PPS Withdrawal Form Investment Account and Preservation Funds FH11

What is the PPS Withdrawal Form Investment Account and Preservation Funds FH11

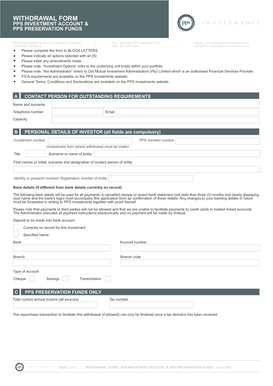

The PPS Withdrawal Form Investment Account and Preservation Funds FH11 is a specific document used for managing withdrawals from investment accounts and preservation funds. This form is essential for individuals who wish to access their funds legally and efficiently. It outlines the necessary information required for processing the withdrawal, ensuring that all parties involved understand the terms and conditions associated with the transaction.

Steps to Complete the PPS Withdrawal Form Investment Account and Preservation Funds FH11

Completing the PPS Withdrawal Form involves several key steps to ensure accuracy and compliance:

- Gather necessary personal information, including your account number and identification details.

- Clearly specify the amount you wish to withdraw from your investment account.

- Review the terms and conditions associated with the withdrawal to ensure you understand any potential fees or penalties.

- Sign the form electronically, ensuring that your signature meets the legal requirements for eSignatures.

- Submit the completed form through the designated method, whether online, by mail, or in person.

Legal Use of the PPS Withdrawal Form Investment Account and Preservation Funds FH11

The legal use of the PPS Withdrawal Form is governed by specific regulations that ensure its validity. For the form to be legally binding, it must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws establish that electronic signatures and documents hold the same legal weight as their paper counterparts, provided that certain criteria are met.

Key Elements of the PPS Withdrawal Form Investment Account and Preservation Funds FH11

Several key elements must be included in the PPS Withdrawal Form to ensure it is complete and valid:

- Account Information: Details about the investment account, including account number and type.

- Withdrawal Amount: The specific sum being requested for withdrawal.

- Signature: An electronic signature that verifies the identity of the individual submitting the form.

- Date: The date on which the form is completed and submitted.

- Contact Information: Up-to-date contact details for any follow-up communications.

How to Obtain the PPS Withdrawal Form Investment Account and Preservation Funds FH11

The PPS Withdrawal Form can typically be obtained through the financial institution managing your investment account. Many institutions provide the form digitally on their websites, allowing for easy access and completion. Alternatively, you may request a physical copy through customer service or your account representative. Ensure you have the latest version of the form to avoid any compliance issues.

Form Submission Methods

Submitting the PPS Withdrawal Form can be done through various methods, depending on the policies of the financial institution:

- Online Submission: Many institutions allow for electronic submission directly through their website.

- Mail: You can print the completed form and send it via postal service to the designated address.

- In-Person: Some individuals may prefer to deliver the form in person at their financial institution's branch.

Quick guide on how to complete pps withdrawal form investment account and preservation funds fh11

Complete PPS Withdrawal Form Investment Account And Preservation Funds FH11 effortlessly on any device

Online document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documentation, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without delays. Manage PPS Withdrawal Form Investment Account And Preservation Funds FH11 across any platform using the airSlate SignNow Android or iOS applications and simplify your document-related processes today.

How to alter and eSign PPS Withdrawal Form Investment Account And Preservation Funds FH11 with ease

- Obtain PPS Withdrawal Form Investment Account And Preservation Funds FH11 and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive details using tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your requirements in document management with just a few clicks from any device you select. Revise and eSign PPS Withdrawal Form Investment Account And Preservation Funds FH11 and ensure excellent communication throughout your document preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pps withdrawal form investment account and preservation funds fh11

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for south africa funds withdrawal using airSlate SignNow?

To initiate a south africa funds withdrawal with airSlate SignNow, you need to ensure your account is verified. After that, navigate to the withdrawal section and follow the prompts to enter your banking details. The process is quick and user-friendly, ensuring your funds are transferred efficiently.

-

Are there any fees associated with south africa funds withdrawal?

Yes, there may be nominal fees associated with south africa funds withdrawal, depending on your chosen payment method. It's important to review our pricing details to understand these fees upfront. This ensures you have complete transparency about the costs involved in your transactions.

-

How long does the south africa funds withdrawal typically take?

The time frame for south africa funds withdrawal can vary depending on your bank and the method used. Generally, you can expect to see your funds transferred within a few business days. This efficiency allows you to manage your finances smoothly and effectively.

-

What are the benefits of using airSlate SignNow for south africa funds withdrawal?

Using airSlate SignNow for south africa funds withdrawal offers signNow benefits, including a user-friendly interface and quick processing times. Our platform is designed to enhance your overall experience and maximize your efficiency in managing funds. Plus, our integrated solutions help streamline your document signing and financial operations.

-

Can I track my south africa funds withdrawal status?

Yes, airSlate SignNow allows you to track the status of your south africa funds withdrawal easily. You can access your account dashboard to view updates on pending transactions, giving you peace of mind. This feature enhances your control over your financial activities.

-

Does airSlate SignNow integrate with other financial tools for south africa funds withdrawal?

Absolutely! airSlate SignNow provides integrations with various financial tools and platforms, facilitating a seamless experience for south africa funds withdrawal. This capability allows you to synchronize your workflows and improve efficiency in managing your financial documents and transactions.

-

Is customer support available for south africa funds withdrawal inquiries?

Yes, our dedicated customer support team is available to assist you with any inquiries related to south africa funds withdrawal. You can signNow us through multiple channels, including chat and email support. Our goal is to ensure you have a smooth experience with our platform.

Get more for PPS Withdrawal Form Investment Account And Preservation Funds FH11

- Internet scavenger hunt answer key form

- Securityalarmnowcom form 1389396

- Alliant credit union wire transfer form

- Monthly cash flow plan form

- Paraprofessional salary upgrade credits form

- Audit party auditing your club records poll 1 form

- Eapnet affiliate invoice aurora health care aurorahealthcare form

- Consulting partnership agreement template form

Find out other PPS Withdrawal Form Investment Account And Preservation Funds FH11

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document