Mortgage Legal Form

Understanding the Mortgage Legal

The mortgage legal refers to the formal documentation that outlines the terms and conditions of a mortgage agreement. This document is crucial for both lenders and borrowers as it establishes the legal framework for the loan. It includes essential details such as the loan amount, interest rate, repayment schedule, and the rights and obligations of both parties. Understanding the mortgage legal is vital to ensure compliance with state and federal regulations and to protect the interests of all parties involved.

Steps to Complete the Mortgage Legal

Completing the mortgage legal involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of income, credit history, and property details. Next, fill out the mortgage application form, ensuring that all information is accurate and complete. After submitting the application, review the terms of the mortgage legal carefully, paying attention to interest rates, fees, and repayment terms. Finally, sign the document electronically or in person, ensuring that all parties involved have a copy for their records.

Key Elements of the Mortgage Legal

Several key elements define the mortgage legal and its enforceability. These include:

- Loan Amount: The total amount borrowed by the borrower.

- Interest Rate: The cost of borrowing, expressed as a percentage of the loan amount.

- Repayment Schedule: The timeline for repaying the loan, including monthly payment amounts.

- Property Description: Details about the property being financed, including its address and legal description.

- Default Terms: Conditions under which the lender can take action if the borrower fails to meet repayment obligations.

Legal Use of the Mortgage Legal

The legal use of the mortgage legal is governed by various federal and state laws. These regulations ensure that the rights of both the lender and borrower are protected. For instance, the Truth in Lending Act requires lenders to provide clear information about loan terms, while the Real Estate Settlement Procedures Act mandates disclosure of settlement costs. Compliance with these laws is essential for the enforceability of the mortgage legal and to avoid potential legal disputes.

Disclosure Requirements

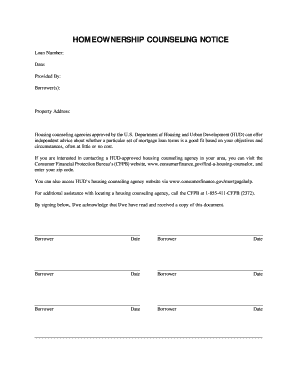

Disclosure requirements play a vital role in the mortgage legal process. Lenders must provide borrowers with specific information regarding the loan, including the annual percentage rate (APR), total finance charges, and the total amount financed. Additionally, borrowers should receive a Good Faith Estimate (GFE) detailing estimated closing costs. These disclosures help borrowers make informed decisions and ensure transparency throughout the mortgage process.

Who Issues the Form

The mortgage legal form is typically issued by the lender, which can be a bank, credit union, or mortgage company. These institutions are responsible for preparing the document according to legal standards and ensuring that it complies with relevant regulations. Borrowers should work closely with their lender to ensure that the mortgage legal accurately reflects the agreed-upon terms and conditions.

Quick guide on how to complete mortgage legal

Easily Prepare Mortgage Legal on Any Device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and effortlessly. Manage Mortgage Legal on any platform using airSlate SignNow's Android or iOS applications and enhance your document-based processes today.

Edit and Electronically Sign Mortgage Legal with Ease

- Obtain Mortgage Legal and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Mortgage Legal to ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mortgage legal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a notice disclosure in the context of electronic signatures?

A notice disclosure refers to the information provided to users before they sign electronic documents, ensuring they understand the implications of their digital signature. airSlate SignNow includes comprehensive notice disclosures to enhance transparency and compliance. This helps in building trust and ensures that all parties are fully informed before executing agreements.

-

How does airSlate SignNow ensure compliance with notice disclosures?

airSlate SignNow adheres to various legal standards and regulations governing electronic signatures, which include clear notice disclosures. We implement features that allow users to review these notices before signing. This commitment to compliance not only protects your business, but also maintains the integrity of the eSignature process.

-

Are there any costs associated with notice disclosure features in airSlate SignNow?

The notice disclosure features are included within our affordable pricing plans at airSlate SignNow. This means that users can access comprehensive notice disclosures at no additional cost beyond their chosen plan. We believe in providing transparent pricing, ensuring that you have all the tools you need without hidden fees.

-

What are the key benefits of using notice disclosures with airSlate SignNow?

The key benefits of using notice disclosures in airSlate SignNow include increased legal compliance, enhanced user trust, and better document clarity. By providing clear notice disclosures before eSigning, you ensure that all participants understand their rights and obligations. This proactive approach ultimately leads to smoother transactions and fewer disputes.

-

Can I customize the notice disclosure for my documents?

Yes, airSlate SignNow allows customization of notice disclosures to ensure they meet your business's specific legal requirements. You can easily modify the wording and format to align with your brand voice and compliance needs. This flexibility allows you to maintain consistency while ensuring all necessary disclosures are made.

-

Does airSlate SignNow integrate with other platforms for notice disclosures?

airSlate SignNow offers various integrations with popular business platforms to streamline the notice disclosure process. By integrating with tools like CRMs, you can automate the dissemination of notice disclosures along with your documents. This integration optimizes workflows and enhances efficiency in your document management.

-

How do I access notice disclosures on airSlate SignNow?

Accessing notice disclosures on airSlate SignNow is straightforward and user-friendly. When preparing a document for eSignature, the system automatically prompts users to review the notice disclosures before signing. This ensures that everyone involved is informed and ready to proceed, making the eSignature process seamless.

Get more for Mortgage Legal

- Ftb 4803e form

- Naked juuce claim form

- Editable oxford ny enrolment form

- Informed consent and permission form extractions

- Online attestation form

- Move in preliminary walk through and final move out inspection form

- Primary care nurse practitioner residency program application form

- Us department of veterans affairs request for lease proposals form

Find out other Mortgage Legal

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney