Income and Expense Worksheet Optima Tax Relief Form

What is the Income And Expense Worksheet Optima Tax Relief

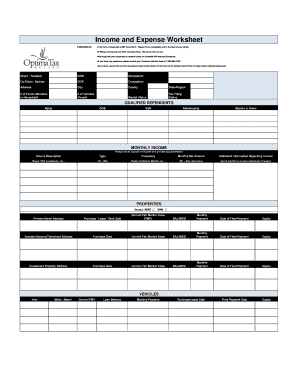

The Income and Expense Worksheet is a crucial document for clients of Optima Tax Relief. It serves as a comprehensive tool for organizing financial information, which is essential for tax preparation and relief processes. This worksheet helps clients track their income sources and categorize their expenses, providing a clear picture of their financial situation. By compiling this information, clients can better understand their tax obligations and identify potential areas for relief.

How to use the Income And Expense Worksheet Optima Tax Relief

Using the Income and Expense Worksheet involves several straightforward steps. First, clients should gather all relevant financial documents, including pay stubs, bank statements, and receipts. Next, they can begin filling out the worksheet by entering their income details in the designated sections. Following this, clients should categorize their expenses, ensuring that they include all necessary deductions. Once completed, the worksheet can be utilized to assess eligibility for tax relief options and to prepare for discussions with tax professionals.

Steps to complete the Income And Expense Worksheet Optima Tax Relief

Completing the Income and Expense Worksheet requires careful attention to detail. Clients should follow these steps:

- Collect all financial documents, including income statements and expense receipts.

- Fill in the income section with accurate figures, ensuring all sources are included.

- List expenses in the appropriate categories, such as housing, transportation, and healthcare.

- Review the worksheet for accuracy and completeness before submission.

- Utilize the completed worksheet to facilitate discussions with tax relief professionals.

Legal use of the Income And Expense Worksheet Optima Tax Relief

The Income and Expense Worksheet is designed to comply with U.S. tax regulations, making it a legally acceptable tool for tax preparation. It is essential for clients to ensure that all information provided is accurate and truthful, as discrepancies can lead to penalties. The worksheet can be used to support claims for tax relief, demonstrating a clear financial picture to tax authorities and relief organizations.

Key elements of the Income And Expense Worksheet Optima Tax Relief

Several key elements are vital for the effective use of the Income and Expense Worksheet. These include:

- Income Sources: A detailed list of all income streams, including wages, freelance work, and investments.

- Expense Categories: Clear categorization of expenses to facilitate deductions, such as housing, utilities, and medical costs.

- Total Calculations: Summaries of total income and expenses to assess overall financial health.

- Documentation: Space for referencing supporting documents that validate the reported figures.

Eligibility Criteria

To effectively utilize the Income and Expense Worksheet, clients should be aware of the eligibility criteria for tax relief programs. Generally, eligibility is determined by factors such as income level, types of expenses incurred, and overall financial hardship. Understanding these criteria can help clients accurately complete the worksheet and enhance their chances of qualifying for relief options.

Quick guide on how to complete income and expense worksheet optima tax relief

Complete Income And Expense Worksheet Optima Tax Relief effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed documents, enabling you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and efficiently. Manage Income And Expense Worksheet Optima Tax Relief on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The most effective way to edit and eSign Income And Expense Worksheet Optima Tax Relief with ease

- Locate Income And Expense Worksheet Optima Tax Relief and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or conceal sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a traditional ink signature.

- Review the information and click on the Done button to save your adjustments.

- Select how you wish to share your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your preference. Edit and eSign Income And Expense Worksheet Optima Tax Relief and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income and expense worksheet optima tax relief

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Optima Tax Relief Portal?

The Optima Tax Relief Portal is a digital platform designed to streamline the management of your tax relief process. It allows users to easily access, share, and track important documents related to their tax situation. With user-friendly features, the Optima Tax Relief Portal simplifies communication with tax professionals.

-

How can I access the Optima Tax Relief Portal?

You can access the Optima Tax Relief Portal by signing up for an account on the platform. Once registered, you will receive login credentials to enter the portal. The process is simple and provides immediate access to your tax relief needs.

-

Is there a cost associated with using the Optima Tax Relief Portal?

While basic access to the Optima Tax Relief Portal may be free, additional features or premium services may incur charges. It's important to review the pricing structure before subscribing to ensure that the features you need are covered. Keeping costs in check is a primary goal of the Optima Tax Relief Portal.

-

What features does the Optima Tax Relief Portal offer?

The Optima Tax Relief Portal includes features such as document storage, eSigning capabilities, and real-time collaboration tools. These features make it easy for users to organize their tax documentation and communicate with their tax specialists efficiently. Overall, the portal enhances the user experience in managing tax relief documentation.

-

Can I integrate the Optima Tax Relief Portal with other applications?

Yes, the Optima Tax Relief Portal offers integrations with various applications to facilitate seamless data transfer and communication. This ensures that your tax documents can easily synchronize with your existing workflow. Check with the portal's support team to learn more about specific integration options.

-

What are the benefits of using the Optima Tax Relief Portal?

Using the Optima Tax Relief Portal provides signNow benefits, including enhanced organization, improved accessibility to tax documents, and simplified communication with tax professionals. These advantages allow users to handle their tax relief issues efficiently. The portal ultimately saves time and reduces stress in managing tax situations.

-

Is the Optima Tax Relief Portal secure?

The Optima Tax Relief Portal prioritizes security and employs various measures to protect user data. These include encryption protocols and secure login processes to safeguard sensitive information. By using the portal, you can have confidence in the privacy and security of your tax documents.

Get more for Income And Expense Worksheet Optima Tax Relief

Find out other Income And Expense Worksheet Optima Tax Relief

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online