AUTO LOAN APPLICATION DETAILS APPLICATION DATE Mm 2019-2026

Key elements of the printable auto loan application

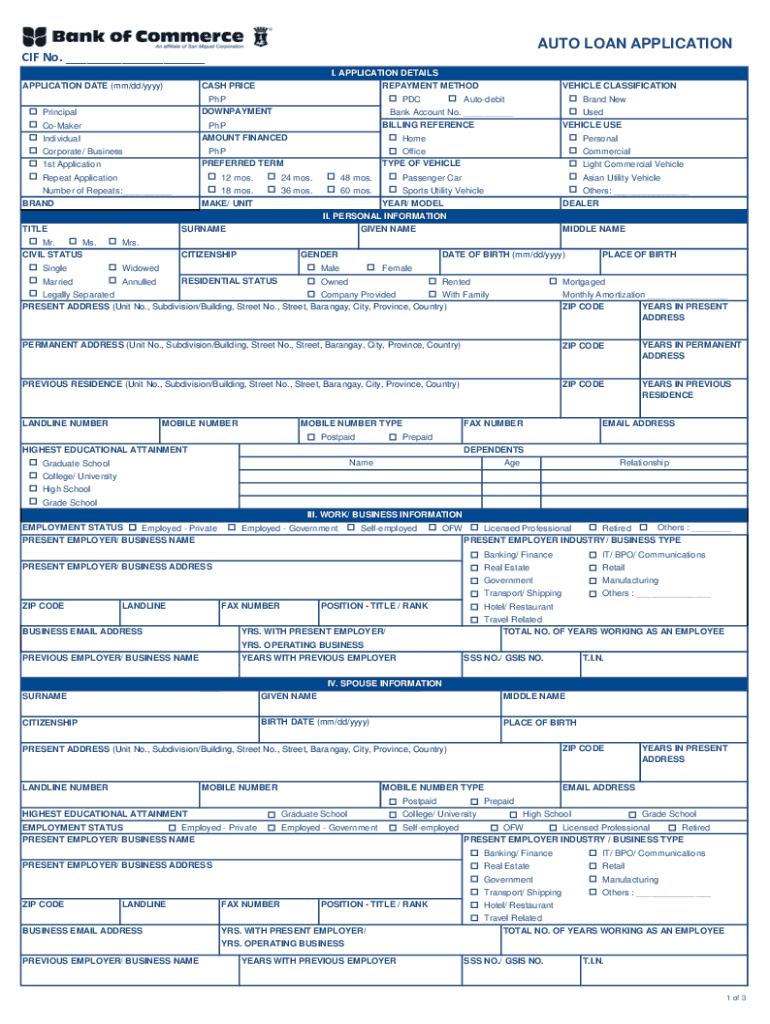

The printable auto loan application includes several essential components that help lenders assess a borrower's eligibility. Understanding these key elements can simplify the application process and enhance the chances of approval.

- Personal Information: This section requires the applicant's full name, address, date of birth, and Social Security number. Accurate information is crucial for identity verification.

- Employment Details: Applicants must provide information about their current employer, job title, and length of employment. This helps lenders evaluate job stability and income reliability.

- Financial Information: This includes income details, monthly expenses, and existing debts. Lenders use this data to calculate the applicant's debt-to-income ratio, which is vital for assessing loan eligibility.

- Vehicle Information: Applicants need to specify the make, model, year, and Vehicle Identification Number (VIN) of the car they wish to finance. This information helps lenders determine the vehicle's value and suitability for the loan.

- Loan Details: This section outlines the requested loan amount, desired loan term, and purpose of the loan. Clear specifications can streamline the approval process.

Steps to complete the printable auto loan application

Completing a printable auto loan application involves several straightforward steps. Following these steps can help ensure that the application is filled out accurately and completely, increasing the likelihood of approval.

- Gather Required Documents: Collect necessary documents such as proof of income, identification, and vehicle information. Having these on hand will facilitate the process.

- Fill Out the Application: Carefully complete each section of the application. Ensure that all information is accurate and up to date to avoid delays.

- Review the Application: Double-check all entries for accuracy. Look for any missing information or errors that could hinder the application process.

- Sign and Date: Ensure that you sign and date the application where required. This step is crucial for the application to be considered valid.

- Submit the Application: Choose your preferred submission method—online, by mail, or in person—based on the lender's requirements.

Legal use of the printable auto loan application

Understanding the legal implications of the printable auto loan application is essential for both borrowers and lenders. The application serves as a binding document that outlines the terms of the loan agreement.

When completed and signed, the application becomes a legal contract between the borrower and the lender. It is important for applicants to provide truthful information, as any discrepancies can lead to legal repercussions, including loan denial or fraud charges. Compliance with federal and state regulations is also necessary to ensure that the application process adheres to legal standards.

Eligibility Criteria for the printable auto loan application

Eligibility for an auto loan is determined by several factors that lenders assess during the application process. Understanding these criteria can help applicants prepare their information effectively.

- Credit Score: A higher credit score typically increases the chances of loan approval and may lead to better interest rates.

- Income Stability: Lenders prefer applicants with a stable income source, demonstrating the ability to repay the loan.

- Debt-to-Income Ratio: This ratio compares monthly debt payments to gross monthly income. Lenders usually look for a ratio below a certain threshold.

- Employment History: A consistent employment history can enhance an applicant's credibility and reliability in the eyes of lenders.

- Down Payment: Making a down payment can reduce the loan amount and signal to lenders that the borrower is financially responsible.

How to use the printable auto loan application

Using the printable auto loan application effectively is crucial for a smooth borrowing experience. Here are some guidelines to follow:

- Access the Form: Obtain the printable auto loan application from a trusted source, ensuring it is the most current version.

- Fill in Required Information: Complete all sections of the application with accurate and relevant details. Incomplete applications may lead to delays.

- Keep Copies: After submission, retain a copy of the completed application for personal records. This can be useful for tracking the loan process.

- Follow Up: After submitting the application, consider following up with the lender to check on the status and address any potential issues.

Form Submission Methods for the printable auto loan application

Submitting the printable auto loan application can be done through various methods, depending on the lender's preferences. Understanding these methods can help applicants choose the most convenient option.

- Online Submission: Many lenders offer online submission options, allowing applicants to fill out and submit the application digitally. This method is often the quickest.

- Mail Submission: Applicants may choose to print the completed application and send it via postal mail. This method may take longer due to processing times.

- In-Person Submission: Some lenders allow applicants to submit their applications in person at a branch location. This can provide an opportunity for immediate assistance.

Quick guide on how to complete auto loan application details application date mm

Easily prepare AUTO LOAN APPLICATION DETAILS APPLICATION DATE mm on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the features required to generate, modify, and eSign your documents swiftly without delays. Handle AUTO LOAN APPLICATION DETAILS APPLICATION DATE mm on any device with airSlate SignNow's Android or iOS applications and streamline any document-focused procedure today.

How to modify and eSign AUTO LOAN APPLICATION DETAILS APPLICATION DATE mm effortlessly

- Obtain AUTO LOAN APPLICATION DETAILS APPLICATION DATE mm and click on Get Form to initiate.

- Make use of the tools available to complete your form.

- Emphasize pertinent sections of the documents or black out sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced papers, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Modify and eSign AUTO LOAN APPLICATION DETAILS APPLICATION DATE mm to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the auto loan application details application date mm

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a printable auto loan application?

A printable auto loan application is a document that you can easily fill out and print, allowing potential borrowers to apply for auto financing. Using airSlate SignNow, you can complete and sign your printable auto loan application digitally, making the process faster and more convenient.

-

How can I create a printable auto loan application using airSlate SignNow?

To create a printable auto loan application using airSlate SignNow, simply design your application form using our intuitive template builder. Once created, you can easily export or share the document in a printable format, enabling users to complete the auto loan application offline if needed.

-

Is there a cost associated with using airSlate SignNow for a printable auto loan application?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can create and manage your printable auto loan application without any hidden fees, ensuring you receive a cost-effective solution for your document needs.

-

What are the benefits of using airSlate SignNow for my printable auto loan application?

By using airSlate SignNow for your printable auto loan application, you streamline the application process, reduce paperwork, and enhance the user experience. Electronic signatures speed up approvals, making it easier for both lenders and borrowers to complete transactions quickly.

-

Can I integrate airSlate SignNow with other software for auto loan applications?

Yes, airSlate SignNow offers robust integrations with various CRM and financial software platforms. This allows for seamless transfer of data, ensuring your printable auto loan application can be incorporated into your existing workflow for improved efficiency.

-

How secure is a printable auto loan application created with airSlate SignNow?

Security is a top priority for airSlate SignNow, and your printable auto loan application is protected with advanced encryption protocols. We ensure that all documents are securely stored and accessible only to authorized users, safeguarding sensitive borrower information.

-

Can I customize my printable auto loan application with airSlate SignNow?

Absolutely! airSlate SignNow allows you to fully customize your printable auto loan application to fit your business needs. You can alter fields, add branding, and include specific instructions, making the application process tailored for your customers.

Get more for AUTO LOAN APPLICATION DETAILS APPLICATION DATE mm

- Guided reading activity economic systems lesson 1 answer key form

- 6b6 subcontractor waiver and partial release of lien upon progress payment conditional form

- Medex eyeglass reimbursement form

- Release of information searchdisclosure nd

- In the xxx judicial district kansas judicial council kansasjudicialcouncil form

- In transit permittitle application form

- Cc dc cr 072a petition for expungement of records form

Find out other AUTO LOAN APPLICATION DETAILS APPLICATION DATE mm

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent