Return Online Form

What is the business tax return?

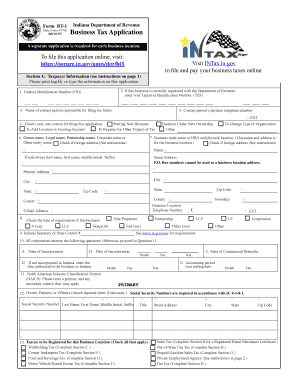

A business tax return is a document that businesses in the United States file with the Internal Revenue Service (IRS) to report income, expenses, and other tax-related information. This form is essential for determining the tax liability of the business, whether it is a corporation, partnership, or sole proprietorship. The specific form used can vary based on the business structure, with common forms including the 1120 for corporations and the 1065 for partnerships. Filing this return accurately is crucial for compliance with federal tax laws.

Steps to complete the business tax return

Completing a business tax return involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense reports, and receipts. Next, determine the appropriate form based on your business structure. Once you have the correct form, fill it out carefully, ensuring all income and deductions are reported accurately. After completing the form, review it for any errors before submitting it electronically or via mail. Finally, keep a copy of the filed return and any supporting documents for your records.

Required documents for the business tax return

Filing a business tax return requires several important documents to substantiate the information reported. Key documents include:

- Income statements, such as profit and loss statements

- Expense reports detailing all business-related costs

- Receipts for deductible expenses

- Previous year’s tax return for reference

- Any relevant schedules or forms specific to your business type

Having these documents organized and readily available will streamline the filing process and help ensure compliance with IRS regulations.

Legal use of the business tax return

The business tax return serves as a legally binding document that reflects the financial activities of a business over a specific tax year. To ensure its legal validity, the return must be completed accurately and submitted by the designated deadline. Additionally, businesses must adhere to IRS guidelines regarding deductions and credits to avoid penalties. Using reliable electronic filing solutions can enhance the security and legality of the submission process, ensuring that all signatures and data are properly authenticated.

Filing deadlines for the business tax return

Each year, businesses must be aware of specific filing deadlines for their tax returns. Generally, the deadline for corporations to file their business tax return is the fifteenth day of the fourth month after the end of their fiscal year, while partnerships typically have a deadline of the fifteenth day of the third month after the end of their fiscal year. It is important to mark these dates on your calendar to avoid late filing penalties and interest charges.

IRS guidelines for the business tax return

The IRS provides comprehensive guidelines that outline the requirements for filing a business tax return. These guidelines include instructions on the types of income that must be reported, allowable deductions, and credits available to businesses. Familiarizing yourself with these regulations is essential for accurate reporting and compliance. The IRS also offers resources and publications that can assist business owners in understanding their tax obligations and ensuring they meet all necessary requirements.

Quick guide on how to complete return online

Complete Return Online effortlessly on any device

Web-based document management has gained traction among both businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documentation, allowing you to locate the desired form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents promptly without any hold-ups. Handle Return Online on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to alter and eSign Return Online with ease

- Find Return Online and click on Get Form to commence.

- Leverage the tools we provide to complete your form.

- Mark pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Produce your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to secure your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Edit and eSign Return Online and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the return online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a business tax return and why is it important?

A business tax return is a form filed with the IRS to report income, expenses, and other tax information for a business entity. It is crucial for ensuring compliance with tax laws and determining the amount of taxes owed or refunds due. Properly managing your business tax return can help you maximize deductions and minimize liabilities.

-

How can airSlate SignNow assist with business tax return documentation?

airSlate SignNow streamlines the process of signing and sending documents related to your business tax return. With our easy-to-use eSignature solution, you can securely collect signatures from clients or partners, ensuring all paperwork is handled efficiently. This helps you stay organized and on track during tax season.

-

What are the pricing options for using airSlate SignNow for business tax return needs?

airSlate SignNow offers flexible pricing plans to cater to different business sizes and needs. Whether you are a solo entrepreneur or a larger entity, there is a solution that fits your budget. Our cost-effective options ensure you have access to essential features for managing your business tax return efficiently.

-

Are there any features specifically designed for handling business tax returns?

Yes, airSlate SignNow includes features such as template creation, document storage, and automated reminders that are particularly beneficial for managing business tax returns. These tools streamline the process of gathering necessary documents and signatures, ensuring you meet all deadlines. The user-friendly interface makes it simple to keep your tax return documentation organized.

-

Can I integrate airSlate SignNow with my accounting software for business tax return preparation?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, which is essential for effective business tax return preparation. This integration allows for easy access to necessary documents and data, enabling you to manage both your accounting and tax filing processes in one place. This ensures accuracy and saves time during tax season.

-

What are the benefits of using eSigning for my business tax return?

Using eSigning through airSlate SignNow for your business tax return offers numerous benefits, including faster document turnaround and enhanced security. It eliminates the need for physical signatures, streamlining the filing process and reducing the risk of lost paperwork. With eSigning, you can ensure your business tax return is submitted efficiently and securely.

-

Is airSlate SignNow compliant with tax regulations for business tax returns?

Yes, airSlate SignNow complies with all relevant eSignature laws and regulations, ensuring that your business tax return documents are legally recognized. Our platform adheres to industry standards for security and data protection, giving you peace of mind when handling sensitive tax information. You can confidently use airSlate SignNow for your business tax return needs.

Get more for Return Online

- Ftb 3567 installment agreement request installment agreement request ftb ca form

- Expense report form

- Psa outline form

- Three aspects from the most important to the less one form

- Harcourts tenancy application form

- Overtakelsesprotokoll pdf form

- Potvrda o zaposlenju word form

- Request for replacement certification card or report of address change form

Find out other Return Online

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word