OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR

What is the OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR

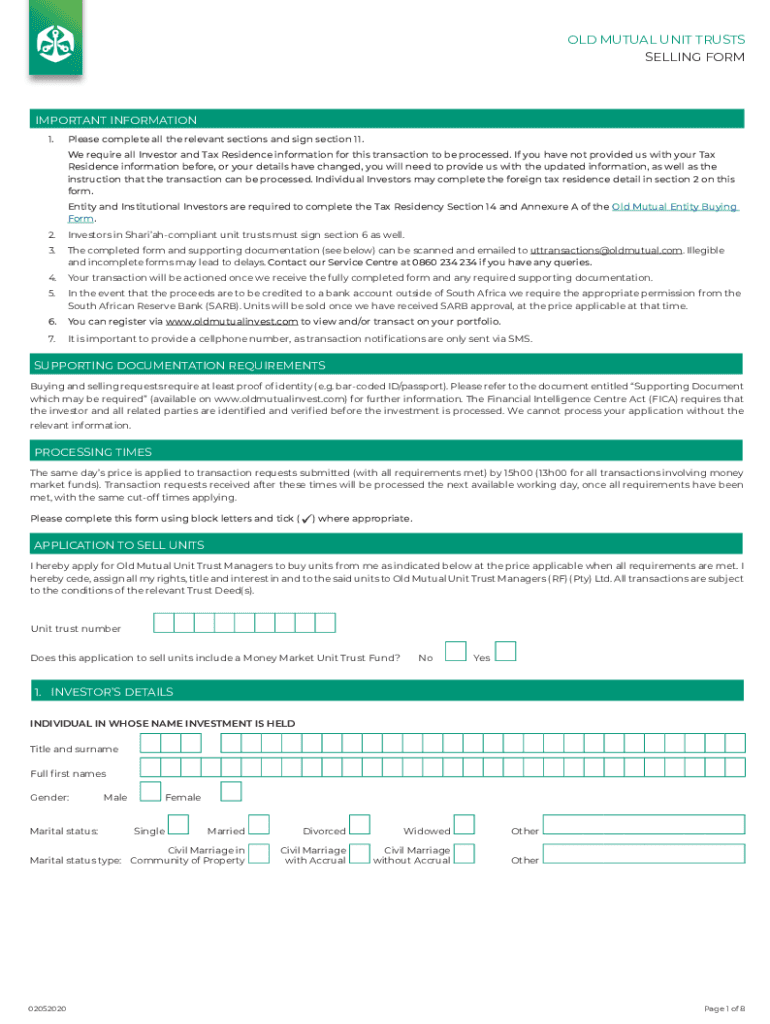

The OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR is a formal document used for transactions involving the sale of unit trusts managed by Old Mutual. This form serves as a request for the redemption of units held in a trust, enabling investors to liquidate their investments. It is essential for ensuring that the transaction is processed accurately and in compliance with relevant regulations. Understanding the specifics of this form is crucial for investors looking to manage their portfolios effectively.

Steps to complete the OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR

Completing the OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR involves several key steps to ensure accuracy and compliance:

- Gather Required Information: Collect all necessary details, including your account number, personal identification, and the specifics of the units you wish to sell.

- Fill Out the Form: Carefully enter the required information in the designated fields. Ensure that all details are accurate to avoid processing delays.

- Review Your Submission: Double-check the form for any errors or omissions. It is important to ensure that all information is complete and correct.

- Submit the Form: Follow the submission guidelines provided with the form, whether online, by mail, or in person, to ensure it reaches the appropriate department.

Legal use of the OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR

The OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR is legally binding when completed and submitted according to the guidelines set forth by Old Mutual and relevant regulatory bodies. It is important to understand that the form must be filled out accurately, as any discrepancies can lead to legal complications or delays in processing your request. Compliance with the applicable laws governing financial transactions is essential to uphold the integrity of the process.

Key elements of the OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR

Several key elements are crucial for the OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR:

- Investor Information: This includes the investor's name, contact details, and account number.

- Details of the Units: Specify the number of units being sold and the specific trust associated with the transaction.

- Signature: The form must be signed by the investor or an authorized representative to validate the request.

- Date of Submission: Including the date ensures that the request is processed in a timely manner.

Form Submission Methods (Online / Mail / In-Person)

The OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR can typically be submitted through various methods:

- Online Submission: Many investors prefer to submit the form electronically for convenience. Ensure you have a secure internet connection and follow the online instructions carefully.

- Mail Submission: If you choose to send the form by mail, ensure it is addressed correctly and sent to the appropriate Old Mutual office.

- In-Person Submission: For those who prefer face-to-face interactions, visiting a local Old Mutual office can provide immediate assistance and confirmation of submission.

Examples of using the OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR

Understanding practical scenarios can help clarify the use of the OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR. Here are a few examples:

- An investor who needs to liquidate part of their investment portfolio due to unexpected expenses might use this form to sell a portion of their unit trusts.

- A retiree may decide to sell their unit trusts to access funds for living expenses, utilizing the form to facilitate the transaction.

- Individuals rebalancing their investment strategy may also use this form to adjust their holdings by selling certain unit trusts.

Quick guide on how to complete old mutual unit trusts selling formimportant infor

Effortlessly Prepare OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR on Any Device

Digital document management has become increasingly favored by both companies and individuals. It offers an ideal sustainable alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly and without any holdups. Manage OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR on any device with airSlate SignNow's Android or iOS applications and simplify any document-oriented task today.

Effortlessly Modify and Electronically Sign OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR

- Find OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR and click Get Form to begin.

- Use the tools we provide to complete your document effectively.

- Highlight pertinent sections of the documents or conceal sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all details and then click on the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any preferred device. Edit and electronically sign OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR while ensuring excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the old mutual unit trusts selling formimportant infor

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR?

The OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR is a vital document necessary for processing sales of your Old Mutual Unit Trusts. It ensures that all transactions are conducted smoothly, adhering to the regulatory standards. By using this form, you can efficiently manage your investment transactions.

-

How can I obtain the OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR?

You can easily download the OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR directly from the airSlate SignNow landing page. Additionally, our platform allows you to access, fill out, and sign the form digitally, which streamlines the entire process for your convenience.

-

What are the benefits of using the OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR?

Using the OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR simplifies the selling process of unit trusts. It enhances security and accuracy, minimizing errors that can occur with manual paperwork. This efficient solution also aids in maintaining a clear documentation trail for your records.

-

Is there a fee associated with the OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR?

There is no direct fee for filling out the OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR itself. However, please check with your financial advisor for any associated costs that may arise during the transaction process, as fees can vary based on your specific investment options.

-

Can I integrate the OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR with other platforms?

Yes, airSlate SignNow allows you to integrate the OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR with various business platforms. This integration facilitates a smoother workflow and enhances document management by connecting with tools you already use, making it more efficient to handle your forms.

-

What features does airSlate SignNow offer for handling the OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR?

airSlate SignNow offers numerous features to enhance your experience with the OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR. These include secure eSigning, real-time tracking of document status, and easy access to previous transactions, all designed to optimize your workflow.

-

Are electronic signatures valid for the OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR?

Yes, electronic signatures on the OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR are legally valid and widely accepted. airSlate SignNow adheres to global eSignature regulations, ensuring your digital signatures are secure and compliant with legal standards.

Get more for OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR

- Medical record supplemental medical data for use of this form see requiring document

- Planet fitness job application form

- Printable disability forms

- Boiler maintenance checklist form

- At t lifeline form

- Femaform

- Entouch wireless login form

- Fillable waiver of attorney client confidentiality student form

Find out other OLD MUTUAL UNIT TRUSTS SELLING FORMIMPORTANT INFOR

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy