New Credit Application Form

What is the New Credit Application

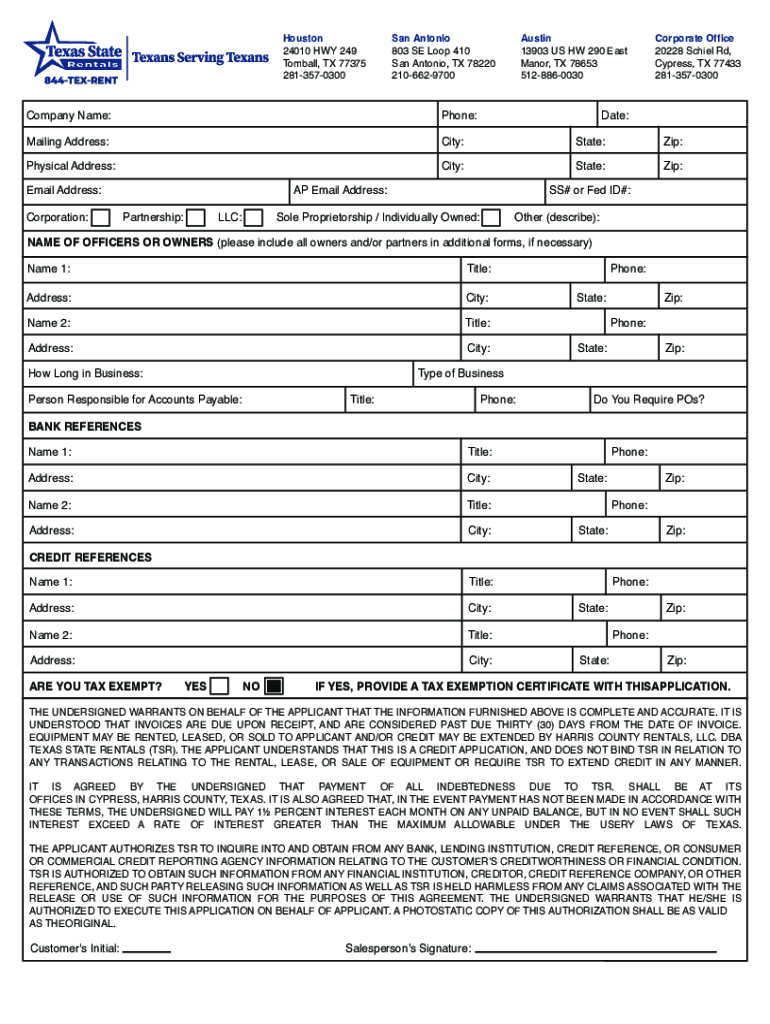

The New Credit Application is a formal document used by individuals or businesses to apply for credit from financial institutions. This application collects essential information about the applicant's financial history, employment status, and personal identification. It serves as a basis for lenders to assess creditworthiness and determine the terms of credit approval. Understanding the components of this application is crucial for ensuring a smooth application process.

Steps to complete the New Credit Application

Completing the New Credit Application involves several important steps to ensure accuracy and compliance. Follow these steps for a successful submission:

- Gather necessary documents, including identification, income verification, and credit history.

- Fill out personal information accurately, including your name, address, and Social Security number.

- Provide details about your employment and income sources.

- Disclose any existing debts or financial obligations.

- Review the application for accuracy before submission.

Taking the time to complete each step carefully can enhance the chances of approval.

Legal use of the New Credit Application

The legal use of the New Credit Application is governed by various regulations to ensure consumer protection and fair lending practices. Institutions must comply with the Equal Credit Opportunity Act (ECOA) and the Fair Credit Reporting Act (FCRA). These laws mandate that lenders provide clear information regarding the application process and the criteria used for credit decisions. Additionally, applicants must provide truthful information to avoid legal repercussions.

Key elements of the New Credit Application

Understanding the key elements of the New Credit Application can help applicants prepare effectively. Important components typically include:

- Personal Information: Name, address, date of birth, and Social Security number.

- Employment Details: Current employer, job title, and income.

- Financial Information: Existing debts, assets, and liabilities.

- Credit History: Previous credit accounts and payment history.

Each of these elements plays a critical role in the evaluation process conducted by lenders.

Form Submission Methods

The New Credit Application can typically be submitted through various methods, including:

- Online Submission: Many lenders offer digital platforms for completing and submitting applications securely.

- Mail: Applicants can send a printed application to the lender's address.

- In-Person: Some institutions allow applicants to submit their forms directly at a branch location.

Choosing the right submission method can depend on the applicant's preferences and the lender's requirements.

Eligibility Criteria

Eligibility for the New Credit Application varies by lender but generally includes several common criteria. Applicants must typically be:

- A legal resident or citizen of the United States.

- At least eighteen years old.

- Employed or have a reliable source of income.

- Free from bankruptcy or significant negative credit history.

Meeting these criteria can significantly impact the likelihood of approval.

Quick guide on how to complete new credit application

Complete New Credit Application effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your papers quickly without delays. Manage New Credit Application on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign New Credit Application with ease

- Obtain New Credit Application and then click Get Form to begin.

- Take advantage of the tools we provide to finalize your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign feature, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details carefully and then hit the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), shareable link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign New Credit Application and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new credit application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a New Credit Application in airSlate SignNow?

A New Credit Application in airSlate SignNow is a digital form that allows businesses to efficiently collect credit information from customers. This solution reduces paperwork and simplifies the process of obtaining necessary financial data, ultimately speeding up credit decisions.

-

How does airSlate SignNow streamline the New Credit Application process?

airSlate SignNow streamlines the New Credit Application process by allowing users to create, send, and eSign documents electronically. This eliminates the need for physical signatures and facilitates faster processing of applications, ensuring a smoother experience for both businesses and their clients.

-

What are the pricing options for using airSlate SignNow for New Credit Applications?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses. Users can choose from monthly or annual subscriptions, with plans that include features specifically designed for managing New Credit Applications efficiently and affordably.

-

Can I customize my New Credit Application template in airSlate SignNow?

Yes, airSlate SignNow allows users to customize their New Credit Application templates to reflect their unique branding and specific data requirements. This feature ensures that each application meets the needs of the business while providing a professional appearance to customers.

-

What are the key benefits of using airSlate SignNow for New Credit Applications?

The key benefits of using airSlate SignNow for New Credit Applications include enhanced efficiency, reduced turnaround times, and improved accuracy in data collection. Digital signatures not only save time but also minimize errors associated with manual entries, creating a more reliable application process.

-

Does airSlate SignNow integrate with other financial software for New Credit Applications?

Absolutely! airSlate SignNow seamlessly integrates with various financial software platforms, making it easy to manage New Credit Applications alongside your existing systems. This ensures that data flows smoothly between applications, enhancing overall operational efficiency.

-

Is there customer support available for New Credit Application queries?

Yes, airSlate SignNow provides customer support to assist users with any queries related to New Credit Applications. Whether you need help setting up your template or troubleshooting an issue, their support team is available to guide you through the process.

Get more for New Credit Application

Find out other New Credit Application

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document