Tax Year Personal Income Tax FormsDepartment of Taxes

What is the Tax Year Personal Income Tax FormsDepartment Of Taxes

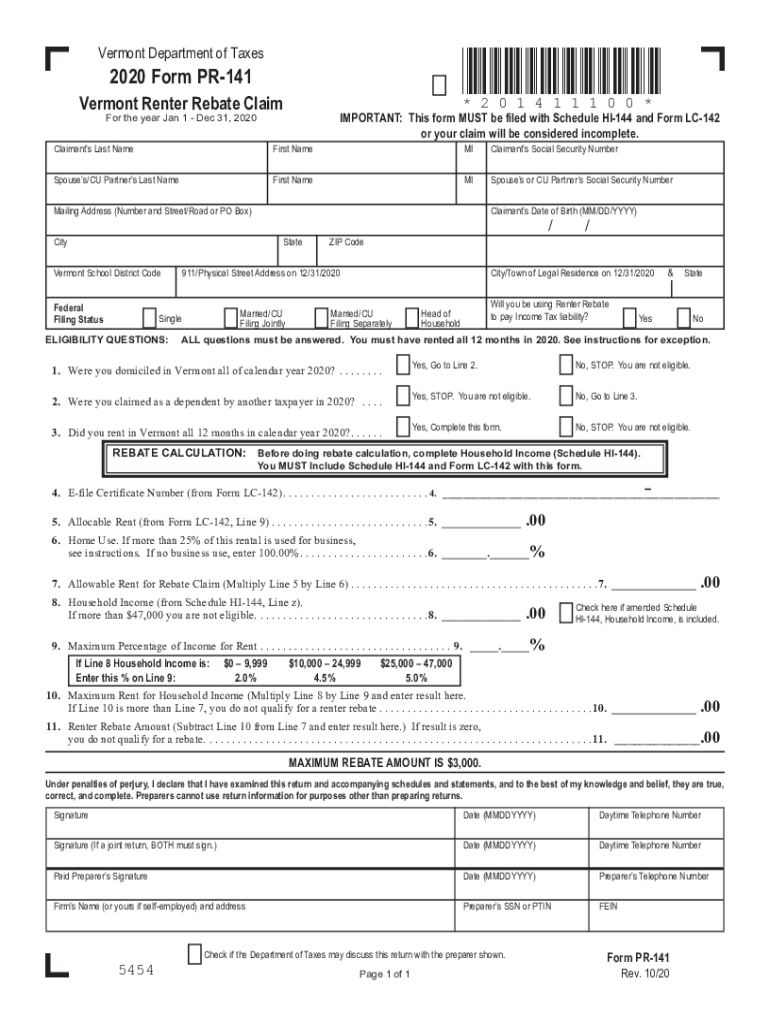

The Tax Year Personal Income Tax FormsDepartment Of Taxes refers to the official documents required for individuals to report their annual income to the government. These forms are essential for calculating tax liabilities, claiming deductions, and ensuring compliance with federal and state tax laws. Each tax year, the Department of Taxes provides updated forms that reflect any changes in tax regulations, making it crucial for taxpayers to use the correct version for accurate filing.

How to use the Tax Year Personal Income Tax FormsDepartment Of Taxes

Using the Tax Year Personal Income Tax FormsDepartment Of Taxes involves several steps. First, individuals must gather all necessary financial documents, such as W-2s, 1099s, and any receipts for deductible expenses. Next, taxpayers should carefully read the instructions provided with the forms to understand the requirements and deadlines. After completing the forms, they can be submitted electronically or via traditional mail, depending on the preferences of the taxpayer and the regulations of the Department of Taxes.

Steps to complete the Tax Year Personal Income Tax FormsDepartment Of Taxes

Completing the Tax Year Personal Income Tax FormsDepartment Of Taxes requires a systematic approach. Here are the key steps:

- Gather all relevant financial documents, including income statements and expense receipts.

- Choose the correct form for your tax situation, such as the 1040 or 1040A.

- Fill out the form accurately, ensuring all income and deductions are reported.

- Review the completed form for any errors or omissions.

- Sign and date the form before submission.

Legal use of the Tax Year Personal Income Tax FormsDepartment Of Taxes

The legal use of the Tax Year Personal Income Tax FormsDepartment Of Taxes is governed by federal and state tax laws. These forms must be filled out truthfully and submitted by the designated deadlines to avoid penalties. E-signatures are recognized as legally binding under the ESIGN Act, provided that the electronic signature process meets specific requirements. Utilizing a reliable e-signature solution can help ensure compliance and security when submitting these forms digitally.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Year Personal Income Tax FormsDepartment Of Taxes are critical for compliance. Typically, the deadline for submitting personal income tax returns is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any state-specific deadlines that may differ from federal requirements. It's advisable to mark these dates on a calendar to avoid late submissions.

Required Documents

To complete the Tax Year Personal Income Tax FormsDepartment Of Taxes, several documents are necessary. These typically include:

- W-2 forms from employers.

- 1099 forms for additional income sources, such as freelance work.

- Receipts for deductible expenses, such as medical costs or charitable contributions.

- Records of any tax credits being claimed.

Who Issues the Form

The Tax Year Personal Income Tax FormsDepartment Of Taxes are issued by the Internal Revenue Service (IRS) at the federal level. State tax departments also provide their own forms and guidelines for state income tax filings. It is essential for taxpayers to ensure they are using the correct forms issued for their specific tax year and jurisdiction to avoid complications during the filing process.

Quick guide on how to complete tax year personal income tax formsdepartment of taxes

Complete Tax Year Personal Income Tax FormsDepartment Of Taxes effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to find the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without any delays. Manage Tax Year Personal Income Tax FormsDepartment Of Taxes on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Tax Year Personal Income Tax FormsDepartment Of Taxes without hassle

- Find Tax Year Personal Income Tax FormsDepartment Of Taxes and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Tax Year Personal Income Tax FormsDepartment Of Taxes and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax year personal income tax formsdepartment of taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the benefits of using airSlate SignNow for Tax Year Personal Income Tax FormsDepartment Of Taxes?

Using airSlate SignNow streamlines the process of completing and submitting Tax Year Personal Income Tax FormsDepartment Of Taxes. The platform allows for easy eSigning and document management, eliminating the hassle of physical paperwork. This ensures a faster, more efficient way to handle your tax documents, thus enhancing your productivity.

-

How does airSlate SignNow ensure the security of my Tax Year Personal Income Tax FormsDepartment Of Taxes?

airSlate SignNow prioritizes security by implementing robust encryption and secure storage for all your Tax Year Personal Income Tax FormsDepartment Of Taxes. The platform complies with industry-standard security protocols to protect sensitive information. Users can feel confident knowing their tax documents are safeguarded against unauthorized access.

-

What features does airSlate SignNow offer for managing Tax Year Personal Income Tax FormsDepartment Of Taxes?

airSlate SignNow provides a suite of features designed to simplify the management of Tax Year Personal Income Tax FormsDepartment Of Taxes. Key features include customizable templates, in-app messaging for better communication, and the ability to track document status in real-time. These tools help ensure that all parties involved in the process are informed and engaged.

-

Is there a mobile app available for managing Tax Year Personal Income Tax FormsDepartment Of Taxes with airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that provides users the flexibility to manage their Tax Year Personal Income Tax FormsDepartment Of Taxes on the go. This app allows you to send, sign, and manage documents directly from your smartphone or tablet. It ensures that you can stay productive, even when you're not at your desk.

-

What are the pricing options for airSlate SignNow when handling Tax Year Personal Income Tax FormsDepartment Of Taxes?

airSlate SignNow offers flexible pricing plans that cater to various business needs when dealing with Tax Year Personal Income Tax FormsDepartment Of Taxes. There are options for individuals, small businesses, and enterprises to suit different budgets and usage levels. Contact airSlate SignNow for specific pricing related to your requirements.

-

Can I integrate airSlate SignNow with other applications for my Tax Year Personal Income Tax FormsDepartment Of Taxes?

Absolutely! airSlate SignNow seamlessly integrates with popular applications like Google Drive, Dropbox, and CRMs to enhance your workflow for Tax Year Personal Income Tax FormsDepartment Of Taxes. This allows you to easily import and export documents, making the process smoother and more efficient.

-

How does airSlate SignNow compare to traditional methods for Tax Year Personal Income Tax FormsDepartment Of Taxes?

Compared to traditional methods, airSlate SignNow signNowly improves efficiency in handling Tax Year Personal Income Tax FormsDepartment Of Taxes. The ability to eSign documents eliminates the need for printing and physically sending forms, saving time and resources. Additionally, the platform provides tracking and reminders, ensuring nothing is overlooked.

Get more for Tax Year Personal Income Tax FormsDepartment Of Taxes

- Pidpa overnameformulier downloaden

- Physician treatment request form globalhealth

- Rcads 25 pdf form

- Citizens complaint form columbiatn com

- Jimmy floyd family center membership fill out ampamp sign online form

- 52 pa code54 5 disclosure statement for residential and form

- Stallion form mid atlantic morgan horse sale

- Pleasant valley high school job shadow application pleasval k12 ia form

Find out other Tax Year Personal Income Tax FormsDepartment Of Taxes

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim