Direct Loan Decline and Reduction Form Summer Qcc Edu

What is the Direct Loan Decline And Reduction Form Summer Qcc edu

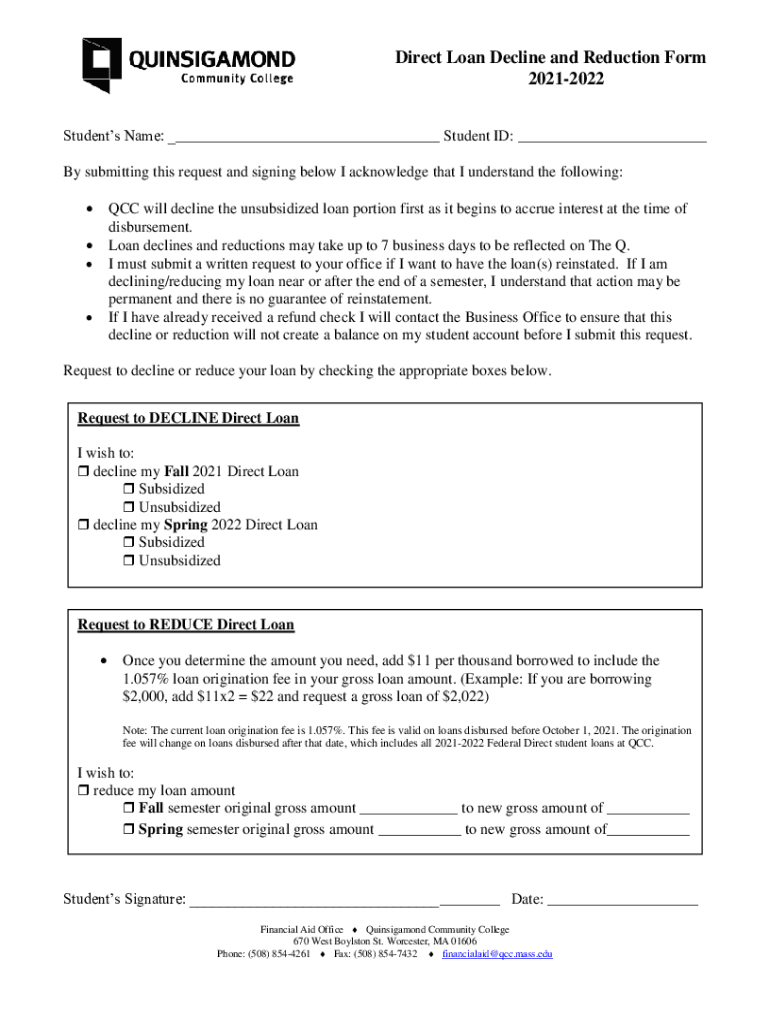

The Direct Loan Decline and Reduction Form Summer Qcc edu is a crucial document for students who wish to decline or reduce their federal student loan amounts for the summer term. This form is typically used by students enrolled in programs at QCC (Quinsigamond Community College) to manage their financial aid effectively. By submitting this form, students can adjust their loan amounts based on their current financial needs and educational plans, ensuring they only borrow what is necessary for their education.

How to obtain the Direct Loan Decline And Reduction Form Summer Qcc edu

To obtain the Direct Loan Decline and Reduction Form Summer Qcc edu, students can visit the financial aid section of the QCC website. The form may be available for download in PDF format, or students may be required to request it directly from the financial aid office. It is essential to ensure that you are accessing the most recent version of the form to avoid any issues during the submission process.

Steps to complete the Direct Loan Decline And Reduction Form Summer Qcc edu

Completing the Direct Loan Decline and Reduction Form Summer Qcc edu involves several straightforward steps:

- Download or request the form from the QCC financial aid office.

- Fill in your personal information, including your name, student ID, and contact details.

- Indicate whether you wish to decline or reduce your loan amount.

- Provide the specific loan amount you wish to decline or reduce.

- Sign and date the form to confirm your request.

- Submit the completed form to the financial aid office via the specified method (online, mail, or in-person).

Legal use of the Direct Loan Decline And Reduction Form Summer Qcc edu

The legal use of the Direct Loan Decline and Reduction Form Summer Qcc edu is governed by federal regulations regarding student financial aid. This form must be completed accurately and submitted within the designated time frame to ensure compliance with these regulations. Proper use of the form protects students from borrowing more than necessary and ensures that their financial aid package aligns with their educational goals.

Key elements of the Direct Loan Decline And Reduction Form Summer Qcc edu

Key elements of the Direct Loan Decline and Reduction Form Summer Qcc edu include:

- Student Information: Personal details such as name, student ID, and contact information.

- Loan Amounts: Sections to specify the original loan amounts and the amounts to be declined or reduced.

- Signature: A section for the student’s signature, confirming the request.

- Date: The date when the form is completed and submitted.

Form Submission Methods

Students can submit the Direct Loan Decline and Reduction Form Summer Qcc edu through various methods, depending on QCC's guidelines. Common submission methods include:

- Online Submission: Uploading the completed form through the QCC financial aid portal.

- Mail: Sending the form to the financial aid office via postal service.

- In-Person: Delivering the form directly to the financial aid office during business hours.

Quick guide on how to complete direct loan decline and reduction form summer qcc edu

Finish Direct Loan Decline And Reduction Form Summer Qcc edu effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents quickly without delays. Manage Direct Loan Decline And Reduction Form Summer Qcc edu on any gadget with the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to edit and electronically sign Direct Loan Decline And Reduction Form Summer Qcc edu with ease

- Obtain Direct Loan Decline And Reduction Form Summer Qcc edu and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Direct Loan Decline And Reduction Form Summer Qcc edu and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the direct loan decline and reduction form summer qcc edu

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Direct Loan Decline And Reduction Form Summer Qcc edu?

The Direct Loan Decline And Reduction Form Summer Qcc edu is a specific document designed for students to formally decline or reduce their federal loan amounts for the summer term. This form helps students manage their financial aid effectively and ensures they only borrow what they truly need. By utilizing this form, students can make informed decisions regarding their educational funding.

-

How can I access the Direct Loan Decline And Reduction Form Summer Qcc edu?

You can access the Direct Loan Decline And Reduction Form Summer Qcc edu directly from the QCC website or through the financial aid office. It is typically available as a downloadable PDF file, making it easy to fill out and submit. For further assistance, you may contact your financial aid advisor.

-

What are the benefits of completing the Direct Loan Decline And Reduction Form Summer Qcc edu?

Completing the Direct Loan Decline And Reduction Form Summer Qcc edu allows you to reduce your debt load and manage your educational expenses better. It also helps avoid unnecessary interest payments on unused loan amounts. Additionally, it provides an opportunity to reassess your financial needs for the summer term.

-

Are there any fees associated with the Direct Loan Decline And Reduction Form Summer Qcc edu?

There are no fees associated with submitting the Direct Loan Decline And Reduction Form Summer Qcc edu. This process is entirely free for students, as it is part of the financial aid services offered by QCC. By utilizing these services, you can take control of your financial planning without incurring additional costs.

-

Can I submit the Direct Loan Decline And Reduction Form Summer Qcc edu online?

Currently, the Direct Loan Decline And Reduction Form Summer Qcc edu must be submitted in person or via mail, as many institutions require signed hard copies of financial aid documents. However, QCC is exploring options to streamline submissions in the future for greater convenience. Be sure to check the official site for updates on submission methods.

-

How will completing the Direct Loan Decline And Reduction Form Summer Qcc edu affect my financial aid package?

Completing the Direct Loan Decline And Reduction Form Summer Qcc edu may affect your overall financial aid package by reducing your loan amount. This can lead to lowered debt levels upon graduation, which is beneficial for your long-term financial health. It’s advisable to review your financial aid package with an advisor after submitting this form.

-

What if I change my mind about declining my loan after submitting the Direct Loan Decline And Reduction Form Summer Qcc edu?

If you decide to reinstate the loan after submitting the Direct Loan Decline And Reduction Form Summer Qcc edu, you should contact the financial aid office immediately. They can guide you on the necessary steps to reinstate your loan eligibility for the summer term. Timely communication is key to ensuring your needs are met.

Get more for Direct Loan Decline And Reduction Form Summer Qcc edu

Find out other Direct Loan Decline And Reduction Form Summer Qcc edu

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free