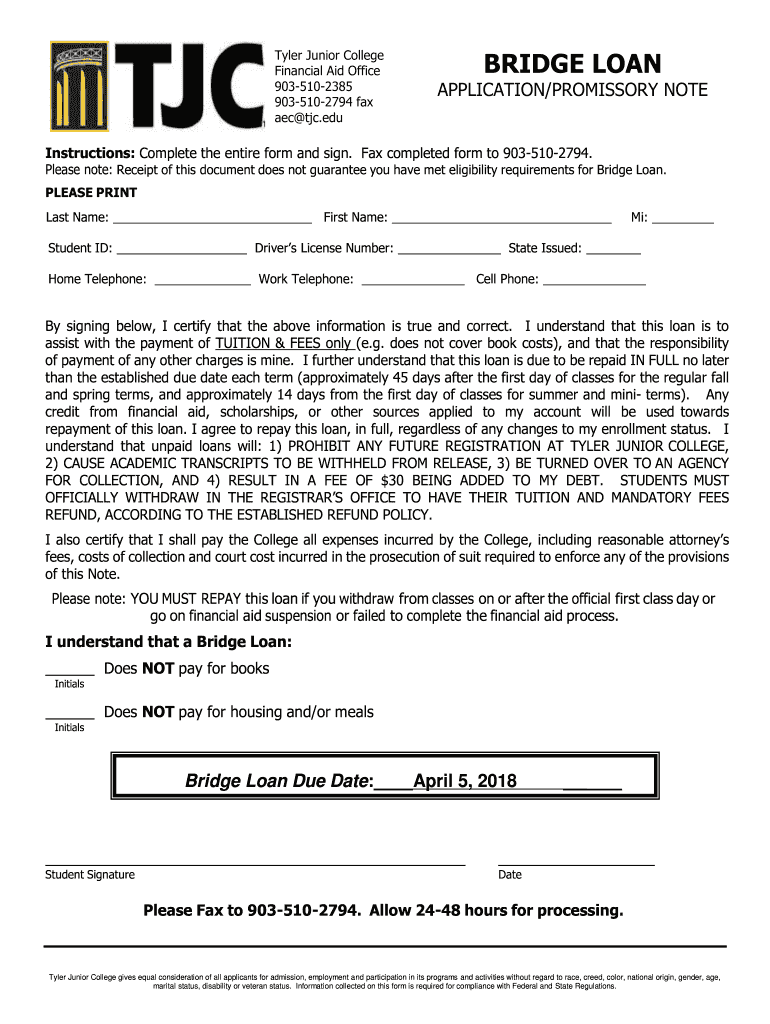

Bridge Loan TJC Form

What is the Bridge Loan TJC

A Bridge Loan TJC is a short-term financing option designed to provide immediate funds to borrowers who need to bridge a gap in financing. This type of loan is often used in real estate transactions, allowing individuals or businesses to secure funding quickly while awaiting longer-term financing solutions. The Bridge Loan TJC can be particularly beneficial in competitive markets where timing is crucial.

How to use the Bridge Loan TJC

Using the Bridge Loan TJC involves several steps to ensure proper execution and compliance. First, borrowers should assess their immediate financial needs and determine how much funding is required. Next, they must complete the Bridge Loan TJC form accurately, providing necessary details such as the purpose of the loan, repayment terms, and any collateral involved. Once the form is completed, it can be submitted electronically for processing.

Steps to complete the Bridge Loan TJC

Completing the Bridge Loan TJC form requires careful attention to detail. Here are the essential steps:

- Gather all necessary documentation, including identification and financial statements.

- Fill out the form with accurate information, ensuring all fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form electronically using a secure platform to ensure compliance with legal standards.

Legal use of the Bridge Loan TJC

The Bridge Loan TJC must be executed in compliance with relevant laws and regulations. Electronic signatures are legally binding under the ESIGN and UETA acts, provided that the signing process meets specific requirements. It is essential to use a reputable eSignature solution that offers security features, such as authentication and audit trails, to ensure the legality of the document.

Eligibility Criteria

To qualify for a Bridge Loan TJC, borrowers typically need to meet certain eligibility criteria. These may include:

- Proof of income or financial stability.

- A good credit score to demonstrate creditworthiness.

- Details of the property or assets being financed.

- Clear repayment plans outlining how the loan will be paid back.

Required Documents

When applying for a Bridge Loan TJC, borrowers must prepare several documents to support their application. Commonly required documents include:

- Personal identification, such as a driver's license or passport.

- Proof of income, such as pay stubs or tax returns.

- Details of the property or asset involved in the loan.

- Bank statements to verify financial standing.

Form Submission Methods

The Bridge Loan TJC form can be submitted through various methods, ensuring flexibility for borrowers. Options typically include:

- Online submission via a secure eSignature platform.

- Mailing the completed form to the lender’s office.

- In-person submission at designated locations, if available.

Quick guide on how to complete bridge loan tjc

Complete Bridge Loan TJC effortlessly on any device

Online document administration has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage Bridge Loan TJC on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Bridge Loan TJC without hassle

- Find Bridge Loan TJC and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or blackout sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal significance as a traditional wet ink signature.

- Verify all the information and click on the Done button to preserve your changes.

- Decide how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Bridge Loan TJC and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bridge loan tjc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Bridge Loan TJC?

A Bridge Loan TJC is a short-term financing option designed to help businesses meet immediate funding needs while they prepare for long-term financing solutions. It provides quick access to cash, allowing you to capitalize on opportunities without delay.

-

How much does a Bridge Loan TJC cost?

The cost of a Bridge Loan TJC varies depending on several factors, including the loan amount, duration, and your credit profile. Typically, there are fees associated with processing the loan, which should be reviewed carefully to understand the overall cost.

-

What are the benefits of using a Bridge Loan TJC?

Using a Bridge Loan TJC offers numerous benefits such as quick access to funds, flexibility in financing, and the ability to secure a property before permanent financing is arranged. This loan type is perfect for businesses looking to take advantage of immediate opportunities without long delays.

-

How long does it take to get approved for a Bridge Loan TJC?

Approval times for a Bridge Loan TJC can range from a few days to a couple of weeks, depending on the lender's requirements and your financial profile. The streamlined process allows for faster access to funds, which is essential for time-sensitive projects.

-

What kind of documents are needed for a Bridge Loan TJC?

To apply for a Bridge Loan TJC, you typically need to provide documentation such as financial statements, proof of income, business plans, and information about the property or project that needs funding. Ensuring all necessary documentation is ready can expedite the approval process.

-

Can a Bridge Loan TJC be integrated with airSlate SignNow?

Yes, a Bridge Loan TJC can seamlessly integrate with airSlate SignNow for efficient document management. The platform allows you to easily send, e-sign, and track loan-related documents, ensuring secure and timely transactions throughout the loan process.

-

Is a Bridge Loan TJC suitable for all types of businesses?

A Bridge Loan TJC can be a suitable financing option for various types of businesses, particularly those needing short-term capital. However, it's essential to evaluate your specific financial needs and circumstances to determine if this loan type aligns with your business goals.

Get more for Bridge Loan TJC

- France visa checklist form

- Record of health cost share of cost nebraska health dhhs ne form

- 540 es form franchise tax board ca gov

- Chew on these bubble gum facts answers form

- Lesson 3 colonial latin america answer key form

- Susitna valley jrsr high school overview form

- Bond refund form 67902254

- Medicaid provider enrollment application and agreement form

Find out other Bridge Loan TJC

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter