Form 3210

What is the Form 3210

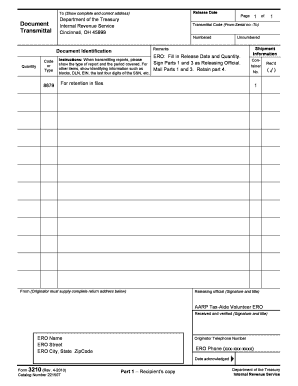

The Form 3210, also known as the IRS Form 3210, is a document used for the transmittal of information related to tax filings. This form is essential for ensuring that the IRS receives the necessary documentation from taxpayers, particularly in cases where other forms are submitted. The 3210 letter serves as a cover sheet that outlines the contents of the accompanying documents, making it easier for the IRS to process submissions efficiently.

How to use the Form 3210

Using the Form 3210 involves several straightforward steps. First, you should gather all relevant documents that need to be submitted to the IRS. Next, complete the Form 3210 by filling in the required fields, including your name, address, and a description of the documents being transmitted. After completing the form, attach it to your documents and ensure everything is organized. Finally, submit the package to the appropriate IRS office as indicated in the instructions.

Steps to complete the Form 3210

Completing the Form 3210 requires careful attention to detail. Follow these steps:

- Gather all necessary documents that you need to submit.

- Fill out the Form 3210, ensuring that all fields are accurately completed.

- Attach the Form 3210 to the relevant documents.

- Review the entire package for completeness and accuracy.

- Submit the package to the designated IRS office.

Legal use of the Form 3210

The Form 3210 is legally recognized as a valid means of transmitting documents to the IRS. To ensure compliance, it is important to follow the guidelines set forth by the IRS regarding the use of this form. This includes using the correct version of the form, providing accurate information, and adhering to submission deadlines. Failure to comply with these requirements may result in delays or penalties.

Key elements of the Form 3210

Several key elements must be included in the Form 3210 for it to be effective:

- Sender Information: Name and address of the individual or entity sending the documents.

- Document Description: A clear description of the documents being transmitted.

- Date of Submission: The date on which the form is completed and submitted.

- Recipient Information: The appropriate IRS office address where the documents are being sent.

Examples of using the Form 3210

Common scenarios for using the Form 3210 include:

- Transmitting tax returns along with supporting documentation.

- Submitting amended returns or additional information requested by the IRS.

- Providing documentation for audits or inquiries initiated by the IRS.

Form Submission Methods

The Form 3210 can be submitted to the IRS through various methods, including:

- Mail: Sending the completed form and documents via postal service to the appropriate IRS address.

- In-Person: Delivering the documents directly to an IRS office, if applicable.

Quick guide on how to complete form 3210

Effortlessly Prepare Form 3210 on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Administer Form 3210 on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to Modify and eSign Form 3210 with Ease

- Obtain Form 3210 and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or obscure sensitive data with the tools available from airSlate SignNow specifically for that task.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device you prefer. Modify and eSign Form 3210 to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3210

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 3210 letter template?

A 3210 letter template is a standardized format used for specific correspondence in business communications. It helps streamline the document creation process, ensuring that all necessary information is included. Using the 3210 letter template can save time and improve the professionalism of your communications.

-

How can I create a 3210 letter template with airSlate SignNow?

Creating a 3210 letter template with airSlate SignNow is simple and user-friendly. You can start by selecting a pre-designed template or creating one from scratch using our intuitive drag-and-drop editor. Once your 3210 letter template is ready, you can easily customize it as needed for your specific business requirements.

-

Is the 3210 letter template customizable?

Yes, the 3210 letter template is fully customizable to fit your unique needs. You can modify text, add your logo, and include any additional fields required for your correspondence. This flexibility allows you to maintain your brand identity while using the 3210 letter template.

-

What are the benefits of using a 3210 letter template?

Using a 3210 letter template offers several benefits, including consistency in communication and saving time on document preparation. It reduces the likelihood of errors, as important information is organized and easy to access. Additionally, the 3210 letter template enhances professionalism, making a positive impression on your recipients.

-

How does pricing work for airSlate SignNow when using the 3210 letter template?

airSlate SignNow offers competitive pricing for its services, including the use of the 3210 letter template. You can choose from various subscription plans based on your business needs, with options for monthly or annual billing. Each plan provides access to the 3210 letter template and a wide range of features, ensuring you get great value for your investment.

-

Can I integrate the 3210 letter template with other tools?

Yes, the 3210 letter template can be easily integrated with other tools and applications your business uses. airSlate SignNow supports integration with various third-party software, including CRM systems and productivity apps. This allows you to streamline your workflows and ensure seamless communication across platforms.

-

What types of documents can I create using the 3210 letter template?

You can use the 3210 letter template to create various types of business documents, such as formal letters, notices, and memos. The template is versatile and can be adapted for different communication purposes. This makes it an essential tool for businesses looking to maintain a professional standard in their correspondence.

Get more for Form 3210

- More than of vehicle accidents are caused by driver error or poor driving habits form

- Guided reading the constitution lesson 1 answer key form

- Skyrizi enrollment form

- Ir881 form

- 3078 appendix a form

- Module 9 transformations and congruence answer key

- Va handbook 0710 form

- Imrf federal withhaoding forms

Find out other Form 3210

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast