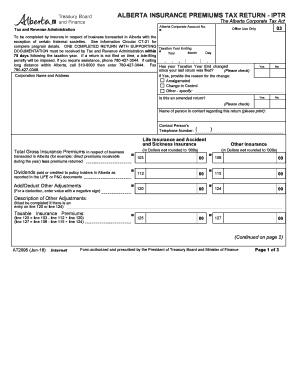

ALBERTA INSURANCE PREMIUMS TAX RETURN IPTR Form

What is the Alberta Insurance Premiums Tax Return IPTR?

The Alberta Insurance Premiums Tax Return, commonly referred to as the IPTR form, is a specific document required for reporting insurance premiums collected by insurance companies operating in Alberta. This form is essential for compliance with Alberta's tax regulations, ensuring that insurers accurately report and remit the appropriate taxes on the premiums they receive. The IPTR is a key component for maintaining transparency and accountability within the insurance sector.

Steps to Complete the Alberta Insurance Premiums Tax Return IPTR

Completing the Alberta Insurance Premiums Tax Return involves several important steps. First, gather all necessary financial records, including details of premiums collected and any applicable deductions. Next, accurately fill out the IPTR form, ensuring that all figures are correct and reflect your business's financial activity. After completing the form, review it for accuracy before submission. Finally, submit the IPTR form by the designated deadline to avoid any penalties.

Legal Use of the Alberta Insurance Premiums Tax Return IPTR

The Alberta Insurance Premiums Tax Return is legally binding when properly completed and submitted. It must adhere to the regulations set forth by the Alberta government. Electronic submissions are accepted, provided they comply with the relevant eSignature laws, such as ESIGN and UETA. Ensuring that the IPTR form is filled out accurately and submitted on time is crucial to avoid potential legal complications or fines.

Filing Deadlines / Important Dates

Filing deadlines for the Alberta Insurance Premiums Tax Return are critical for compliance. Typically, the IPTR form must be submitted annually, with specific dates set by the Alberta government. It is important for businesses to stay informed about these deadlines to ensure timely filing and avoid late fees. Keeping a calendar of important dates related to the IPTR can help maintain compliance and streamline the filing process.

Required Documents

To complete the Alberta Insurance Premiums Tax Return, certain documents are necessary. These include detailed records of all insurance premiums collected during the reporting period, any relevant financial statements, and documentation supporting any deductions claimed. Having these documents readily available can facilitate a smoother completion process and ensure that the IPTR form is accurate and comprehensive.

Form Submission Methods (Online / Mail / In-Person)

The Alberta Insurance Premiums Tax Return can be submitted through various methods. Businesses have the option to file the IPTR form online, which is often the most efficient method. Alternatively, the form can be mailed or submitted in person at designated government offices. Each submission method has its own requirements and processing times, so it is advisable to choose the method that best suits your business needs.

Penalties for Non-Compliance

Failure to comply with the requirements of the Alberta Insurance Premiums Tax Return can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for businesses to understand these penalties and take proactive measures to ensure timely and accurate submission of the IPTR form. Awareness of compliance requirements can help mitigate risks and maintain good standing with regulatory authorities.

Quick guide on how to complete alberta insurance premiums tax return iptr

Complete ALBERTA INSURANCE PREMIUMS TAX RETURN IPTR effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents rapidly and without complications. Handle ALBERTA INSURANCE PREMIUMS TAX RETURN IPTR seamlessly on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign ALBERTA INSURANCE PREMIUMS TAX RETURN IPTR with ease

- Obtain ALBERTA INSURANCE PREMIUMS TAX RETURN IPTR and click on Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize necessary sections of your documents or redact sensitive information with specialized tools that airSlate SignNow offers for that purpose.

- Create your eSignature with the Sign feature, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious document searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management demands in just a few clicks from any device you select. Modify and eSign ALBERTA INSURANCE PREMIUMS TAX RETURN IPTR and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the alberta insurance premiums tax return iptr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the iptr form and how can it be used?

The iptr form is a document designed for easy electronic signing and management. With airSlate SignNow, you can seamlessly create, send, and eSign your iptr form, ensuring an efficient workflow. This tool not only simplifies the signing process but also keeps all your files organized.

-

How does airSlate SignNow ensure the security of my iptr form?

Security is a priority with airSlate SignNow. When you send or store your iptr form, it is protected with industry-standard encryption and secure servers. This means that your sensitive information will remain confidential and protected against unauthorized access.

-

Are there any costs associated with using the iptr form on airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to cater to different business needs. You can access the iptr form and its features at an affordable price, ensuring a cost-effective solution for document management and electronic signing. Evaluate your requirements to choose the best plan for your organization.

-

What are the key features available for the iptr form in airSlate SignNow?

The iptr form comes with multiple features including electronic signatures, customizable templates, and real-time tracking. Additionally, airSlate SignNow allows you to automate workflows and send reminders to ensure timely completion of your iptr form. These features enhance productivity and streamline your document handling.

-

Can I integrate the iptr form with other applications?

Yes, airSlate SignNow supports integration with various third-party applications. You can easily connect your iptr form with platforms like Google Drive, Salesforce, and more, allowing for a smoother workflow. This integration capability ensures that you can manage your documents in a way that suits your existing systems.

-

How does the iptr form benefit my business?

Utilizing the iptr form through airSlate SignNow helps your business reduce paperwork and streamline processes. It enhances efficiency by allowing for quicker approvals and fewer delays, ultimately improving customer satisfaction. Moreover, it contributes to cost savings by minimizing the need for physical document handling.

-

Is there a mobile app for signing the iptr form?

Yes, airSlate SignNow offers a mobile app that allows you to sign and manage your iptr form on the go. The app provides full access to all features, enabling you to review, send, and eSign documents from anywhere. This flexibility is ideal for busy professionals and teams in remote settings.

Get more for ALBERTA INSURANCE PREMIUMS TAX RETURN IPTR

Find out other ALBERTA INSURANCE PREMIUMS TAX RETURN IPTR

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract