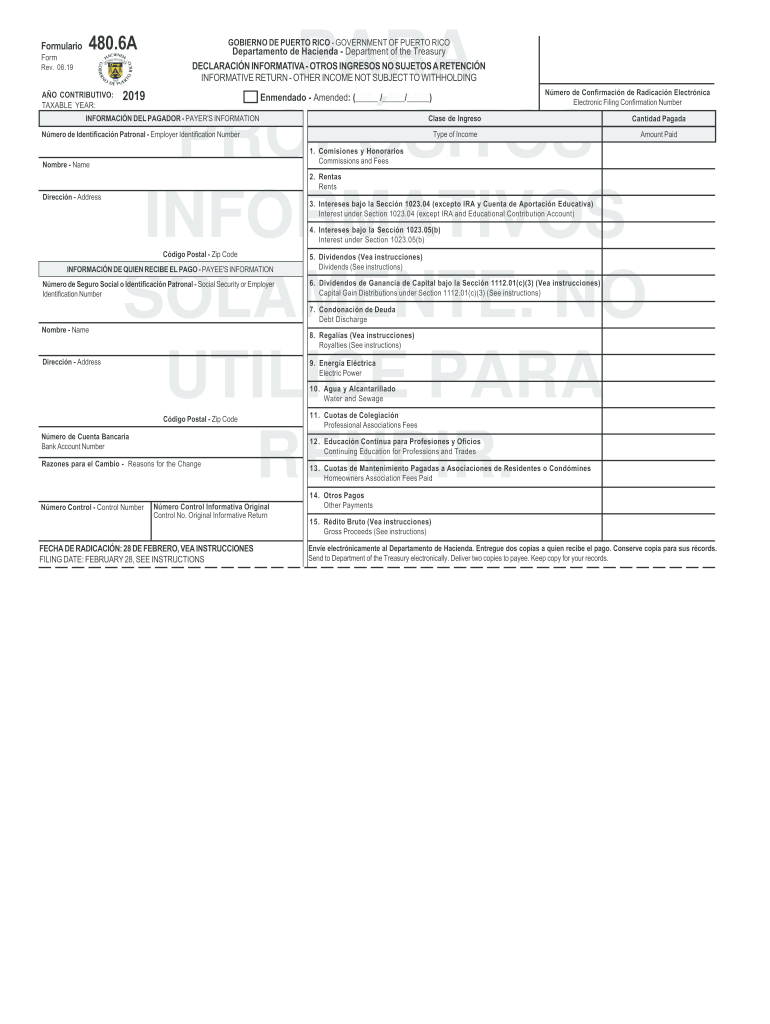

The 480 6A Rev 08 19 is a tax form used in the United States, specifically for reporting income and expenses related to certain business activities. This form is essential for taxpayers who need to declare their earnings and ensure compliance with federal tax regulations. It is particularly relevant for self-employed individuals and business owners who operate as sole proprietors, partnerships, or limited liability companies (LLCs).

Steps to complete the 480 6A Rev 08 19

Completing the 480 6A Rev 08 19 involves several key steps to ensure accuracy and compliance. Here is a simplified process:

- Gather necessary documentation, including income statements, expense receipts, and any relevant financial records.

- Fill out the form accurately, ensuring all income sources and expenses are reported.

- Review the completed form for any errors or omissions.

- Sign and date the form to validate it.

- Submit the form by the designated deadline to avoid penalties.

Legal use of the 480 6A Rev 08 19

The 480 6A Rev 08 19 is legally binding when completed correctly and submitted on time. It is important to adhere to the guidelines set forth by the IRS and ensure that all information provided is truthful and accurate. Failure to comply with tax regulations can result in penalties, including fines or audits. Utilizing a reliable eSignature solution can enhance the legal validity of the form by providing a secure method for signing and submitting documents electronically.

Filing Deadlines / Important Dates

Filing deadlines for the 480 6A Rev 08 19 are crucial for maintaining compliance with tax regulations. Typically, the form must be submitted by April 15 of the following tax year. However, it is advisable to check for any specific updates or extensions that may apply, especially in light of changing regulations or circumstances. Marking these dates on your calendar can help prevent last-minute filing issues.

Required Documents

To complete the 480 6A Rev 08 19 accurately, certain documents are required. These may include:

- Income statements from all sources.

- Receipts for business-related expenses.

- Bank statements that reflect business transactions.

- Any prior year tax returns for reference.

Form Submission Methods

The 480 6A Rev 08 19 can be submitted through various methods, ensuring flexibility for taxpayers. Options include:

- Online submission through secure e-filing platforms.

- Mailing a paper copy to the appropriate IRS address.

- In-person submission at designated IRS offices, if necessary.

Quick guide on how to complete 480 6a rev 08 19 480 6a rev 08 19

Complete 480 6A Rev 08 19 480 6A Rev 08 19 seamlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents rapidly without delays. Manage 480 6A Rev 08 19 480 6A Rev 08 19 across any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign 480 6A Rev 08 19 480 6A Rev 08 19 effortlessly

- Find 480 6A Rev 08 19 480 6A Rev 08 19 and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize signNow sections of your documents or hide sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign 480 6A Rev 08 19 480 6A Rev 08 19 and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 480 6a rev 08 19 480 6a rev 08 19

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the airSlate SignNow 480 6a 2020 feature?

The airSlate SignNow 480 6a 2020 feature allows businesses to efficiently send and eSign documents with a user-friendly platform. This capability is particularly beneficial for organizations looking to streamline their document signing processes, ensuring quicker turnaround times and enhanced productivity.

-

How much does the airSlate SignNow 480 6a 2020 plan cost?

The pricing for the airSlate SignNow 480 6a 2020 plan varies based on your usage needs and the number of users. We offer flexible pricing options that cater to both small businesses and larger enterprises, ensuring cost-effectiveness and scalability as you grow.

-

What are the key benefits of using airSlate SignNow 480 6a 2020?

Using airSlate SignNow 480 6a 2020 provides businesses with a reliable and secure method to handle document signing. Key benefits include reduced paperwork, improved workflow efficiency, and enhanced security features that safeguard your documents and user data.

-

Can I integrate airSlate SignNow 480 6a 2020 with my existing software?

Yes, airSlate SignNow 480 6a 2020 offers extensive integration options that can connect seamlessly with your current software solutions. Popular integrations include CRM systems, cloud storage services, and project management tools, helping you unify your workflow.

-

Is support available for airSlate SignNow 480 6a 2020 users?

Absolutely! All users of airSlate SignNow 480 6a 2020 have access to our dedicated support team. Whether you need assistance with setup or have questions about features, our team is ready to help you make the most of your eSigning experience.

-

What types of documents can I sign with airSlate SignNow 480 6a 2020?

With airSlate SignNow 480 6a 2020, you can sign a variety of document types, including contracts, agreements, and forms. The platform supports multiple file formats, ensuring you can easily manage all your essential documents in one place.

-

How secure is airSlate SignNow 480 6a 2020 for signing documents?

Security is a top priority for airSlate SignNow 480 6a 2020. We employ industry-leading encryption, secure cloud storage, and compliance with regulations to ensure that your documents are safe and confidential throughout the signing process.

Get more for 480 6A Rev 08 19 480 6A Rev 08 19

Find out other 480 6A Rev 08 19 480 6A Rev 08 19

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT