Taxes Loans Form

Understanding Taxes Loans

Taxes loans are financial products that allow individuals or businesses to borrow money to pay their tax obligations. These loans can be beneficial for those who may not have the immediate funds available to settle their tax debts. By utilizing a taxes loan, borrowers can manage their cash flow more effectively while ensuring compliance with tax regulations.

How to Obtain Taxes Loans

Obtaining a taxes loan typically involves a straightforward application process. Borrowers should first assess their financial situation and determine the amount needed. Next, they can approach lenders, which may include banks or credit unions, to inquire about their loan offerings. The application will generally require personal information, financial statements, and details regarding the tax obligation. Once submitted, lenders will review the application and may offer terms based on the borrower's creditworthiness.

Steps to Complete Taxes Loans

Completing a taxes loan involves several key steps:

- Evaluate your tax liability and determine how much you need to borrow.

- Research potential lenders and their loan products.

- Gather necessary documentation, such as income statements and tax returns.

- Submit your loan application along with the required documents.

- Review loan terms and conditions before signing the agreement.

- Receive funds and use them to pay your tax obligations.

Legal Use of Taxes Loans

Taxes loans must be used in compliance with applicable laws and regulations. Borrowers should ensure that the funds are directed solely towards paying tax debts to avoid any legal repercussions. It is essential to maintain proper records of the loan and the tax payments made to demonstrate compliance in case of an audit.

Required Documents for Taxes Loans

When applying for a taxes loan, borrowers typically need to provide several documents, including:

- Proof of identity, such as a driver's license or passport.

- Recent pay stubs or income statements to verify earnings.

- Tax returns for the past few years to establish tax obligations.

- Bank statements to demonstrate financial stability.

Penalties for Non-Compliance

Failing to comply with tax obligations can result in significant penalties, including fines and interest on unpaid taxes. Additionally, not adhering to the terms of a taxes loan can lead to further financial strain, including damage to credit scores and potential legal action from lenders. It is crucial for borrowers to stay informed about their responsibilities to avoid these consequences.

Quick guide on how to complete taxes loans

Complete Taxes Loans effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Taxes Loans across any platform with airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to edit and eSign Taxes Loans seamlessly

- Find Taxes Loans and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign Taxes Loans and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the taxes loans

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

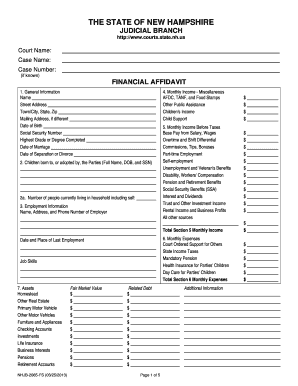

What is a financial affidavit NH and why is it important?

A financial affidavit NH is a legal document that outlines an individual's financial status during legal proceedings, such as divorce or custody battles. It is important because it provides a clear representation of income, expenses, assets, and liabilities, which can influence court decisions.

-

How does airSlate SignNow simplify the process of creating a financial affidavit NH?

airSlate SignNow simplifies the creation of a financial affidavit NH by offering easy-to-use templates that can be customized. Users can quickly fill in their financial information and electronically sign the document, ensuring a quick turnaround.

-

Is airSlate SignNow secure for handling sensitive financial information in a financial affidavit NH?

Yes, airSlate SignNow employs robust security measures, including encryption and secure cloud storage, to protect sensitive financial information in a financial affidavit NH. You can trust that your data is safe from unauthorized access.

-

What are the pricing options for using airSlate SignNow to manage financial affidavits NH?

airSlate SignNow offers a variety of pricing plans tailored to different business needs, providing cost-effective solutions for managing financial affidavits NH. Users can choose from monthly or annual subscriptions based on their volume of use and additional features required.

-

Can I integrate airSlate SignNow with other applications for managing a financial affidavit NH?

Absolutely! airSlate SignNow supports integrations with various applications, allowing you to streamline the process of managing a financial affidavit NH alongside your other business tools. This helps maintain efficiency and consistency across all your documents.

-

What are the benefits of eSigning a financial affidavit NH with airSlate SignNow?

eSigning a financial affidavit NH with airSlate SignNow enhances the signing process by making it fast and legally binding. Additionally, it allows for easy tracking, reminders, and automated workflows, signNowly reducing paperwork and time spent.

-

Can I collaborate with others on a financial affidavit NH using airSlate SignNow?

Yes, airSlate SignNow allows for collaboration with multiple users on a financial affidavit NH. Team members can review, comment, and make changes in real-time, which fosters effective communication and speeds up the document completion.

Get more for Taxes Loans

Find out other Taxes Loans

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple