Nyc Department of Finance Parking Tax Exemption Form

Understanding the NYC Department of Finance Parking Tax Exemption

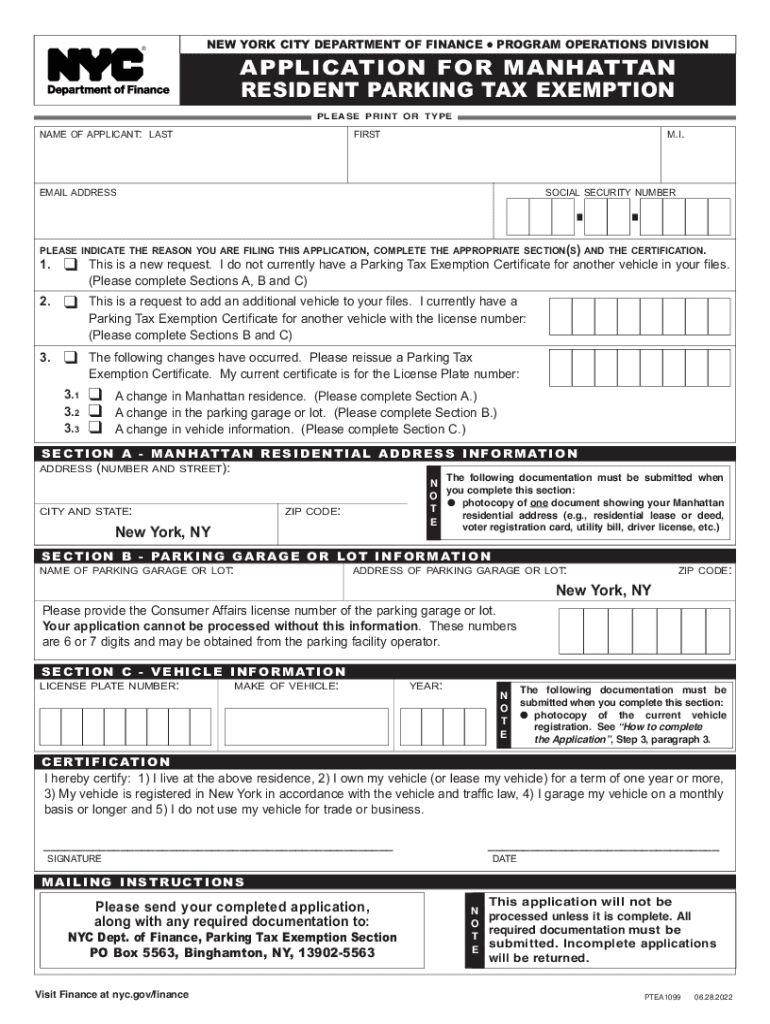

The NYC Department of Finance offers a parking tax exemption for residents, allowing eligible individuals to reduce or eliminate parking tax liabilities. This exemption is primarily aimed at those who reside in New York City and meet specific criteria. It is essential to understand the eligibility requirements and the implications of this exemption to ensure compliance with local regulations.

Eligibility Criteria for the NYC Parking Tax Exemption

To qualify for the NYC parking tax exemption, residents must meet certain conditions. Typically, applicants need to provide proof of residency, such as a valid driver's license or utility bill. Additionally, the vehicle must be registered in New York City, and the applicant must not have any outstanding parking violations. Understanding these criteria is crucial for a successful application.

Steps to Complete the NYC Parking Tax Exemption Form

Completing the NYC parking tax exemption form involves several straightforward steps. First, gather all required documents, including proof of residency and vehicle registration. Next, fill out the exemption form accurately, ensuring all information is current and complete. Once the form is filled out, submit it either online or via mail, following the submission guidelines provided by the NYC Department of Finance.

Required Documents for the NYC Parking Tax Exemption

Applicants must provide specific documents to support their exemption request. Commonly required documents include:

- Proof of residency (e.g., utility bill, lease agreement)

- Vehicle registration showing the NYC address

- Identification, such as a driver's license

Having these documents ready will streamline the application process and help avoid delays.

Form Submission Methods for the NYC Parking Tax Exemption

Residents can submit the NYC parking tax exemption form through various methods. The most convenient option is online submission via the NYC Department of Finance website. Alternatively, residents may choose to mail their completed forms or submit them in person at designated city offices. Understanding these options can help ensure timely processing of the exemption request.

Legal Use of the NYC Parking Tax Exemption

The NYC parking tax exemption is legally binding once approved. Residents must adhere to the terms of the exemption and ensure that they continue to meet eligibility requirements. Misuse of the exemption, such as providing false information or failing to maintain residency, can result in penalties. Therefore, it is crucial to understand the legal implications of the exemption to avoid potential issues.

Quick guide on how to complete nyc department of finance parking tax exemption

Complete Nyc Department Of Finance Parking Tax Exemption effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools you require to create, edit, and eSign your documents quickly without any delays. Manage Nyc Department Of Finance Parking Tax Exemption on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Nyc Department Of Finance Parking Tax Exemption without effort

- Locate Nyc Department Of Finance Parking Tax Exemption and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow has designed specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all details and click the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about misplaced or lost files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Nyc Department Of Finance Parking Tax Exemption and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nyc department of finance parking tax exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the resident parking tax exemption?

The resident parking tax exemption is a financial benefit that allows eligible residents to avoid certain parking taxes. By applying for this exemption, residents can save on parking fees related to their status. Understanding this exemption can help you make informed decisions about your financial responsibilities.

-

Who is eligible for the resident parking tax exemption?

Eligibility for the resident parking tax exemption typically includes residents who can prove they live in a specific area and meet other local criteria. It often applies to property owners and long-term tenants. To determine your eligibility, check with your local government’s parking authority.

-

How can I apply for the resident parking tax exemption?

Applying for the resident parking tax exemption usually involves submitting an application form to your local tax office or parking authority. You'll need to provide proof of residency and any additional documentation required. A straightforward process will ensure you can quickly start benefiting from this exemption.

-

Is there a fee associated with applying for the resident parking tax exemption?

Generally, there is no fee to apply for the resident parking tax exemption itself, but some jurisdictions may charge a processing fee. It's essential to check with your local authority for specific details. This exemption can lead to signNow savings, making it worthwhile to investigate.

-

What documents do I need for the resident parking tax exemption application?

To apply for the resident parking tax exemption, you will typically need to provide proof of residency, such as a utility bill or lease agreement. Some applications may require additional documentation like ID or vehicle registration. Preparation of these documents can streamline your application process.

-

How long does it take to process the resident parking tax exemption application?

The processing time for the resident parking tax exemption application can vary depending on the local authority. Generally, you can expect a response within a few weeks, but in some cases, it may take longer. Always check with your local office for the most accurate timelines.

-

Can I renew my resident parking tax exemption each year?

Yes, many local governments require annual renewal for the resident parking tax exemption. This renewal process ensures that you remain eligible according to current residency requirements. It’s advisable to keep track of any deadlines to maintain your exemption benefits.

Get more for Nyc Department Of Finance Parking Tax Exemption

- Application update form admission clayton state university admissions clayton

- Dd form 2628

- Storyworks jr pdf form

- Applicant consent form for fingerprinting for justice center

- Turf removal application golden state water company form

- Tb 400a texas department of state health services dshs state tx form

- Caste validity form pdf in marathi

- Gv 110 771268048 form

Find out other Nyc Department Of Finance Parking Tax Exemption

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online