Fidelity Transfer Death 2016-2026

What is the Fidelity Transfer Death?

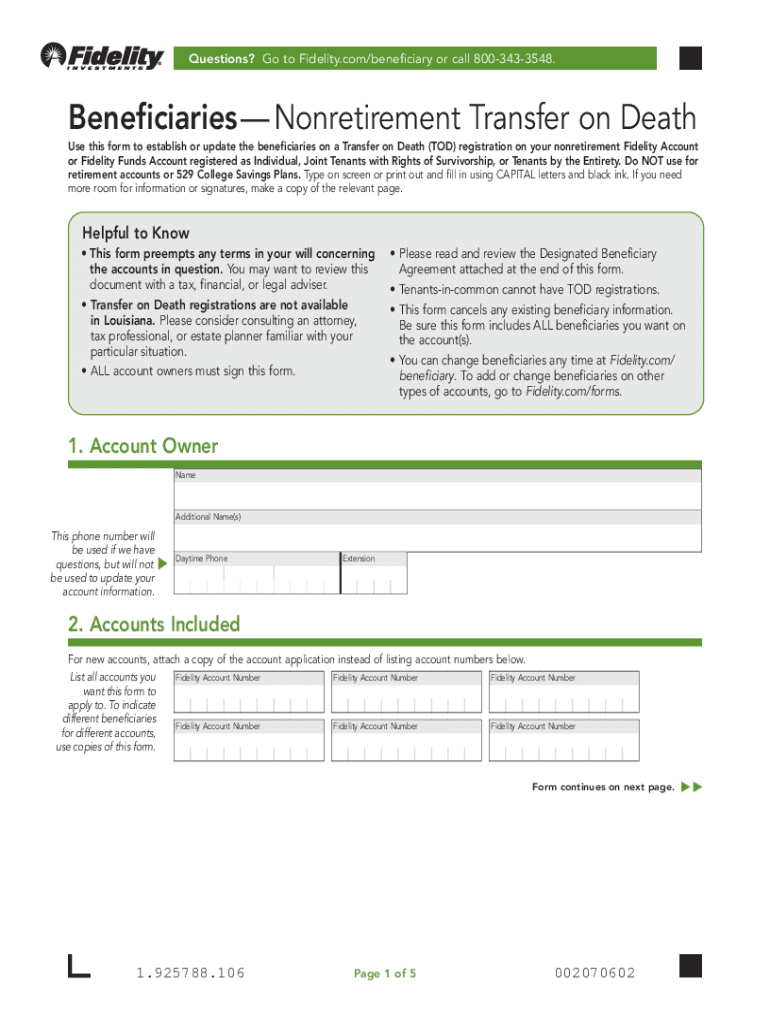

The Fidelity Transfer Death refers to a legal process that allows the transfer of assets held in a Fidelity account upon the account holder's death. This process is essential for ensuring that the designated beneficiaries receive the assets without the need for probate, which can be a lengthy and costly procedure. The transfer typically involves filling out a Fidelity Transfer on Death form, which designates beneficiaries and outlines the specific assets to be transferred. Understanding this process is crucial for individuals planning their estate and ensuring their assets are distributed according to their wishes.

Steps to complete the Fidelity Transfer Death

Completing the Fidelity Transfer Death involves several important steps to ensure that the transfer is executed correctly. Here are the key steps:

- Identify the assets: Determine which accounts and investments will be included in the transfer.

- Designate beneficiaries: Clearly specify who will receive the assets. This can include family members, friends, or charitable organizations.

- Obtain the Fidelity Transfer on Death form: This form can be downloaded from the Fidelity website or requested directly from their customer service.

- Fill out the form accurately: Provide all required information, including account details and beneficiary information.

- Submit the form: Send the completed form to Fidelity, either online or via mail, depending on your preference.

- Confirm the transfer: After submission, verify with Fidelity that the transfer has been processed and that beneficiaries are correctly designated.

Legal use of the Fidelity Transfer Death

The legal use of the Fidelity Transfer Death is governed by state laws and federal regulations. This form allows account holders to bypass probate, making the transfer of assets more efficient. To ensure the legality of the transfer, it is important to comply with the following:

- Ensure the form is properly filled out and signed.

- Designate beneficiaries clearly to avoid disputes.

- Keep the form updated, especially after major life events such as marriage or divorce.

- Consult with an estate planning attorney if there are complex assets or family dynamics involved.

Required Documents

To complete the Fidelity Transfer Death, certain documents are necessary. These may include:

- The completed Fidelity Transfer on Death form.

- A copy of the death certificate of the account holder.

- Identification documents for the beneficiaries, such as a driver's license or Social Security number.

- Any additional documentation required by Fidelity, which may vary based on the specific accounts involved.

Form Submission Methods

Submitting the Fidelity Transfer on Death form can be done through various methods to accommodate different preferences:

- Online submission through Fidelity's secure portal, which allows for quick processing.

- Mailing the completed form to Fidelity's designated address for processing.

- In-person submission at a Fidelity branch, if available, for those who prefer face-to-face assistance.

Examples of using the Fidelity Transfer Death

Understanding how the Fidelity Transfer Death is applied can clarify its importance. Here are a few examples:

- A parent designates their children as beneficiaries on their Fidelity investment accounts, ensuring a smooth transfer of assets upon their passing.

- A retiree updates their Fidelity Transfer on Death form after the birth of a grandchild, adding them as a beneficiary to include them in their estate planning.

- An individual with multiple accounts consolidates their beneficiary designations to simplify the transfer process for their heirs.

Quick guide on how to complete fidelity transfer death

Finalize Fidelity Transfer Death seamlessly on any gadget

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Fidelity Transfer Death on any system with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Fidelity Transfer Death effortlessly

- Obtain Fidelity Transfer Death and click on Get Form to commence.

- Use the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign feature, which takes moments and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tiresome form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Fidelity Transfer Death and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fidelity transfer death

Create this form in 5 minutes!

How to create an eSignature for the fidelity transfer death

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is beneficiary transferring in the context of airSlate SignNow?

Beneficiary transferring refers to the process of designating a new beneficiary for a document, allowing for proper succession of rights and responsibilities. With airSlate SignNow, you can easily update beneficiary details in your agreements while maintaining secure and compliant electronic signatures.

-

How does airSlate SignNow facilitate beneficiary transferring?

airSlate SignNow streamlines beneficiary transferring by providing an intuitive interface that enables users to easily edit and reassign beneficiary designations. This ensures that all necessary parties can review, approve, and sign the documents quickly, reducing delays and improving workflow efficiency.

-

Are there any costs associated with beneficiary transferring in airSlate SignNow?

Using airSlate SignNow for beneficiary transferring is included in your subscription plan, which offers a range of features designed to enhance document management. We provide transparent pricing options that cater to businesses of any size, making it a cost-effective solution for all your signing needs.

-

What are the benefits of using airSlate SignNow for beneficiary transferring?

The primary benefits of using airSlate SignNow for beneficiary transferring include ease of use, fast document turnaround, and enhanced security. Our platform ensures that all transactions are signed electronically and tracked, providing peace of mind to users managing sensitive agreements.

-

Can I integrate airSlate SignNow with other platforms for beneficiary transferring?

Yes, airSlate SignNow offers integrations with various third-party applications, enhancing your workflow efficiency when managing beneficiary transferring. This integration capability allows you to seamlessly connect with CRM systems, cloud storage, and other essential tools for a more holistic document management experience.

-

Is airSlate SignNow compliant with legal standards for beneficiary transferring?

Absolutely! airSlate SignNow is designed to meet stringent legal standards, ensuring that all beneficiary transferring actions are compliant with regulations such as eSignature laws. Our platform provides legally binding signatures, so you can confidently manage and execute beneficiary designations.

-

How do I initiate beneficiary transferring on the airSlate SignNow platform?

Initiating beneficiary transferring on airSlate SignNow is straightforward. Simply log into your account, select the document you wish to update, and follow our guided steps to change the beneficiary designation. You'll have the option to send the document for eSignature immediately after you make the updates.

Get more for Fidelity Transfer Death

- Rfi response examples form

- Memorial sloan kettering medical records form

- Wonderboom 3 bus timetable form

- Sled security application form

- Lesson 5 skills practice similar triangles and indirect measurement answer key form

- K 12 education expense credit worksheet form

- The girl and the chenoo form

- Dch 0854 form

Find out other Fidelity Transfer Death

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online