Cowichan Tobacco Tax Distribution 2022-2026

What is the Cowichan Tobacco Tax Distribution

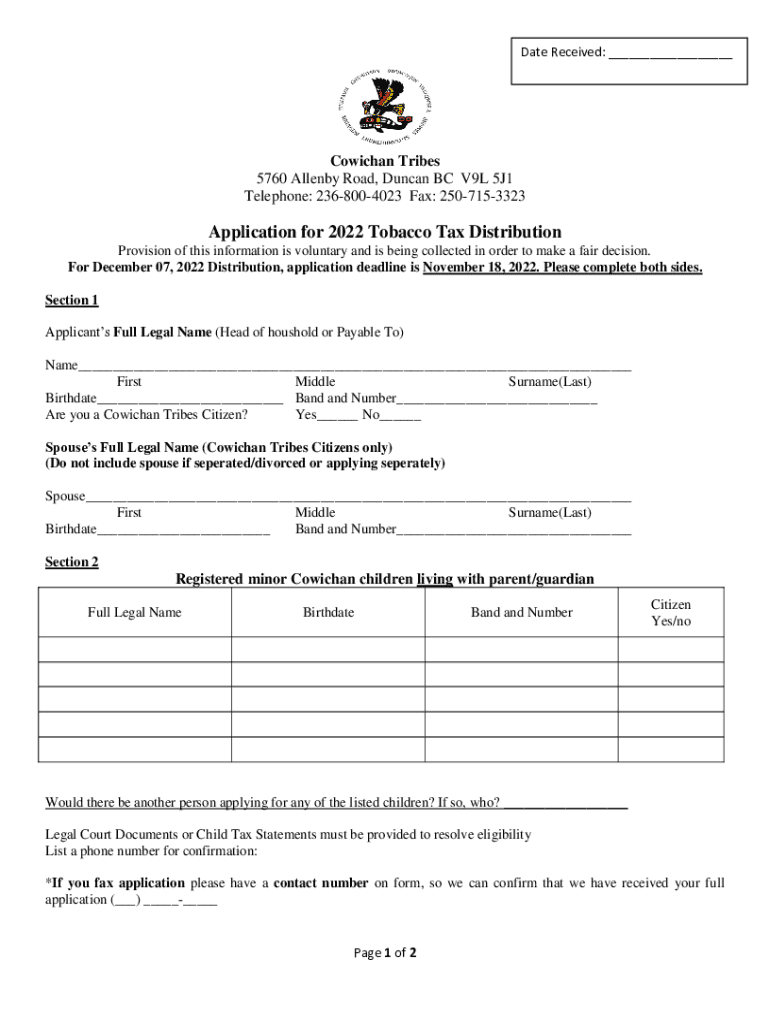

The Cowichan Tobacco Tax Distribution refers to the taxation framework established by the Cowichan Tribes in Canada, which governs the sale and distribution of tobacco products within their jurisdiction. This tax is designed to regulate tobacco sales, ensuring compliance with local laws while generating revenue for community programs and services. The Cowichan Tribes have the authority to implement their own tax rates and regulations, which may differ from federal and provincial standards.

How to Use the Cowichan Tobacco Tax Distribution

Utilizing the Cowichan Tobacco Tax Distribution involves understanding the specific tax obligations when purchasing or selling tobacco products within the Cowichan Tribes' territory. Businesses and consumers must be aware of the applicable tax rates and ensure that they are compliant with the local regulations. This may include obtaining the necessary permits and maintaining accurate records of tobacco transactions to facilitate tax reporting and payment.

Steps to Complete the Cowichan Tobacco Tax Distribution

Completing the Cowichan Tobacco Tax Distribution involves several key steps:

- Identify the applicable tax rate for the tobacco products being sold or purchased.

- Gather all necessary documentation, including permits and sales records.

- Calculate the total tax owed based on the sales figures.

- Complete any required forms or reports as mandated by the Cowichan Tribes.

- Submit the completed documentation along with the tax payment by the specified deadline.

Legal Use of the Cowichan Tobacco Tax Distribution

The legal use of the Cowichan Tobacco Tax Distribution is governed by both tribal laws and applicable Canadian federal regulations. Businesses operating within the Cowichan Tribes' jurisdiction must adhere to these laws to avoid penalties. Compliance ensures that tobacco sales are conducted legally, contributing to community well-being and supporting local initiatives.

Required Documents

To effectively manage the Cowichan Tobacco Tax Distribution, several documents may be required:

- Tax registration forms specific to the Cowichan Tribes.

- Sales records detailing all tobacco transactions.

- Permits for businesses selling tobacco products.

- Completed tax return forms as specified by the Cowichan Tribes.

Penalties for Non-Compliance

Failure to comply with the Cowichan Tobacco Tax Distribution regulations can result in significant penalties. These may include fines, revocation of business permits, and potential legal action. It is crucial for businesses and individuals to stay informed about their tax obligations to avoid these consequences and ensure smooth operations within the Cowichan Tribes' territory.

Quick guide on how to complete cowichan tobacco tax distribution

Accomplish Cowichan Tobacco Tax Distribution seamlessly on any gadget

Digital document management has gained traction among companies and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed paperwork, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without interruptions. Manage Cowichan Tobacco Tax Distribution on any device with airSlate SignNow Android or iOS applications and enhance any document-related task today.

The simplest method to modify and electronically sign Cowichan Tobacco Tax Distribution effortlessly

- Obtain Cowichan Tobacco Tax Distribution and click Get Form to begin.

- Utilize the tools we provide to submit your document.

- Select important sections of your documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your adjustments.

- Choose how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign Cowichan Tobacco Tax Distribution and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cowichan tobacco tax distribution

Create this form in 5 minutes!

How to create an eSignature for the cowichan tobacco tax distribution

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the cowichan tribes tobacco tax?

The cowichan tribes tobacco tax is a tax imposed on the sale of tobacco products within the Cowichan Tribes' jurisdiction. This tax is crucial for funding community programs and services. Understanding the tax structure helps businesses comply and plan financially.

-

How does airSlate SignNow support compliance with the cowichan tribes tobacco tax?

AirSlate SignNow provides businesses with the tools needed to streamline documentation and compliance related to the cowichan tribes tobacco tax. By digitizing documents, businesses can ensure that all necessary tax forms are properly filled out and stored securely. This increases efficiency and reduces the risk of errors.

-

What features does airSlate SignNow offer for managing cowichan tribes tobacco tax documents?

AirSlate SignNow offers features like automated workflows, templates, and eSigning that simplify the management of documents related to the cowichan tribes tobacco tax. These features help businesses quickly generate and send tax documents to ensure compliance. The platform also allows for easy document sharing and collaboration.

-

Is airSlate SignNow cost-effective for businesses dealing with cowichan tribes tobacco tax?

Yes, airSlate SignNow is a cost-effective solution for businesses managing the cowichan tribes tobacco tax. The platform offers competitive pricing plans tailored to different business needs, ensuring that even small businesses can afford to maintain compliance. This helps save time and money in managing paperwork.

-

Can airSlate SignNow integrate with other software to manage cowichan tribes tobacco tax more efficiently?

Absolutely! AirSlate SignNow integrates seamlessly with various software solutions, enhancing your ability to handle the cowichan tribes tobacco tax. Whether you're using accounting software or customer relationship management tools, the integration allows for better data management and improved workflows.

-

What are the benefits of using airSlate SignNow for cowichan tribes tobacco tax documentation?

Using airSlate SignNow for cowichan tribes tobacco tax documentation provides numerous benefits, including simplified processes and reduced paperwork. Businesses can generate, sign, and store documents securely, helping to prevent compliance issues. Additionally, the platform enhances collaboration among team members.

-

How can I get started with airSlate SignNow for cowichan tribes tobacco tax needs?

Getting started with airSlate SignNow for cowichan tribes tobacco tax needs is easy! Simply sign up for an account and explore the features designed for managing tax documents. The platform offers tutorials and customer support to help you make the most of your experience.

Get more for Cowichan Tobacco Tax Distribution

Find out other Cowichan Tobacco Tax Distribution

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement