Claim for Local Tax Rebate Arkansas 2019-2026

What is the ET 179A Form?

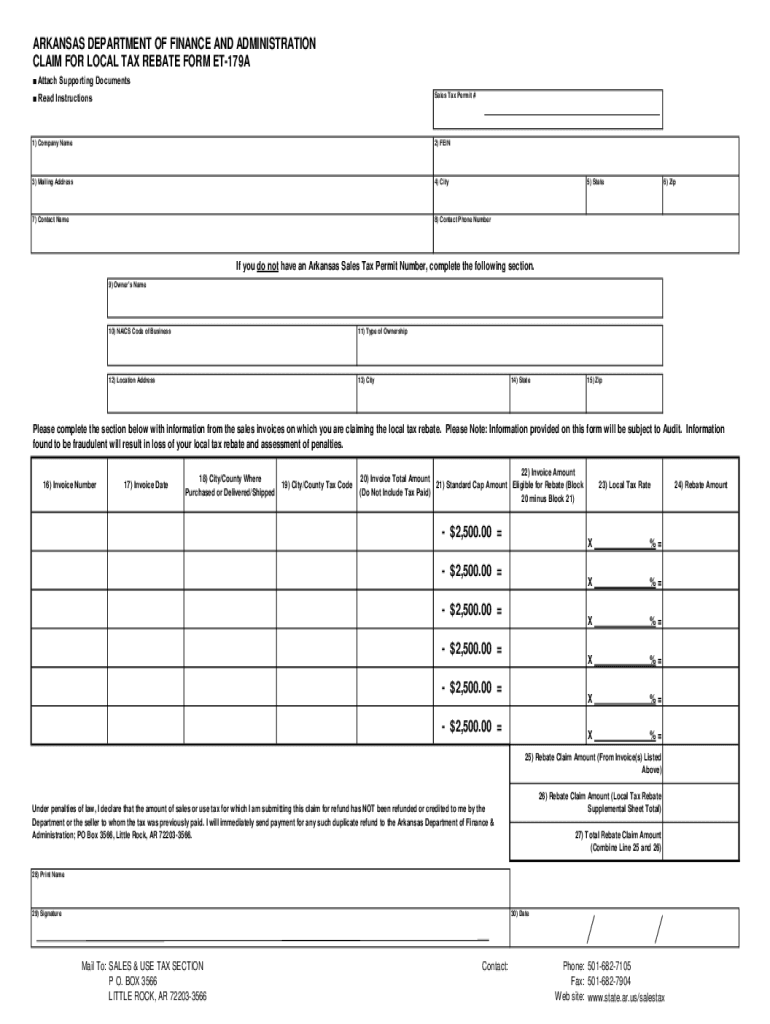

The ET 179A form, also known as the Arkansas Local Tax Rebate, is a document used by residents of Arkansas to claim a rebate on local taxes paid. This form is essential for individuals who have incurred local taxes and wish to receive a refund from their local government. Understanding the purpose and function of the ET 179A form is crucial for ensuring that taxpayers can take advantage of available rebates and effectively manage their local tax obligations.

How to Use the ET 179A Form

To utilize the ET 179A form, taxpayers must first ensure they meet the eligibility criteria set by the state of Arkansas. Once eligibility is confirmed, individuals can access the form online or through local government offices. After filling out the required information, including personal details and tax amounts, the form must be submitted according to the specified guidelines. It is important to keep a copy of the completed form for personal records and future reference.

Steps to Complete the ET 179A Form

Completing the ET 179A form involves several key steps:

- Gather necessary documentation, including proof of local taxes paid.

- Access the ET 179A form from an official source.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Submit the completed form via the designated method: online, by mail, or in person.

Following these steps carefully can help ensure a smooth submission process and increase the likelihood of receiving the rebate in a timely manner.

Eligibility Criteria for the ET 179A Form

To qualify for the ET 179A form, applicants must meet specific eligibility requirements established by the Arkansas Department of Finance and Administration. Generally, these criteria include:

- Being a resident of Arkansas.

- Having paid local taxes during the applicable tax year.

- Filing the form within the designated time frame set by the state.

Understanding these criteria is essential for taxpayers to ensure they can successfully claim their local tax rebate.

Required Documents for the ET 179A Form

When completing the ET 179A form, certain documents are necessary to support the claim. These typically include:

- Proof of local taxes paid, such as receipts or tax statements.

- Identification documents, such as a driver's license or Social Security number.

- Any additional documentation requested by the Arkansas Department of Finance and Administration.

Having these documents ready can streamline the process and help avoid delays in receiving the rebate.

Form Submission Methods for the ET 179A

The ET 179A form can be submitted through various methods, allowing taxpayers flexibility in how they choose to file. Available submission methods include:

- Online submission through the Arkansas Department of Finance and Administration website.

- Mailing a physical copy of the completed form to the appropriate government office.

- In-person submission at designated local government offices.

Each method has its own guidelines and deadlines, so it is important to choose the option that best fits the taxpayer's needs.

Quick guide on how to complete claim for local tax rebate arkansas

Complete Claim For Local Tax Rebate Arkansas effortlessly on any device

Digital document management has gained traction with businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Claim For Local Tax Rebate Arkansas on any platform using airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The simplest way to modify and eSign Claim For Local Tax Rebate Arkansas without any hassle

- Find Claim For Local Tax Rebate Arkansas and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, through email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes requiring new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Claim For Local Tax Rebate Arkansas and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct claim for local tax rebate arkansas

Create this form in 5 minutes!

How to create an eSignature for the claim for local tax rebate arkansas

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the et 179a form used for?

The et 179a form is essential for businesses looking to streamline their document signing processes. It allows users to manage electronic signatures efficiently while ensuring compliance with legal standards. By integrating the et 179a form into your workflow, you can enhance your operational efficiency and reduce paperwork.

-

How much does it cost to use airSlate SignNow with et 179a?

airSlate SignNow offers competitive pricing plans for businesses utilizing the et 179a form. Our pricing varies based on the features required, but we aim to provide a cost-effective solution tailored to your needs. Whether you're a small business or a large enterprise, our plans are designed to fit different budgets.

-

What features does airSlate SignNow offer for the et 179a process?

With airSlate SignNow, you can leverage features specifically optimized for the et 179a process, including customizable templates, real-time tracking, and secure document storage. These features simplify the eSigning process and improve overall productivity. You can also integrate with other tools to enhance the efficiency of your workflows.

-

How does airSlate SignNow ensure the security of documents processed with et 179a?

Security is a top priority for airSlate SignNow when handling documents processed with the et 179a form. We implement advanced encryption technologies and comply with industry standards to protect sensitive information. Additionally, our audit trails and user authentication processes ensure that only authorized personnel can access the documents.

-

Can I integrate airSlate SignNow with other software while using the et 179a form?

Yes, airSlate SignNow offers seamless integrations with a variety of software solutions when using the et 179a form. This allows you to automate your workflows and connect with tools like CRM systems, project management apps, and more. Our integration capabilities enhance your overall operational efficiency.

-

What are the benefits of using airSlate SignNow for the et 179a signing process?

Using airSlate SignNow for the et 179a signing process provides numerous benefits including increased speed, reduced costs, and improved accuracy. You can signNowly decrease turnaround times for document approvals and minimize the risks associated with manual processes. Moreover, our user-friendly interface ensures a seamless experience for all parties involved.

-

Is airSlate SignNow compliant with legal standards for the et 179a?

Yes, airSlate SignNow complies with all necessary legal standards when handling documents related to the et 179a form. We adhere to electronic signature laws such as the ESIGN Act and UETA, ensuring that your eSignatures are legally binding. This compliance adds an extra layer of trust to your document management processes.

Get more for Claim For Local Tax Rebate Arkansas

- 5 1 perpendicular and angle bisectors answer key form

- Rgpv degree challan form download

- Ny state disability forms

- Madison river srp use report sheet foam mtorg form

- Cascade city county health departmenthuman services form

- Dhrd childcare block grant application confederated salish and cskt form

- State form 42850 affidavit for lost or not received warrant

- Fillable online schools utah co teaching handbook pdf utah form

Find out other Claim For Local Tax Rebate Arkansas

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document