Texas Sales Tax Exemption Form

What is the Texas Sales Tax Exemption Form

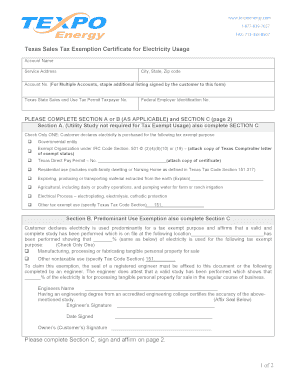

The Texas Sales Tax Exemption Form is a crucial document that allows eligible businesses and organizations to purchase goods and services without paying sales tax. This form is essential for entities that qualify under specific exemptions, such as non-profit organizations, government agencies, and certain types of businesses. By submitting this form, the buyer certifies that the purchase is exempt from sales tax, thereby ensuring compliance with Texas tax regulations.

How to use the Texas Sales Tax Exemption Form

Using the Texas Sales Tax Exemption Form involves several straightforward steps. First, the buyer must complete the form accurately, providing all necessary information, including the name of the purchaser, the type of exemption, and the seller’s details. Once filled out, the form should be presented to the seller at the time of purchase. It is important to retain a copy of the form for your records, as it may be required for future audits or compliance checks.

Steps to complete the Texas Sales Tax Exemption Form

Completing the Texas Sales Tax Exemption Form requires careful attention to detail. Follow these steps:

- Obtain the Texas Sales Tax Exemption Form, which can be downloaded as a PDF.

- Fill in the required fields, including the purchaser's name, address, and type of exemption.

- Provide a description of the items being purchased.

- Sign and date the form to validate it.

- Present the completed form to the seller at the time of purchase.

Legal use of the Texas Sales Tax Exemption Form

The legal use of the Texas Sales Tax Exemption Form is governed by Texas tax laws. To ensure compliance, the form must be completed accurately and used only for qualifying purchases. Misuse of the form, such as using it for taxable items, can lead to penalties and fines. It is advisable to consult with a tax professional if there are any uncertainties regarding eligibility or proper usage.

Eligibility Criteria

Eligibility for using the Texas Sales Tax Exemption Form is defined by specific criteria set forth by the Texas Comptroller's office. Common eligible entities include:

- Non-profit organizations, such as charities and educational institutions.

- Government entities, including federal, state, and local agencies.

- Certain businesses that purchase items for resale or manufacturing.

It is essential for applicants to review the full list of eligible categories to determine if they qualify for tax exemption.

Required Documents

To successfully complete the Texas Sales Tax Exemption Form, certain documents may be required. These typically include:

- Proof of the entity's tax-exempt status, such as a letter from the IRS.

- Identification documents for the individual completing the form.

- Any additional documentation that supports the claim for exemption.

Having these documents ready can facilitate a smoother process when filling out and submitting the form.

Quick guide on how to complete texas sales tax exemption form 250881400

Effortlessly Prepare Texas Sales Tax Exemption Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Texas Sales Tax Exemption Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related operations today.

How to Edit and eSign Texas Sales Tax Exemption Form with Ease

- Locate Texas Sales Tax Exemption Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, laborious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign Texas Sales Tax Exemption Form to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the texas sales tax exemption form 250881400

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a TX sales tax exemption certificate?

A TX sales tax exemption certificate is a document provided by the state of Texas that allows businesses to purchase certain goods and services without paying sales tax. This certificate is crucial for businesses wanting to avoid unnecessary expenses and ensure compliance with state laws. Using this exemption certificate can help streamline the purchasing process for tax-exempt organizations.

-

How can airSlate SignNow assist with TX sales tax exemption certificate documentation?

airSlate SignNow facilitates the easy creation and signing of TX sales tax exemption certificates, making the process efficient for businesses. Users can customize their exemption documents, share them with required parties, and collect electronic signatures quickly. This feature not only saves time but also ensures that all necessary paperwork is compliant with Texas regulations.

-

Are there any fees associated with obtaining a TX sales tax exemption certificate through airSlate SignNow?

Using airSlate SignNow, there may be associated subscription fees depending on the services and features selected. However, the ability to create and manage TX sales tax exemption certificates electronically can ultimately save businesses money in terms of time and compliance costs. It’s advisable to review pricing plans to choose the best option for your needs.

-

What documents are needed to apply for a TX sales tax exemption certificate?

To apply for a TX sales tax exemption certificate, typically a business will need to provide proof of tax-exempt status, such as nonprofit status or government agency documentation. The application process can be streamlined with airSlate SignNow, enabling easy attachment and sharing of necessary documents. This ensures that the application for the TX sales tax exemption certificate is processed efficiently.

-

Can airSlate SignNow integrate with other software to manage TX sales tax exemption certificates?

Yes, airSlate SignNow offers integrations with various business applications to enhance workflow efficiency. This allows users to manage TX sales tax exemption certificates alongside other important documents and tasks seamlessly. By integrating with accounting and ERP systems, businesses can ensure that their exemption certificates are accurately tracked and managed.

-

What are the benefits of using airSlate SignNow for TX sales tax exemption certificates?

Using airSlate SignNow for TX sales tax exemption certificates streamlines the documentation process, reducing paper waste and enhancing collaboration. The platform offers a user-friendly interface that simplifies the signing and tracking of documents. Additionally, the electronic nature of airSlate SignNow ensures that businesses maintain compliance and have easier access to their certificate records.

-

Is airSlate SignNow secure for handling sensitive TX sales tax exemption certificate information?

Absolutely, airSlate SignNow employs industry-standard security measures to protect sensitive information, including TX sales tax exemption certificates. Data encryption, secure storage, and compliance with privacy regulations ensure that your documents and signatures are safe. This level of security is crucial for maintaining trust and integrity in sensitive transactions.

Get more for Texas Sales Tax Exemption Form

- World geography sol review packet virginia answer key form

- Hindustan unilever registration form

- What is rheumatology form

- Nature of business template form

- Facility event space rental agreement template form

- Facility rental agreement template form

- Family member rental agreement template form

- Fake rental agreement template form

Find out other Texas Sales Tax Exemption Form

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile