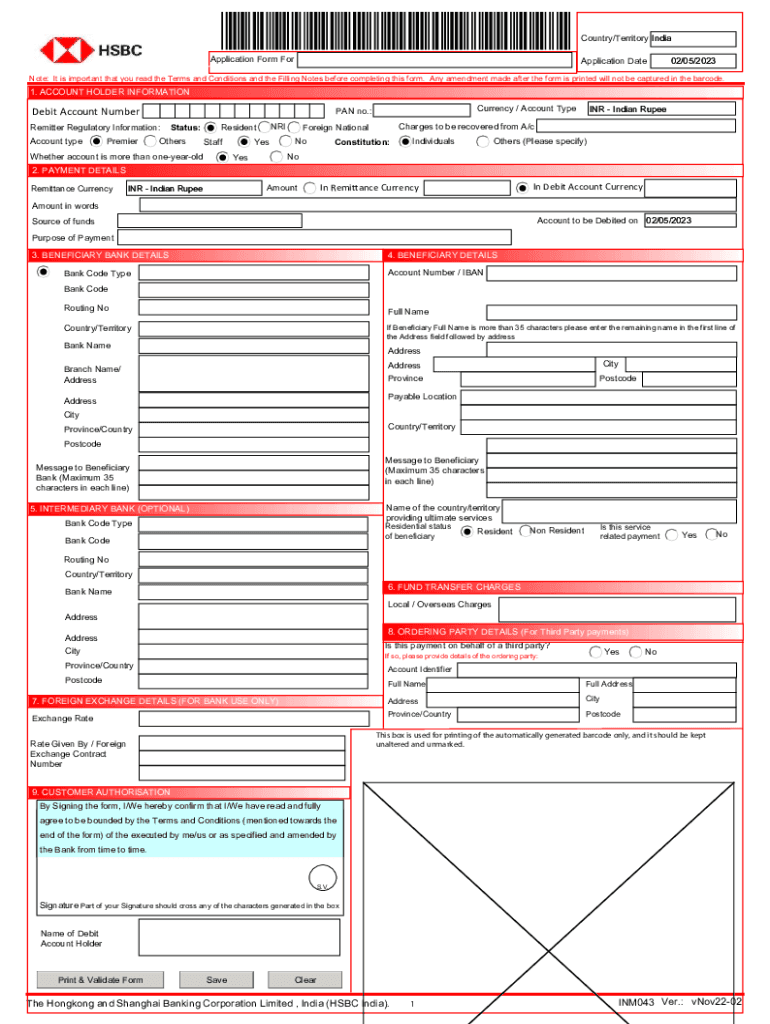

Liberalised Remittance Scheme LRS Application Cum Form A2 Only for Resident Customers

Understanding the outward telegraphic transfer application form

The outward telegraphic transfer application form is a crucial document for individuals and businesses wishing to send money internationally. This form is specifically designed for residents of the United States who wish to utilize the Liberalised Remittance Scheme (LRS). It allows for the transfer of funds to foreign banks for various purposes, such as education, travel, or investments. Understanding the details of this form is essential for ensuring compliance with regulations and for a smooth transfer process.

Steps to complete the outward telegraphic transfer application form

Completing the outward telegraphic transfer application form involves several key steps. First, gather all necessary information, including the recipient's bank details, the amount to be transferred, and the purpose of the transfer. Next, accurately fill out the form, ensuring that all sections are completed without errors. Once the form is filled out, review it for accuracy before submitting it to your bank. It is also advisable to keep a copy of the completed form for your records.

Required documents for the outward telegraphic transfer application

When submitting the outward telegraphic transfer application form, specific documents may be required to support your application. Typically, these documents include proof of identity, such as a government-issued ID, and proof of the purpose of the remittance, which could be an invoice or a letter of admission for educational transfers. Additionally, banks may require a completed LRS declaration form. Ensure you have all necessary documents ready to avoid delays in processing your application.

Legal considerations for the outward telegraphic transfer application

Using the outward telegraphic transfer application form involves adhering to various legal regulations. It is essential to comply with the guidelines set forth by the U.S. Department of the Treasury and the Federal Reserve. These regulations are designed to prevent money laundering and ensure that funds are transferred for legitimate purposes. Familiarizing yourself with these legal requirements can help you avoid potential penalties and ensure a smooth transaction.

Eligibility criteria for using the outward telegraphic transfer application

To use the outward telegraphic transfer application form, applicants must meet specific eligibility criteria. Generally, this includes being a resident of the United States and being of legal age, typically eighteen years or older. Additionally, the purpose of the transfer must fall within the approved categories under the Liberalised Remittance Scheme. Understanding these criteria is vital for ensuring that your application is accepted and processed efficiently.

Form submission methods for the outward telegraphic transfer application

The outward telegraphic transfer application form can typically be submitted through various methods, depending on the bank's policies. Common submission methods include online submissions through the bank's secure portal, in-person submissions at a local branch, or mailing the completed form. Each method may have different processing times, so it is advisable to check with your bank for the most efficient option.

Quick guide on how to complete liberalised remittance scheme lrs application cum form a2 only for resident customers

Complete Liberalised Remittance Scheme LRS Application Cum Form A2 Only For Resident Customers effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It presents an ideal eco-conscious substitute for conventional printed and signed paperwork, allowing you to obtain the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without hindrances. Manage Liberalised Remittance Scheme LRS Application Cum Form A2 Only For Resident Customers on any device using the airSlate SignNow Android or iOS applications and simplify your document-related processes today.

How to modify and eSign Liberalised Remittance Scheme LRS Application Cum Form A2 Only For Resident Customers with ease

- Obtain Liberalised Remittance Scheme LRS Application Cum Form A2 Only For Resident Customers and click Get Form to begin.

- Utilize the resources we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes a matter of seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Edit and eSign Liberalised Remittance Scheme LRS Application Cum Form A2 Only For Resident Customers to ensure excellent communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the liberalised remittance scheme lrs application cum form a2 only for resident customers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an outward telegraphic transfer application form?

The outward telegraphic transfer application form is a document needed to initiate a funds transfer internationally through a bank. It contains important details such as the sender's and recipient's banking information, amount, and purpose of the transfer. Understanding and completing this form correctly is essential to ensure a smooth transaction process.

-

How do I fill out the outward telegraphic transfer application form?

To fill out the outward telegraphic transfer application form, you will need to provide specific information including your bank details, beneficiary information, and transfer amount. Ensure that all fields are completed accurately to prevent any delays. It is advisable to double-check the recipient's information to avoid complications.

-

What are the fees associated with the outward telegraphic transfer application form?

Fees for submitting an outward telegraphic transfer application form can vary by bank, but they typically include a flat fee or a percentage of the transfer amount. It's important to inquire directly with your banking institution for exact pricing. This helps in planning your finances better around the transaction costs.

-

Can I track my outward telegraphic transfer after submitting the application form?

Yes, once you have submitted your outward telegraphic transfer application form, most banks provide a way to track your transfer. You can usually obtain a unique reference number after submission that allows you to check the status. Tracking offers peace of mind, knowing where your funds are during the transfer process.

-

What documents do I need to submit with the outward telegraphic transfer application form?

Along with the outward telegraphic transfer application form, you may need to provide identification (like a passport), proof of the source of funds, and any additional documentation required by the bank. This is to comply with regulatory standards and to help streamline your transaction. Always check with your bank for their specific requirements.

-

Is there a maximum limit on transactions using the outward telegraphic transfer application form?

Many banks impose a maximum limit on transactions conducted via the outward telegraphic transfer application form. This limit can vary depending on bank policies and regulatory factors. Contact your bank for detailed information regarding transaction limits, especially for large transfers.

-

How does airSlate SignNow facilitate the outward telegraphic transfer application form process?

airSlate SignNow streamlines the process of filling out the outward telegraphic transfer application form by allowing users to eSign documents quickly and securely. The platform simplifies document management, ensuring that all necessary forms are completed accurately and submitted on time. This can signNowly reduce the complexity often associated with international transfers.

Get more for Liberalised Remittance Scheme LRS Application Cum Form A2 Only For Resident Customers

- Letter of recommendation for eagle scout candidate form

- Air quality webquest answer key form

- Compound words worksheet grade 5 pdf form

- Scjc texas form

- Form 990 ez

- Santa clara valley medical center 751 south bascom avenue san jose ca 95128 telephone 408 885 5147 fax 408 885 5170 form

- Umschulungsvertrag mit personalbogen form

- 1313 washington dc jurisdictional addendum req 1012 pdf form

Find out other Liberalised Remittance Scheme LRS Application Cum Form A2 Only For Resident Customers

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now