Adding a Joint Owner Instructions & Authorization Form

What is the Adding a Joint Owner Instructions & Authorization Form

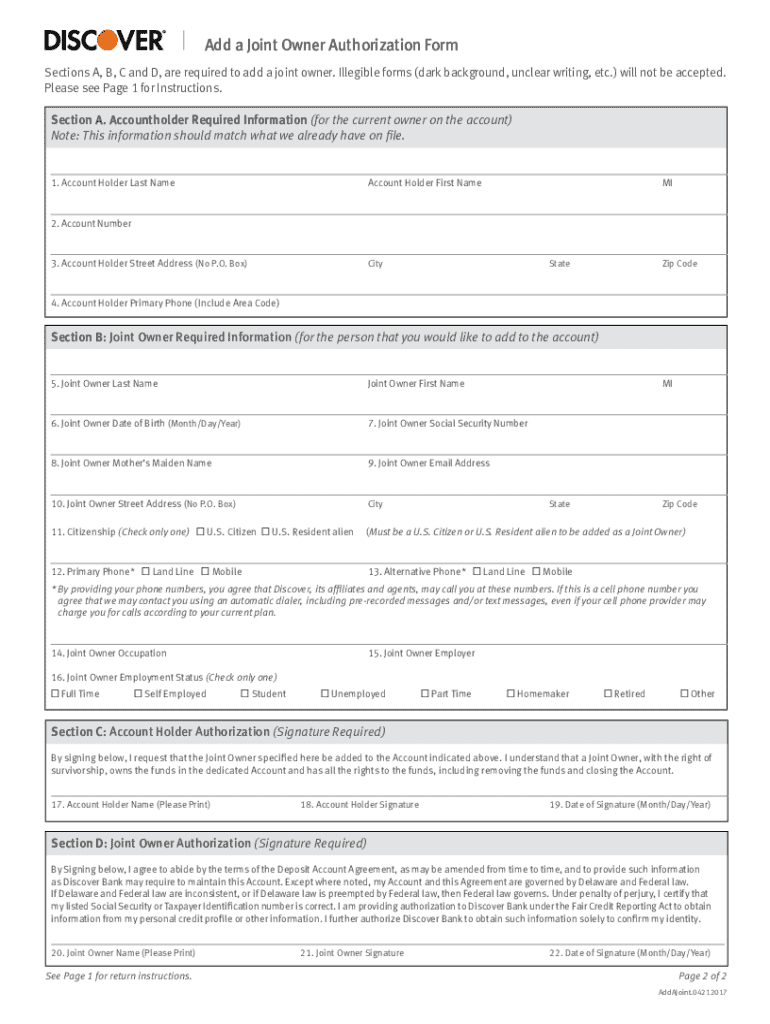

The Adding a Joint Owner Instructions & Authorization Form is a legal document used to designate an additional owner on an account, such as a bank account or investment account. This form is essential for individuals who wish to share ownership of their financial assets with another person. By completing this form, the primary account holder grants permission for the joint owner to access and manage the account, which can include making deposits, withdrawals, and other transactions. It is important to ensure that both parties understand the implications of joint ownership, including shared responsibility for any debts or obligations associated with the account.

Steps to Complete the Adding a Joint Owner Instructions & Authorization Form

Completing the Adding a Joint Owner Instructions & Authorization Form involves several key steps to ensure accuracy and compliance. First, gather all necessary information about both the primary account holder and the joint owner, including full names, addresses, and Social Security numbers. Next, fill out the form with this information, ensuring that all fields are completed accurately. After filling out the form, both parties should review it for any errors or omissions. Once verified, both the primary account holder and the joint owner must sign the form to authorize the addition. Finally, submit the completed form to the relevant financial institution, either online or in person, as per their submission guidelines.

Legal Use of the Adding a Joint Owner Instructions & Authorization Form

The Adding a Joint Owner Instructions & Authorization Form is legally binding once it is properly completed and signed by both parties. To ensure its legality, the form must adhere to the specific requirements set forth by the financial institution. This includes compliance with relevant state laws regarding joint ownership. Additionally, the form should be stored securely, as it may be required for future reference or in case of disputes. It is advisable to consult with a legal professional if there are any questions regarding the implications of joint ownership or the legalities surrounding the form.

Key Elements of the Adding a Joint Owner Instructions & Authorization Form

Several key elements are essential to the Adding a Joint Owner Instructions & Authorization Form. These include:

- Account Information: Details about the account being modified, including account numbers and types.

- Primary Account Holder Information: Full name, address, and Social Security number of the primary account holder.

- Joint Owner Information: Full name, address, and Social Security number of the joint owner being added.

- Signatures: Signatures of both the primary account holder and the joint owner, indicating their consent.

- Date: The date on which the form is completed and signed.

How to Obtain the Adding a Joint Owner Instructions & Authorization Form

The Adding a Joint Owner Instructions & Authorization Form can typically be obtained directly from the financial institution where the account is held. Most institutions provide this form on their official website, allowing users to download and print it. Alternatively, individuals can request a physical copy at a local branch or contact customer service for assistance. It is important to ensure that the correct version of the form is used, as requirements may vary between institutions.

Form Submission Methods

Submitting the Adding a Joint Owner Instructions & Authorization Form can be done through various methods, depending on the policies of the financial institution. Common submission methods include:

- Online Submission: Many institutions allow users to upload the completed form through their secure online portal.

- Mail: The form can be mailed to the institution's designated address, ensuring that it is sent securely.

- In-Person: Individuals may choose to deliver the form in person at a local branch, allowing for immediate processing and confirmation.

Quick guide on how to complete adding a joint owner instructions amp authorization form

Complete Adding A Joint Owner Instructions & Authorization Form effortlessly on any device

Online document organization has gained traction among companies and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Adding A Joint Owner Instructions & Authorization Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to modify and electronically sign Adding A Joint Owner Instructions & Authorization Form effortlessly

- Obtain Adding A Joint Owner Instructions & Authorization Form and click on Get Form to begin.

- Make use of the features we provide to complete your document.

- Emphasize essential parts of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Adding A Joint Owner Instructions & Authorization Form and ensure effective communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Can a joint owner of a property force another joint owner to move out?

Although I am not a lawyer, I have represented clients where in certain circumstances it’s possible.CASE 1: [All parties moved out]One of my clients co-owned a home with his mother and due to family issues needed to hire a lawyer to fight and win his case to sell the home to obtain his equity portion of it. Since the mother was not able to buy him out, she had to go along with the sale and so wasn’t able to stay in the house.In his situation, he was paying the mortgage, the insurance, utilities, and all the expenses of upkeep. The courts considered it unfair that he had all the cost burdens while the rest of the family got to enjoy the home for free.Of course there is more to the story concerning issues between siblings but the court felt he had the right to pull his equity out and so allowed him to sell the home.CASE 2: [Either both or one moves out]Almost in all divorce cases, if either spouse cannot buy the other out, then the home will be sold and proceeds shared between spouses. If one can buy the other out, then one of the spouses will be removed from the deed after the divorce has been settled.CASE 3: [One has to move out, the other gets to stay]When a restraining order has been placed on one of the joint tenants against another joint tenant it can result in one of the joint tenants being forced out of the home.Again, I am not a lawyer and am NOT giving legal advice. In the event you are seeking to accomplish this, please hire a good real estate attorney in your area to answer your questions and represent you.

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

If I change my individual account by adding someone with joint ownership, would I be able to remove that joint owner at a later date if need be, or would I have to close it since it is owned jointly?

The answer will probably vary from bank to bank, and possibly vary from branch to branch. It would make sense to allow you to drop someone you once added. However, to avoid a risk to the bank, often the bank will require the account to be closed and a new one opened. (This would apply to personal accts and not business accts where authorized names may change throughout time.) And again, the sole purpose of a bank or branch requiring this is to avoid being involved in litigation as to is owner of $$ in an acct and who is or was authorized to withdraw it.

-

How a Non-US residence company owner (has EIN) should fill the W-7 ITIN form out? Which option is needed to be chosen in the first part?

Depends on the nature of your business and how it is structured.If you own an LLC taxed as a passthrough entity, then you probably will check option b and submit the W7 along with your US non-resident tax return. If your LLC’s income is not subject to US tax, then you will check option a.If the business is a C Corp, then you probably don’t need an ITIN, unless you are receiving taxable compensation from the corporation and then we are back to option b.

-

What's the best way to get users to read a set of instructions for filling out a form?

Your question confuses me a bit. What's missing is "WHY are the instructions displayed?" What makes them so important? More to the point, what makes them so important to the user?You say it's a simple form, but also say they must read the instructions before filling it out. If it's simple, what are all the instructions for? I haven't seen the form and already I'm confused.People will do things if they understand (and agree with) the purpose for doing them. If they don't understand the need for the instructions (e.g. because the form appears to be simple), you'll have a hard time getting users to read them (they won't see the need).My suggestion would be to take a step back from the design a bit and look at the form's purpose. If the instructions are to minimize data entry errors, look for ways in your design to do that and eliminate an instruction or two. For example, do real-time validation of things like zip codes, phone numbers, usernames, and anything else your web page can do.If the instructions are to educate the user on some specific process, look at the process to see if it can be made simpler or more obvious such that it doesn't need any explanation.Finally, don't forget user testing--ask some potential (or representative) users what they think works for them.

-

Where do you find instructions about how to replace a CV joint?

In-depth instructions for making vehicle repairs are found in the factory service manual. You can also find instructions in the likes of a Chiltons or Haynes manual covering the make, model and year of your vehicle.As Joe pointed out, these days the joint itself isn't replaced. The whole half-shaft axle along with both CV joints and boots is replaced. Doing the entire axle replacement is much easier (for the DIY-er) and saves on labor costs if the repair is done in a shop. Since the repair is simpler to accomplish it can also reduce potential call backs for a shop too. Typically if one CV joint has gone bad, the other is probably not far behind; best practice is to replace both at the same time.

-

How should form 26QB be filled in the case of a joint ownership property and multiple sellers?

For each buyer and seller a separate Form 26QB is to be filed.Say A & B buy a property from X & Y for Rs.1 crore in equal proportionate.In that case 4 Form 26QB to be filed.Buyer A - Seller X for sale consideration of Rs.25,00,000Buyer A - Seller Y for sale consideration of Rs.25,00,000Buyer B - Seller X for sale consideration of Rs.25,00,000Buyer B - Seller Y for sale consideration of Rs.25,00,000

Create this form in 5 minutes!

How to create an eSignature for the adding a joint owner instructions amp authorization form

How to create an eSignature for the Adding A Joint Owner Instructions Amp Authorization Form in the online mode

How to generate an eSignature for the Adding A Joint Owner Instructions Amp Authorization Form in Google Chrome

How to generate an electronic signature for signing the Adding A Joint Owner Instructions Amp Authorization Form in Gmail

How to generate an eSignature for the Adding A Joint Owner Instructions Amp Authorization Form from your mobile device

How to make an electronic signature for the Adding A Joint Owner Instructions Amp Authorization Form on iOS devices

How to generate an eSignature for the Adding A Joint Owner Instructions Amp Authorization Form on Android

People also ask

-

What is the purpose of the Adding A Joint Owner Instructions & Authorization Form?

The Adding A Joint Owner Instructions & Authorization Form is designed to streamline the process of adding a joint owner to accounts or services. By using this form, you can ensure that all necessary permissions and authorizations are properly documented, which simplifies future transactions and account management.

-

How does airSlate SignNow facilitate the Adding A Joint Owner Instructions & Authorization Form?

With airSlate SignNow, you can easily create, send, and eSign the Adding A Joint Owner Instructions & Authorization Form digitally. Our platform provides a user-friendly interface that simplifies the signing process, making it efficient for both you and the joint owner.

-

Are there any costs associated with using the Adding A Joint Owner Instructions & Authorization Form on airSlate SignNow?

airSlate SignNow offers various pricing plans that include access to features like the Adding A Joint Owner Instructions & Authorization Form. While there may be costs associated with premium features, the platform is designed to be cost-effective, providing excellent value for businesses.

-

Can I integrate the Adding A Joint Owner Instructions & Authorization Form with other software?

Yes, airSlate SignNow allows seamless integrations with various software applications. This means you can incorporate the Adding A Joint Owner Instructions & Authorization Form into your existing workflows, enhancing efficiency and ensuring all documents are easily accessible.

-

What are the benefits of using airSlate SignNow for the Adding A Joint Owner Instructions & Authorization Form?

Using airSlate SignNow for the Adding A Joint Owner Instructions & Authorization Form provides numerous benefits, including enhanced security, easy document tracking, and quick turnaround times. This results in a more streamlined process for both you and the joint owner, making it easier to manage your accounts.

-

Is the Adding A Joint Owner Instructions & Authorization Form legally binding?

Yes, when completed through airSlate SignNow, the Adding A Joint Owner Instructions & Authorization Form is legally binding. Our platform complies with eSignature laws, ensuring that your signed documents hold the same legal weight as traditional paper forms.

-

How can I ensure the security of the Adding A Joint Owner Instructions & Authorization Form?

airSlate SignNow prioritizes security by using advanced encryption methods to protect your documents, including the Adding A Joint Owner Instructions & Authorization Form. You can trust that sensitive information is safe throughout the signing process.

Get more for Adding A Joint Owner Instructions & Authorization Form

Find out other Adding A Joint Owner Instructions & Authorization Form

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself