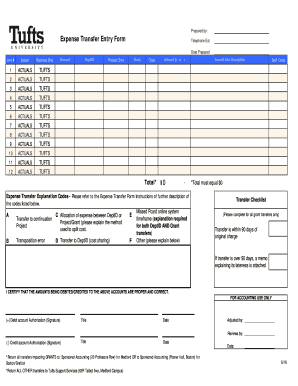

Expense Transfer Entry Form

What is the transfer entry form?

The transfer entry form is a document used to facilitate the transfer of funds or assets from one account or entity to another. This form is essential in various contexts, including financial institutions, businesses, and personal transactions. It ensures that all necessary information is recorded accurately, which helps maintain transparency and accountability in financial dealings.

How to use the transfer entry form

Using the transfer entry form involves several straightforward steps. First, gather all relevant information, including the names and account numbers of both the sender and receiver. Next, fill out the form with accurate details, ensuring that all required fields are completed. After completing the form, review it for any errors before submitting it to the appropriate institution or organization. This process can often be done electronically, making it more efficient and secure.

Steps to complete the transfer entry form

Completing the transfer entry form requires attention to detail. Follow these steps for a successful submission:

- Obtain the latest version of the transfer entry form from the relevant institution.

- Provide the sender's information, including name, address, and account number.

- Enter the receiver's details, ensuring accuracy in name and account information.

- Specify the amount being transferred and any additional instructions if necessary.

- Review the completed form for accuracy and completeness.

- Sign and date the form, if required, to validate the transaction.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal use of the transfer entry form

The transfer entry form must comply with relevant laws and regulations to be considered legally binding. In the United States, electronic signatures are recognized under the ESIGN Act and UETA, provided that certain conditions are met. This includes ensuring that the signer has the intent to sign and that the form is stored securely. Using a trusted electronic signature platform can help maintain compliance and enhance the legal validity of the transfer entry form.

Key elements of the transfer entry form

Several key elements must be included in the transfer entry form to ensure its effectiveness and legality:

- Sender Information: Name, address, and account number of the individual or entity initiating the transfer.

- Receiver Information: Name, address, and account number of the individual or entity receiving the funds or assets.

- Transfer Amount: The specific amount being transferred, clearly stated.

- Date of Transfer: The date on which the transfer is to take place.

- Signatures: Required signatures from both parties, if applicable, to validate the transaction.

Form submission methods

The transfer entry form can typically be submitted through various methods, depending on the institution's policies. Common submission methods include:

- Online Submission: Many institutions allow users to fill out and submit the form electronically through their secure portals.

- Mail: The completed form can often be printed and mailed to the appropriate address.

- In-Person: Some institutions may require or allow individuals to submit the form in person at a local branch.

Quick guide on how to complete expense transfer entry form

Effortlessly Prepare Expense Transfer Entry Form on Any Device

Online document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents quickly and without delays. Manage Expense Transfer Entry Form on any device using the airSlate SignNow apps for Android or iOS and streamline your document-related tasks today.

The Simplest Way to Edit and eSign Expense Transfer Entry Form Effortlessly

- Find Expense Transfer Entry Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your edits.

- Choose how you wish to deliver your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Expense Transfer Entry Form and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the expense transfer entry form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a transfer entry form and how does it work with airSlate SignNow?

A transfer entry form is a document used to record and manage the transfer of assets or information from one party to another. With airSlate SignNow, you can easily create, send, and eSign transfer entry forms, ensuring a seamless transition and legally binding documentation. Our platform simplifies tracking and storing these forms, making the process efficient and hassle-free.

-

How much does it cost to use airSlate SignNow for transfer entry forms?

The cost of using airSlate SignNow for transfer entry forms depends on the plan you choose. We offer various pricing tiers, starting with a free trial, followed by affordable monthly subscriptions tailored to meet the needs of businesses of all sizes. This ensures you get the best value for your investment in an efficient document management solution.

-

What features does airSlate SignNow offer for creating transfer entry forms?

airSlate SignNow provides a range of features for creating transfer entry forms, including customizable templates, drag-and-drop editing, and easy eSignature capabilities. You can add fields for necessary information, such as signatures and dates, and streamline the approval process. These features enhance user experience and ensure all essential details are captured.

-

Can I integrate airSlate SignNow with other applications for transfer entry forms?

Yes, airSlate SignNow allows seamless integration with various applications such as CRM systems, document storage services, and project management tools. This enables you to manage your transfer entry forms alongside other vital business processes, enhancing your workflow efficiency. Integration simplifies the transfer of data and improves overall productivity.

-

What are the benefits of using airSlate SignNow for transfer entry forms?

Using airSlate SignNow for transfer entry forms comes with numerous benefits, such as enhanced security, compliance with legal standards, and improved turnaround times. The platform ensures your documents are securely stored and easily accessible, while electronic signatures speed up the approval process. This results in signNow time savings and increased operational efficiency.

-

Is it easy to track the status of my transfer entry forms with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for all your transfer entry forms. You can monitor who has viewed, signed, or approved the documents, making it easy to follow up on pending forms and ensure timely completion. This feature enhances transparency and accountability in your document management processes.

-

Can I customize my transfer entry form templates in airSlate SignNow?

Yes, airSlate SignNow allows you to customize transfer entry form templates to meet your specific business needs. You can modify fields, add your branding, and create unique workflows that align with your operational processes. This level of customization ensures that your forms are both functional and reflective of your brand identity.

Get more for Expense Transfer Entry Form

- Ophthalmology referral form

- Acs chicago aon com form

- Kuntotarkastuslomake form

- Unlicensed nail tech waiver form

- Prize acceptance form

- Circuit court district court of courts state md us form

- Affidavit of bail bondsman maryland courts courts state md form

- Community engagement for racial equity and social justice form

Find out other Expense Transfer Entry Form

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now