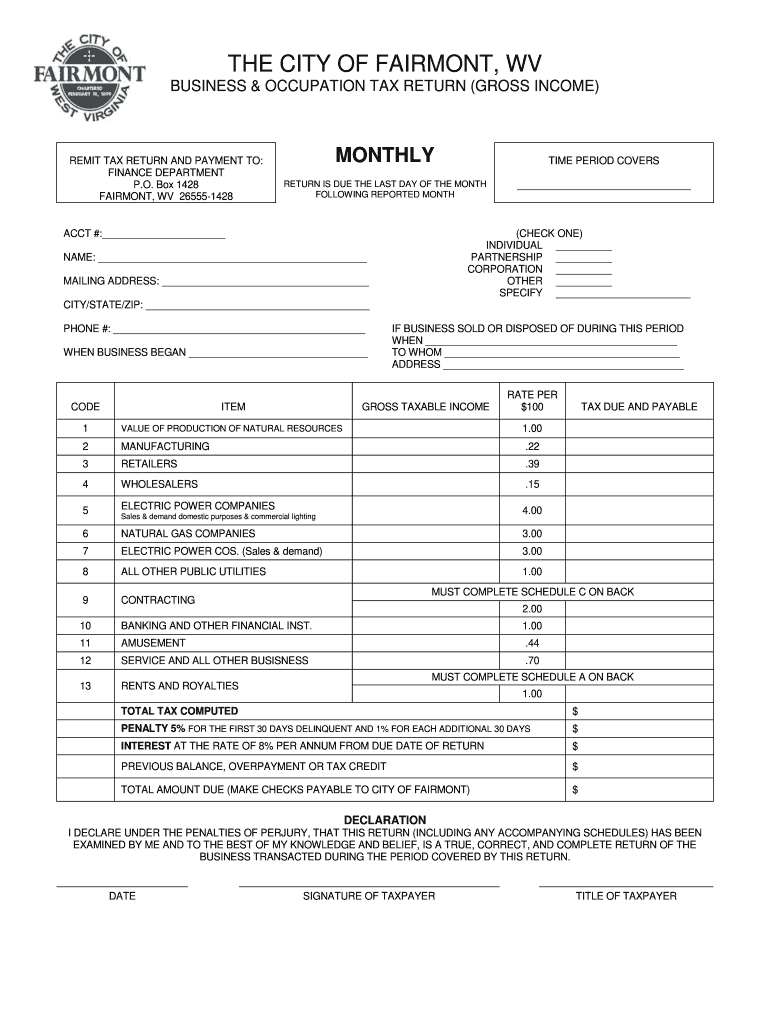

The CITY of FAIRMONT, WV Form

Understanding the West Virginia Tax Return

The West Virginia tax return is a crucial document for individuals and businesses operating within the state. It serves as a formal declaration of income, deductions, and tax owed to the state. Completing this return accurately is essential to ensure compliance with state tax laws. The form typically requires information about total income, tax credits, and any applicable deductions. Understanding the specific requirements for your situation can help avoid potential issues with the West Virginia State Tax Department.

Steps to Complete the West Virginia Tax Return

Filing your West Virginia tax return involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documents, including W-2 forms, 1099s, and any records of deductions. Next, choose the appropriate tax return form based on your filing status, whether you are an individual or a business. Once you have the correct form, fill it out carefully, ensuring all information is accurate. After completing the form, review it for any errors before submitting it to the state tax department.

Filing Deadlines for the West Virginia Tax Return

Timely filing of the West Virginia tax return is essential to avoid penalties. Generally, individual tax returns are due by April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Businesses may have different deadlines depending on their entity type. It is important to check the specific due dates for your situation to ensure compliance and avoid late fees.

Required Documents for the West Virginia Tax Return

When preparing to file your West Virginia tax return, several documents are necessary to support your claims. Commonly required documents include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of any other income sources

- Documentation for deductions, such as mortgage interest statements or medical expenses

- Previous year’s tax return for reference

Having these documents ready will streamline the process and help ensure that your return is accurate.

Legal Use of the West Virginia Tax Return

The West Virginia tax return is legally binding and must be completed in compliance with state regulations. To ensure its legal validity, the return must be signed and dated by the taxpayer. Electronic signatures are acceptable and must comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). Using a reliable eSignature solution can facilitate this process while maintaining compliance with legal standards.

Form Submission Methods for the West Virginia Tax Return

You can submit your West Virginia tax return through various methods. The options include:

- Online filing through the West Virginia State Tax Department's website

- Mailing a paper return to the appropriate tax office

- In-person submission at designated tax offices

Choosing the right submission method can affect the processing time of your return. Online submissions are typically processed more quickly than paper returns.

Quick guide on how to complete the city of fairmont wv

Complete THE CITY OF FAIRMONT, WV effortlessly on any device

Online document administration has gained traction among enterprises and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the appropriate form and securely save it online. airSlate SignNow supplies all the resources necessary to create, modify, and electronically sign your documents swiftly and without hindrances. Manage THE CITY OF FAIRMONT, WV on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign THE CITY OF FAIRMONT, WV with ease

- Obtain THE CITY OF FAIRMONT, WV and click on Get Form to initiate the process.

- Utilize the resources we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and press the Done button to save your modifications.

- Select your preferred method to share your form, whether via email, text message (SMS), an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Alter and eSign THE CITY OF FAIRMONT, WV to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the the city of fairmont wv

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for filing my West Virginia tax return using airSlate SignNow?

Filing your West Virginia tax return with airSlate SignNow is straightforward. You can easily upload your tax documents, eSign them, and send them directly to the relevant authorities. Our platform ensures that all documents are securely processed and kept organized, making tax season easier.

-

How does airSlate SignNow help simplify my West Virginia tax return process?

AirSlate SignNow streamlines the West Virginia tax return process by allowing you to electronically sign and send documents without the hassle of printing. Our intuitive interface helps remove the complexity associated with traditional filing methods. Plus, you can track your documents at every step.

-

Are there any fees associated with using airSlate SignNow for my West Virginia tax return?

Yes, airSlate SignNow offers a range of pricing plans tailored to fit your needs. While there are fees associated with our services, we aim to provide a cost-effective solution for managing your West Virginia tax return. Review our pricing page for a detailed breakdown of services.

-

What kind of features does airSlate SignNow offer for my West Virginia tax return?

AirSlate SignNow includes features like document management, eSignature capabilities, and secure sharing options for your West Virginia tax return. You can easily collaborate with your accountant and ensure that all signatures are gathered efficiently. This enhances the overall filing experience.

-

Can I use airSlate SignNow on multiple devices for my West Virginia tax return?

Absolutely! AirSlate SignNow is designed to be accessed across various devices, including desktops, tablets, and smartphones. This means you can manage your West Virginia tax return from anywhere, giving you the flexibility to eSign and submit documents on the go.

-

Does airSlate SignNow integrate with other software I use for my West Virginia tax return?

Yes, airSlate SignNow offers integrations with popular accounting and tax software platforms. This allows you to seamlessly connect your tools for a more efficient workflow when preparing your West Virginia tax return. Check our integrations page for a full list of supported applications.

-

What benefits can I expect when using airSlate SignNow for my West Virginia tax return?

Using airSlate SignNow for your West Virginia tax return means quicker processing times, enhanced security, and reduced paperwork. You'll also enjoy the convenience of eSigning documents, which saves you time and effort. Our platform supports better organization, leading to a smoother tax filing experience.

Get more for THE CITY OF FAIRMONT, WV

Find out other THE CITY OF FAIRMONT, WV

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT