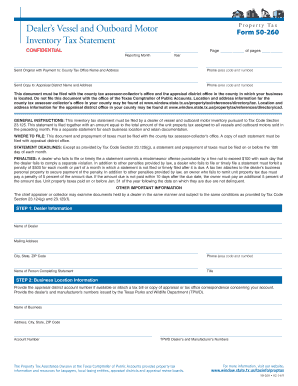

50 260 Form

What is the 50 260

The 50 260 form is a document used primarily for tax purposes in the United States. It serves as a means for individuals and businesses to report specific financial information to the Internal Revenue Service (IRS). Understanding the purpose and requirements of the 50 260 is essential for ensuring compliance with federal regulations. This form typically pertains to various tax-related activities, including income reporting and deductions.

How to use the 50 260

Using the 50 260 form involves several steps to ensure accurate and efficient completion. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form with the required information, ensuring that each section is completed accurately. After filling out the form, review it for any errors or omissions. Finally, submit the completed 50 260 form to the IRS by the specified deadline, either electronically or via mail.

Steps to complete the 50 260

Completing the 50 260 form requires careful attention to detail. Follow these steps for successful completion:

- Collect all relevant financial documents, such as W-2s, 1099s, and receipts.

- Begin filling out the form, starting with personal identification information.

- Accurately report income and any applicable deductions.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the 50 260

The legal use of the 50 260 form is governed by IRS regulations. To ensure that the form is legally valid, it must be completed accurately and submitted within the required timeframe. Compliance with federal tax laws is crucial, as failure to adhere to these regulations can result in penalties or audits. Utilizing a reliable eSignature solution can further enhance the legal standing of the submitted form.

Filing Deadlines / Important Dates

Filing deadlines for the 50 260 form are critical for compliance. Generally, the form must be submitted by April fifteenth of the tax year following the income reported. However, specific circumstances may allow for extensions. It is essential to stay informed about any changes to deadlines to avoid potential penalties for late submissions.

Examples of using the 50 260

The 50 260 form can be used in various scenarios. For instance, self-employed individuals may use it to report their earnings and claim deductions for business expenses. Additionally, small businesses may utilize the form to report income from sales and services. Understanding these examples can help users determine how the 50 260 applies to their specific tax situations.

Quick guide on how to complete 50 260

Easily Prepare 50 260 on Any Device

Managing documents online has become increasingly favored by organizations and individuals alike. It offers a suitable eco-conscious substitute to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without any hold-ups. Handle 50 260 on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to Modify and eSign 50 260 Effortlessly

- Find 50 260 and click on Get Form to begin.

- Utilize the available tools to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specially offers for that purpose.

- Generate your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for sharing your form via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhaustive form searching, or errors that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign 50 260 and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 50 260

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the number 50 260 in relation to airSlate SignNow?

The number 50 260 may refer to a specific plan or pricing tier offered by airSlate SignNow, highlighting features tailored for businesses seeking efficient signing solutions. Understanding these tiers can help you choose the best option for your needs.

-

How does airSlate SignNow pricing compare for businesses with 50 260 documents?

airSlate SignNow offers competitive pricing plans that cater specifically to organizations handling around 50 260 documents per year. By selecting the right plan, users can benefit from scalable solutions that optimize document processing and eSigning efficiency.

-

What features does airSlate SignNow provide for managing 50 260 documents?

airSlate SignNow includes advanced features such as bulk sending, template creation, and real-time tracking, which are essential for managing large volumes of documents like 50 260. These tools streamline the signing process, making it easy to handle high document loads.

-

Can airSlate SignNow integrate with other software to manage 50 260 documents?

Yes, airSlate SignNow seamlessly integrates with multiple applications like CRM systems and file management software, ideal for managing 50 260 documents. This integration enhances workflow efficiency and ensures that documents are processed smoothly across platforms.

-

What are the key benefits of using airSlate SignNow for businesses dealing with 50 260 document signatures?

Businesses that utilize airSlate SignNow for 50 260 document signatures experience faster turnaround times, improved accuracy, and enhanced security. The user-friendly interface further reduces training time, allowing teams to focus on core operations rather than document management.

-

Is airSlate SignNow suitable for enterprises needing to manage 50 260 multiple users?

Absolutely, airSlate SignNow is designed to accommodate enterprises with multiple users managing 50 260 documents. The platform supports user management features that allow organizations to easily assign roles, monitor usage, and maintain security.

-

What payment options are available for businesses looking to purchase airSlate SignNow for 50 260 uses?

When purchasing airSlate SignNow for 50 260 uses, businesses have access to various payment options, including monthly or annual subscriptions. This flexibility allows teams to select a payment method that aligns with their budgeting preferences.

Get more for 50 260

- Wyoming foreign judgment enrollmentus legal forms

- Their state of residence not the same attorney and that they form

- International travel consent for a minor affidavit and authorization form

- Loan application checklist tom andolsen midfirst bank form

- Sample arbitration clause language a simple arbitration form

- This agreement made by and between amp form

- 12 2027 appendix of forms 2014 oklahoma statutes us codes

- Usps postmaster address request letter us department of labor form

Find out other 50 260

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document