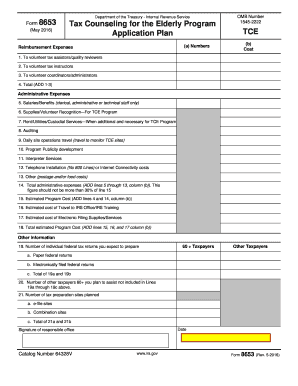

Tax Counseling for the Elderly Program Application Plan TCE Apply07 Grants Form

What is the Tax Counseling For The Elderly Program Application Plan TCE Apply07 Grants

The Tax Counseling for the Elderly Program Application Plan TCE Apply07 Grants is designed to provide free tax assistance to individuals aged sixty and older. This program aims to help seniors navigate the complexities of tax filing, ensuring they receive all eligible benefits and deductions. The grants facilitate the training of volunteers who assist elderly taxpayers, making the tax preparation process accessible and stress-free for this demographic.

Steps to complete the Tax Counseling For The Elderly Program Application Plan TCE Apply07 Grants

Completing the Tax Counseling for the Elderly Program Application Plan TCE Apply07 Grants involves several key steps:

- Gather necessary documentation, including identification, income statements, and previous tax returns.

- Access the application form online through authorized platforms.

- Fill out the form with accurate personal and financial information.

- Review the completed application for any errors or omissions.

- Submit the application electronically or via mail as per the guidelines provided.

Eligibility Criteria

To qualify for the Tax Counseling for the Elderly Program Application Plan TCE Apply07 Grants, applicants must meet specific criteria. Primarily, individuals must be aged sixty or older. Additionally, they should demonstrate a need for assistance, which may include limited income or difficulty in understanding tax regulations. It is essential to review these criteria thoroughly to ensure eligibility before applying.

Required Documents

When applying for the Tax Counseling for the Elderly Program Application Plan TCE Apply07 Grants, certain documents are necessary to support your application. These typically include:

- Proof of identity, such as a government-issued ID.

- Income documentation, including W-2s or 1099 forms.

- Previous year’s tax return, if available.

- Any relevant financial statements that may impact tax filing.

Form Submission Methods

The Tax Counseling for the Elderly Program Application Plan TCE Apply07 Grants can be submitted through various methods to accommodate different preferences. Applicants may choose to:

- Submit the application electronically via designated online platforms.

- Mail the completed form to the appropriate address listed in the application guidelines.

- Visit local tax assistance centers for in-person submission and support.

IRS Guidelines

The IRS provides specific guidelines regarding the Tax Counseling for the Elderly Program Application Plan TCE Apply07 Grants. These guidelines outline the eligibility requirements, application process, and compliance standards that must be adhered to. It is crucial for applicants to familiarize themselves with these guidelines to ensure a smooth application experience and to understand their rights and responsibilities under the program.

Quick guide on how to complete tax counseling for the elderly program application plan tce apply07 grants

Effortlessly complete Tax Counseling For The Elderly Program Application Plan TCE Apply07 Grants on any device

Managing documents online has surged in popularity among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, enabling you to locate the appropriate template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Handle Tax Counseling For The Elderly Program Application Plan TCE Apply07 Grants on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to modify and electronically sign Tax Counseling For The Elderly Program Application Plan TCE Apply07 Grants effortlessly

- Locate Tax Counseling For The Elderly Program Application Plan TCE Apply07 Grants and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Verify the information and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Edit and electronically sign Tax Counseling For The Elderly Program Application Plan TCE Apply07 Grants and guarantee exceptional communication throughout any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax counseling for the elderly program application plan tce apply07 grants

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tax Counseling For The Elderly Program Application Plan TCE Apply07 Grants?

The Tax Counseling For The Elderly Program Application Plan TCE Apply07 Grants is designed to assist elderly individuals with their tax preparation needs. This program offers comprehensive support, allowing seniors to take advantage of available tax credits and deductions. By using this service, elderly users can ensure they maximize their financial benefits while navigating complex tax regulations.

-

How can I apply for the Tax Counseling For The Elderly Program Application Plan TCE Apply07 Grants?

To apply for the Tax Counseling For The Elderly Program Application Plan TCE Apply07 Grants, visit our website and fill out the application form. You'll need to provide some basic information about yourself and your tax situation. After submission, our team will review your application and guide you through the next steps.

-

What are the costs associated with the Tax Counseling For The Elderly Program Application Plan TCE Apply07 Grants?

The Tax Counseling For The Elderly Program Application Plan TCE Apply07 Grants is often offered at low or no cost to eligible seniors. This ensures that financial constraints do not prevent elderly individuals from receiving essential tax counseling services. Always check with local providers for any specific fees associated with the program.

-

What features does the Tax Counseling For The Elderly Program Application Plan TCE Apply07 Grants offer?

This program provides a range of features, including personalized tax counseling, assistance with form completion, and access to experienced tax professionals. Additionally, the Tax Counseling For The Elderly Program Application Plan TCE Apply07 Grants includes informative resources to help elderly individuals understand tax laws better. These features ensure seniors receive the support they need during tax season.

-

What are the benefits of the Tax Counseling For The Elderly Program Application Plan TCE Apply07 Grants?

The primary benefits of the Tax Counseling For The Elderly Program Application Plan TCE Apply07 Grants include professional guidance through tax complexity and assistance in obtaining maximum refunds. Seniors can also reduce the risk of errors on their tax returns with expert support. Overall, this program is designed to alleviate the stress commonly associated with tax filing for the elderly.

-

Is the Tax Counseling For The Elderly Program Application Plan TCE Apply07 Grants available in my area?

The availability of the Tax Counseling For The Elderly Program Application Plan TCE Apply07 Grants may vary by location. Many local non-profits and community organizations participate in this program. To find a nearby provider, check the program's official website for a list of participating sites in your area.

-

How does the Tax Counseling For The Elderly Program Application Plan TCE Apply07 Grants ensure privacy and security?

Privacy and security are top priorities for the Tax Counseling For The Elderly Program Application Plan TCE Apply07 Grants. All personal and financial information provided is protected using robust data security measures. Additionally, licensed tax professionals are trained to maintain client confidentiality throughout the counseling process.

Get more for Tax Counseling For The Elderly Program Application Plan TCE Apply07 Grants

Find out other Tax Counseling For The Elderly Program Application Plan TCE Apply07 Grants

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free