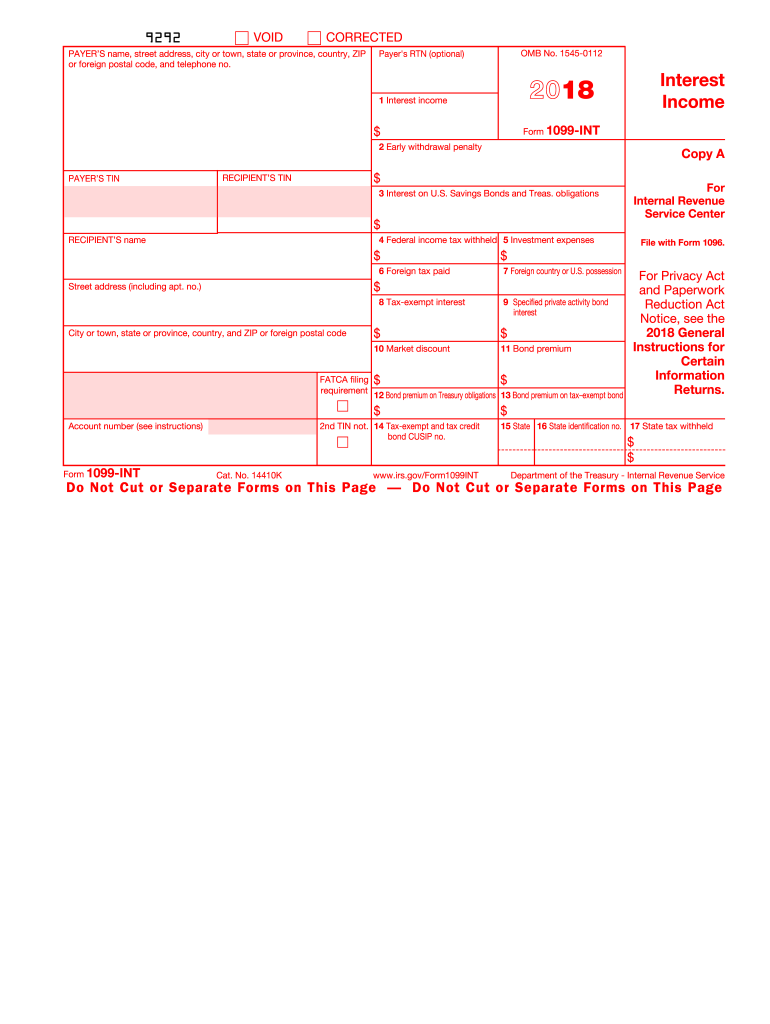

1099 Int Form

What is the 1099 Int

The 1099 Int form, officially known as the 1099 Interest form, is a tax document used in the United States to report interest income earned by individuals and entities. This form is typically issued by banks, credit unions, and other financial institutions to account holders who have received $10 or more in interest during the tax year. The information reported on the 1099 Int is crucial for taxpayers, as it must be included in their annual income tax returns to ensure accurate reporting and compliance with IRS regulations.

How to complete the 1099 Int

Completing the 1099 Int form involves several key steps. First, gather all relevant financial information, including the total interest earned from various accounts. Next, accurately fill in the payer's details, including their name, address, and taxpayer identification number (TIN). Then, enter your information as the recipient, including your name, address, and TIN. Finally, report the total interest income in the appropriate box on the form. It is essential to double-check all entries for accuracy to avoid potential issues with the IRS.

Filing Deadlines / Important Dates

For the 1099 Int form, the IRS requires that the form be sent to recipients by January 31 of the year following the tax year in which the interest was earned. Additionally, the form must be filed with the IRS by February 28 if submitted by mail, or by March 31 if filed electronically. Adhering to these deadlines is crucial to avoid penalties and ensure compliance with tax regulations.

Legal use of the 1099 Int

The 1099 Int form is legally binding and must be used in accordance with IRS guidelines. It is essential for taxpayers to report all interest income accurately to avoid potential audits or penalties. The form serves as a record of income received and is a critical component of the taxpayer's overall financial documentation. Using a reliable digital platform for filling out and submitting the 1099 Int can enhance security and compliance with legal standards.

Who Issues the Form

The 1099 Int form is typically issued by banks, credit unions, brokerage firms, and other financial institutions that pay interest to account holders. These entities are responsible for providing accurate information regarding the interest earned by their clients. Taxpayers should expect to receive this form from any institution where they have earned interest that meets the reporting threshold.

Examples of using the 1099 Int

Common scenarios for using the 1099 Int include individuals who have savings accounts, certificates of deposit, or bonds that generate interest income. For instance, if a taxpayer has a savings account that earned $500 in interest over the year, the bank will issue a 1099 Int form reporting that amount. This form must then be included in the taxpayer's income tax return to ensure accurate reporting of total income.

Quick guide on how to complete 2018 1099 int form

Complete 1099 Int effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed materials, as you can easily access the correct form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly and efficiently. Manage 1099 Int on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign 1099 Int with minimal effort

- Locate 1099 Int and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which only takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Select how you would prefer to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign 1099 Int and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You’ll get a copy of the 1099-INT that they filed.

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

-

Do you have to fill out form 1099 (for tax reporting) if you send over $600 in bitcoin to company for a product?

Among the numerous tax forms, the IRS will be expecting you to fill out a 1099-MISC form in two cases:you made payments to freelancers or independent contractors for business-related services totaling at least $600 within the year;or you paid minimum $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.However, if you made any payments for personal or household services, there is no need to submit a 1099-MISC form.This site has a lot of information about it - http://bit.ly/2Nkf48f

-

Do you need to fill I-9 form for 1099 contract?

There's no such thing as a “1099 employee.” You are either an employee or you are not. The IRS rules are here Independent Contractor Self Employed or Employee and ICE uses a similar process to determine who is an employee and who is not.While it is illegal to retain a contractor whom you know to be working illegally, you are not required to connect Form I-9 from your independent contractors. You may do so if you wish.Who Needs Form I-9? Explains who must provide Form I-9.

Create this form in 5 minutes!

How to create an eSignature for the 2018 1099 int form

How to make an electronic signature for the 2018 1099 Int Form in the online mode

How to generate an electronic signature for the 2018 1099 Int Form in Chrome

How to create an eSignature for putting it on the 2018 1099 Int Form in Gmail

How to generate an electronic signature for the 2018 1099 Int Form straight from your mobile device

How to make an electronic signature for the 2018 1099 Int Form on iOS devices

How to create an eSignature for the 2018 1099 Int Form on Android devices

People also ask

-

What is a 1099 Int. and why is it important?

A 1099 Int. is a tax form used by banks and other financial institutions to report interest income earned by individuals. It's important for taxpayers to accurately report this income on their tax returns to avoid penalties. Understanding the 1099 Int. form helps ensure compliance with IRS regulations.

-

How does airSlate SignNow simplify the 1099 Int. signing process?

airSlate SignNow allows users to electronically sign and send 1099 Int. forms quickly and securely. The platform's intuitive interface makes it easy to prepare and manage documents, ensuring that you can focus on your business without worrying about paperwork delays.

-

What are the pricing plans for using airSlate SignNow for 1099 Int. forms?

airSlate SignNow offers competitive pricing plans to accommodate businesses of all sizes, with options for monthly or annual billing. Each plan includes features that streamline the signing process for 1099 Int. forms, making it a cost-effective solution for your document management needs.

-

Can I integrate airSlate SignNow with other accounting software for 1099 Int. management?

Yes, airSlate SignNow integrates seamlessly with a variety of accounting software, making it easier to manage your 1099 Int. forms. This integration allows for smooth data transfer, reducing the risk of errors and ensuring that your financial records are accurate and up to date.

-

What features does airSlate SignNow offer for managing 1099 Int. forms?

airSlate SignNow provides features like customizable templates, automated reminders, and secure cloud storage specifically for handling 1099 Int. forms. These tools streamline the process, ensuring that you can send, receive, and store documents efficiently and securely.

-

Is airSlate SignNow compliant with IRS requirements for 1099 Int. forms?

Yes, airSlate SignNow is designed to comply with IRS regulations for 1099 Int. forms. Using our platform ensures that your electronic signatures and document management processes meet the necessary legal standards, providing peace of mind during tax season.

-

How can airSlate SignNow benefit small businesses dealing with 1099 Int. forms?

For small businesses, airSlate SignNow offers a cost-effective way to manage 1099 Int. forms without the hassle of traditional paper processes. Our user-friendly platform saves time and reduces administrative burdens, allowing you to focus on growing your business.

Get more for 1099 Int

- Feuille de match futsal form

- Federal tax exempt certificate for mississippi form

- Printable expungement forms for ohio

- Shipping power of attorney template form

- Podiatry progress note template form

- Aml independent review template form

- Ncic initial entry report txdps state tx form

- Private career colleges branch instructor qualification form

Find out other 1099 Int

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online