File # Titleservices Form

What is the File # Titleservices

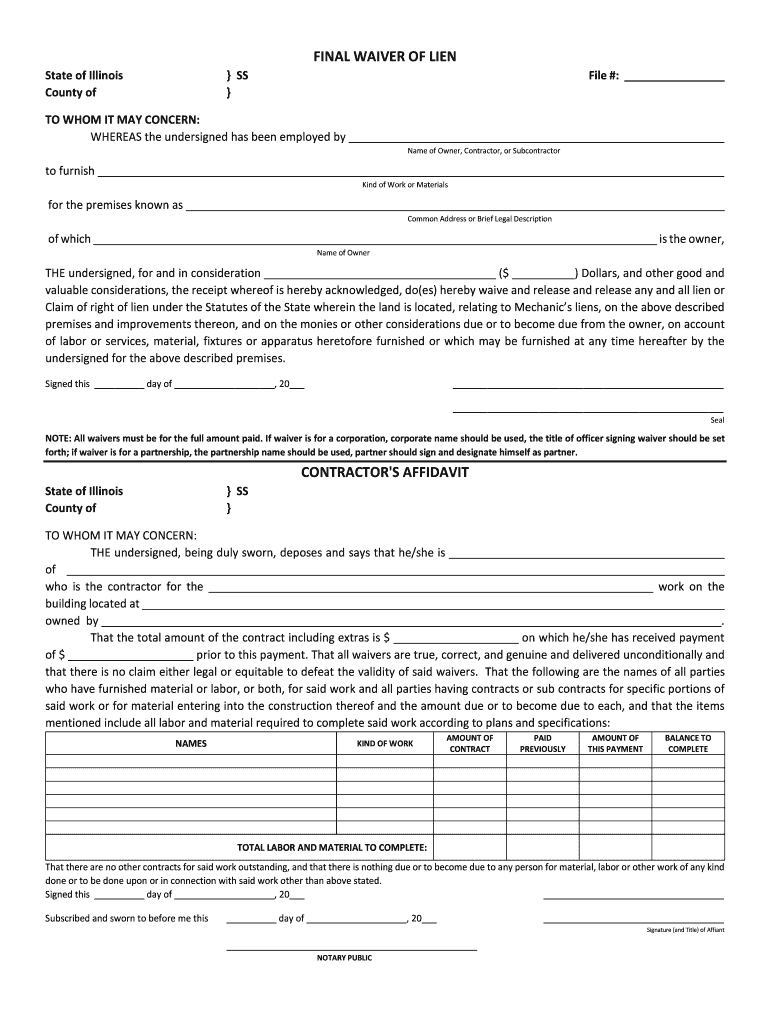

The File # Titleservices form is a crucial document used primarily in real estate transactions, particularly in the context of title insurance. This form serves to facilitate the transfer of property ownership and ensure that the title is clear of any liens or encumbrances. It is essential for buyers, sellers, and lenders to understand the implications of this form, as it plays a significant role in the closing process of real estate deals.

How to use the File # Titleservices

Using the File # Titleservices form involves several steps that ensure compliance with legal requirements. First, gather all necessary information related to the property, including the legal description and any existing liens. Next, complete the form accurately, ensuring that all required fields are filled out. Once completed, the form must be submitted to the appropriate title company or real estate attorney for processing. It is advisable to retain a copy for your records.

Steps to complete the File # Titleservices

Completing the File # Titleservices form requires attention to detail. Follow these steps for successful completion:

- Gather relevant property information, including the address and legal description.

- Identify all parties involved in the transaction, including buyers, sellers, and lenders.

- Fill out the form, ensuring accuracy in all entries.

- Review the completed form for any errors or omissions.

- Submit the form to the title company or legal representative.

Legal use of the File # Titleservices

The legal use of the File # Titleservices form is governed by state-specific regulations and requirements. To ensure that the form is legally binding, it must be executed in compliance with local laws. This includes obtaining the necessary signatures and, in some cases, notarization. Understanding the legal framework surrounding this form is essential for all parties involved in a real estate transaction.

Key elements of the File # Titleservices

Several key elements must be included in the File # Titleservices form to ensure its validity. These elements typically include:

- The names and addresses of all parties involved in the transaction.

- A detailed legal description of the property.

- Information regarding any existing liens or encumbrances.

- Signatures of all parties, confirming their agreement to the terms outlined in the form.

Required Documents

When preparing to complete the File # Titleservices form, certain documents are typically required. These may include:

- Proof of identity for all parties involved.

- Existing title documents or previous title insurance policies.

- Any relevant legal documents, such as deeds or court orders.

Form Submission Methods

The File # Titleservices form can be submitted through various methods, depending on the requirements of the title company or legal representative. Common submission methods include:

- Online submission via secure portals provided by title companies.

- Mailing the completed form to the title company or attorney.

- In-person submission at the office of the title company or legal representative.

Quick guide on how to complete file titleservices

Prepare File # Titleservices effortlessly on any gadget

Web-based document management has gained popularity among businesses and individuals. It offers a superb eco-friendly substitute to traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without hindrances. Manage File # Titleservices on any device using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest method to modify and electronically sign File # Titleservices with ease

- Find File # Titleservices and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to preserve your updates.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choosing. Edit and electronically sign File # Titleservices and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What is the procedure for filling out a TDS return?

TDS is the collection of tax of the income. TDS Return include the details like PAN Number of debuctor, tax paid to the government, challan details and other information is required for TDS.There are some procedures to follow while filling out a TDS return:-C1 Correction:- In this type you want to fill details like name, address, etc.C2 Correction:- In this step you want to provide some few details of challan like challan serial number, challan name, date.C3 Correction:- In this step we can change or update the details of the deductee person.C4 Correction:- This type can help you from maintaining your salary details or you can edit your salary system.C5 Correction:- You can edit the deductee documents like pan card, name, etc in this step.C9 Correction:- This is the final step where you can handover the new challan after editing the details of the deductee.The above mentioned details are some easy steps are explained in details for more information or if you want to do TDS return filing here is the link Online TDS Return Filing Where you will get guide from the CA expert and from professional expert staffs.Thank you!!!

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How do I fill out the GSTR 1?

GST has rolled out and paved the way for a uniform and systematic reporting system that is seldom found anywhere else. This transaction-wise, destination-based reporting system provides for a much effective credit flow, removes chances of corruption and illegal transactions.To achieve this, the government has come up with an effective form-based reporting system that needs to be filed either monthly, quarterly or yearly, as the case may be, by the dealers and manufacturers. The aggregation of information uploaded by all the dealers will lead to a common reservoir of data, which can be accessed by either. Moreover, dealers can view their credit statement or payables with respect to GST easily in a common internet portal.What Is GSTR-1 ?It all starts with GSTR-1. It is where the suppliers will report their outward supplies during the reporting month. As such, all registered taxable persons are required to file GSTR-1 by the 10th of the following month. It is the first or the starting point for passing input tax credits to the dealers.Who needs to file GSTR-1?GSTR-1 has to be filed by “all” taxable registered persons under GST. However, there are certain dealers who are not required to file GSTR-1, instead, are required to file other different GST returns as the case may be. These dealers are E-Commerce Operators, Input Service Distributors, dealers registered under the Composition Scheme, Non-Resident dealers and Tax deductors. It has to be filed even in cases where there is no business conducted during the reporting month.How to file GSTR-1 In few steps.What needs to be filled in GSTR-1?GSTR-1 has 13 different heads that need to be filled in. The major ones are enlisted here:GSTIN of the taxable person filing the return – Auto-populated resultName of the taxable person – Auto-populated fieldTotal Turnover in Last Financial Year – This is a one-time action and has to be filled once. This field will be auto-populated with the closing balance of the last yearThe Period for which the return is being filed – Month & Year is available as a drop down for selectionDetails of Taxable outward supplies made to registered persons – CGST and SGST shall be filled in case of intra-state movement whereas IGST shall be filled only in the case of inter-state movement. Details of exempted sales or sales at nil rate of tax shall also be mentioned hereDetails of Outward Supplies made to end customer, where the value exceeds Rs. 2.5 lakhs – Other than mentioned, all such supplies are optional in natureThe total of all outward supplies made to end consumers, where the value does not exceed Rs. 2.5 lakhs.Details of Debit Notes or Credit NotesAmendments to outward supplies of previous periods – Apart from these two, any changes made to a GST invoice has to be mentioned in this sectionExempted, Nil-Rated and Non-GST Supplies – If nothing was mentioned in the above sections, then complete details of such supplies have to be declared.Details of Export Sales made – In addition to the sales figures, HSN codes of the goods supplied have to be mentioned as well.Tax Liability arising out of advance receiptsTax Paid during the reporting period – it can also include taxes paid for earlier periods.The form has to be digitally signed in case of a Company or an LLP, whereas in the case of a proprietorship concern, the same can be signed physically.How shall I file GSTR-1?After going through the checklist, suppliers need to log in to the GSTN portal with the given User ID and password, follow these steps to file their returns successfully.Search for “Services” and then click on Returns, followed by Returns Dashboard.In the dashboard, the dealer has to enter the financial year and the month for which the return needs to be filed. Click on Search after that.All returns relating to this period will be displayed on the screen in a tiled manner.Dealer has to select the tile containing GSTR-1After this, he will have the option either to prepare online or to upload the return.The dealer will now Add invoices or upload all invoices directlyOnce the entire form is filled up, the dealer shall then click on Submit and validate the data filled upWith the data validated, dealer will now click on FILE GSTR-1 and proceed to either E-Sign or digitally sign the formAnother confirmation pop-up will be displayed on the screen with a yes or no option to file the return.Once yes is selected, an Acknowledgement Reference Number (ARN) is generated.How To File GSTR-1 Online?Apart from filing GSTR-1 directly on GSTN portal, you can use third party softwares which are simpler to use. Most of these software accept data from your existing accounting software and help you upload it to GSTN portal. Almost all the GSPs have come up with their return filing solution.If you want to avoid multiple steps and hassle of using lot of softwares, try ProfitBooks today. Its an easy to use accounting software with super fast GST return filing. Its designed for business owners who do not have any accounting background.You can read the entire article here http://www.profitbooks.net/gstr-1-return-filing/.

-

How do you fill out the 1080 form when filing taxes?

There is no such form in US taxation. Thus you can not fill it out. If you mean a 1098 T you still do not. The University issues it to you. Please read the answers to the last 4 questions you posted about form 1080. IT DOES NOT EXIST.

-

How can I create an auto-fill JavaScript file to fill out a Google form which has dynamic IDs that change every session?

Is it possible to assign IDs on the radio buttons as soon as the page loads ?

-

How do I store form values to a JSON file after filling the HTML form and submitting it using Node.js?

//on submit you can do like this

Create this form in 5 minutes!

How to create an eSignature for the file titleservices

How to create an eSignature for the File Titleservices in the online mode

How to make an eSignature for the File Titleservices in Google Chrome

How to create an eSignature for signing the File Titleservices in Gmail

How to create an eSignature for the File Titleservices straight from your mobile device

How to generate an eSignature for the File Titleservices on iOS devices

How to generate an eSignature for the File Titleservices on Android

People also ask

-

What are File # Titleservices and how do they work?

File # Titleservices are essential tools that streamline the process of managing and signing documents electronically. With airSlate SignNow, users can easily create, send, and eSign documents, ensuring a secure and efficient workflow. Our platform simplifies document management, making it easier for businesses to handle their titles and contracts.

-

How much do File # Titleservices cost with airSlate SignNow?

The pricing for File # Titleservices through airSlate SignNow is competitive and designed to provide value for businesses of all sizes. We offer flexible plans that cater to different needs, allowing you to choose the best option based on your document volume and features required. For specific pricing details, visit our pricing page or contact our sales team.

-

What features are included in airSlate SignNow's File # Titleservices?

airSlate SignNow's File # Titleservices include a range of features designed to enhance your document signing experience. Key functionalities include customizable templates, real-time tracking of document status, and integration with popular applications. Our platform ensures that you can manage your titles efficiently while maintaining compliance and security.

-

Can I integrate File # Titleservices with other software?

Yes, airSlate SignNow offers seamless integrations with various software applications to enhance your File # Titleservices experience. You can connect our platform with CRM systems, cloud storage, and productivity tools to streamline your workflow. This integration capability ensures that you can manage documents efficiently across your entire business ecosystem.

-

What are the benefits of using File # Titleservices with airSlate SignNow?

Using File # Titleservices with airSlate SignNow provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to send, sign, and manage documents electronically, saving time and resources. Additionally, our user-friendly interface ensures that both your team and clients can easily navigate the signing process.

-

Is airSlate SignNow secure for handling sensitive documents in File # Titleservices?

Absolutely! airSlate SignNow prioritizes security, especially for sensitive documents associated with File # Titleservices. We utilize advanced encryption protocols and comply with industry standards to ensure that your data is protected at all times. You can confidently manage and sign your documents knowing they are secure.

-

How does airSlate SignNow improve the efficiency of File # Titleservices?

airSlate SignNow enhances the efficiency of File # Titleservices by automating the document workflow, which reduces the time spent on manual tasks. Our platform allows users to send documents for eSignature in just a few clicks, signNowly speeding up the process. By minimizing delays and improving communication, businesses can complete transactions faster.

Get more for File # Titleservices

- State alcohol license application foodservice resource associates form

- Birth certificate san diego form

- Hipaa privacy and security policy acknowledgment form

- Mvp routine eyewear benefit eyeglasses contact lens reimbursement form

- Cellular south bill application c spire form

- Odometer disclosure statement mvr 180 form

- Ongoing service agreement template form

- One way nda agreement template form

Find out other File # Titleservices

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim