Professional Liability Insurance Occurrence Application Form

Understanding the Professional Liability Insurance Occurrence Application

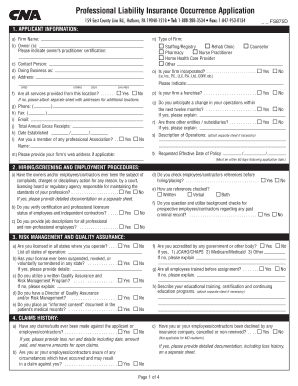

The Professional Liability Insurance Occurrence Application is essential for professionals seeking coverage against claims of negligence or malpractice. This form serves as a formal request to obtain insurance that protects against potential legal actions arising from professional services rendered. It outlines the applicant's qualifications, business practices, and any previous claims or incidents that may impact the insurance coverage.

Steps to Complete the Professional Liability Insurance Occurrence Application

Completing the Professional Liability Insurance Occurrence Application involves several key steps. First, gather all necessary information, including your business details, professional qualifications, and any relevant documentation. Next, accurately fill out the application form, ensuring that all information is truthful and complete. After completing the form, review it for any errors or omissions before submission. Finally, submit the application through the preferred method, whether online, by mail, or in person, as specified by the insurance provider.

Legal Use of the Professional Liability Insurance Occurrence Application

The legal use of the Professional Liability Insurance Occurrence Application hinges on its accuracy and completeness. Misrepresentation or failure to disclose pertinent information can lead to denial of coverage or claims. It is crucial to understand the legal implications of the information provided, as this form serves as a binding agreement between the applicant and the insurance provider. Compliance with state regulations and industry standards is also necessary to ensure the application is legally valid.

Required Documents for the Professional Liability Insurance Occurrence Application

When applying for professional liability insurance, certain documents are typically required to support your application. These may include proof of professional qualifications, a detailed description of your services, and any previous claims history. Additionally, financial statements or business plans may be requested to assess risk. Having these documents ready can streamline the application process and enhance the likelihood of approval.

Form Submission Methods for the Professional Liability Insurance Occurrence Application

The Professional Liability Insurance Occurrence Application can be submitted through various methods, depending on the insurance provider's preferences. Common submission options include online applications via the provider's website, mailing a printed version of the form, or delivering it in person to a local office. Each method has its benefits, so it is essential to choose the one that best suits your needs and ensures timely processing.

Eligibility Criteria for the Professional Liability Insurance Occurrence Application

Eligibility for the Professional Liability Insurance Occurrence Application varies by provider and industry. Generally, applicants must demonstrate a valid professional license and adhere to specific industry standards. Additionally, the absence of recent claims or disciplinary actions can enhance eligibility. Understanding these criteria can help applicants prepare a stronger application and increase their chances of obtaining coverage.

Quick guide on how to complete professional liability insurance occurrence application

Complete Professional Liability Insurance Occurrence Application effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents promptly without any hold-ups. Manage Professional Liability Insurance Occurrence Application on any platform with airSlate SignNow Android or iOS applications and streamline any document-centric task today.

How to modify and electronically sign Professional Liability Insurance Occurrence Application with ease

- Locate Professional Liability Insurance Occurrence Application and click Get Form to begin.

- Utilize the features we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional ink signature.

- Review the details and click on the Done button to save your alterations.

- Select how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Professional Liability Insurance Occurrence Application and ensure excellent communication at any point of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the professional liability insurance occurrence application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an executed notice in the context of eSigning?

An executed notice is a confirmation that a document has been signed and finalized by the involved parties. In the context of airSlate SignNow, this feature ensures that once a document is eSigned, all parties receive a notification that the document has been executed, providing peace of mind and legal verification.

-

How does airSlate SignNow handle executed notices?

airSlate SignNow automatically generates an executed notice once a document is completed. This notice includes essential details such as the signers’ names, timestamps, and a copy of the signed document, making it easy to maintain records for future reference.

-

Is there a cost associated with receiving executed notices?

No, receiving executed notices is included within the pricing plans of airSlate SignNow. Our cost-effective solution ensures businesses can easily eSign and manage documents without worrying about additional fees for essential features like executed notices.

-

What features enhance the value of executed notices in airSlate SignNow?

airSlate SignNow offers several features that complement executed notices, such as secure document storage, customizable templates, and real-time tracking. These features help businesses manage their eSigning processes efficiently while ensuring every executed notice is easily accessible.

-

Can I integrate airSlate SignNow with other software to improve my executed notice process?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications such as CRMs, document management systems, and cloud storage solutions. This integration allows for a more streamlined workflow and ensures that executed notices are easily shared across platforms.

-

How can executed notices benefit my business?

Executed notices provide legal proof of signature and can support compliance requirements in various industries. Using airSlate SignNow to manage executed notices simplifies tracking and ensures that all parties are aware of the document's current status, which aids in transparency and accountability.

-

Are executed notices legally binding?

Yes, executed notices generated by airSlate SignNow are legally binding under applicable eSigning laws, such as the ESIGN Act and UETA. Our platform ensures that all signatures are collected securely, making executed notices valid and enforceable in legal situations.

Get more for Professional Liability Insurance Occurrence Application

- Sars card qualification form

- Student development theory cheat sheet form

- Third party payment declaration letter format in word 446224071

- Registro de proveedores del estado dgcpgobdo dgcp gob form

- Chapter 36 skeletal muscular and integumentary systems answer key pdf form

- 28 no form vahan

- Wis dnr boat registration form

- Llc dissolution agreement template form

Find out other Professional Liability Insurance Occurrence Application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later