Mortgage World Bankers Form

What is the Mortgage World Bankers

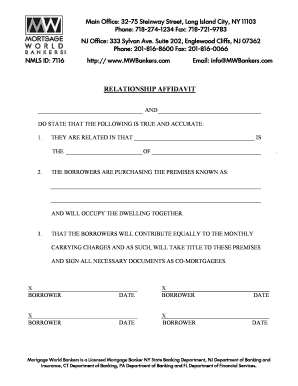

The Mortgage World Bankers form is a crucial document utilized in the mortgage industry, designed to facilitate the process of obtaining and managing mortgage loans. This form serves as a standard template that lenders and borrowers can use to outline the terms and conditions of a mortgage agreement. It includes essential information such as loan amounts, interest rates, payment schedules, and borrower details. Understanding this form is vital for both parties to ensure clarity and compliance with lending regulations.

How to use the Mortgage World Bankers

Using the Mortgage World Bankers form involves several key steps to ensure proper completion and submission. First, gather all necessary information, including personal identification, financial details, and property information. Next, fill out the form accurately, paying close attention to the required fields. Once completed, review the document thoroughly to avoid errors. Finally, submit the form digitally using a secure platform, ensuring that all signatures are obtained electronically to comply with legal standards.

Steps to complete the Mortgage World Bankers

Completing the Mortgage World Bankers form requires a systematic approach:

- Gather required documents, including proof of income, credit history, and property details.

- Access the form through a reliable digital platform that supports eSigning.

- Fill in personal and financial information accurately, ensuring all fields are completed.

- Review the form for any mistakes or missing information.

- Utilize electronic signature options to sign the document securely.

- Submit the completed form electronically and retain a copy for your records.

Legal use of the Mortgage World Bankers

The legal use of the Mortgage World Bankers form hinges on compliance with federal and state regulations governing mortgage transactions. To be considered legally binding, the form must include valid signatures, which can be obtained through electronic means, provided they meet the requirements of the ESIGN Act and UETA. Ensuring that the form is filled out correctly and submitted through a secure platform is essential for its legal standing in any mortgage agreement.

Key elements of the Mortgage World Bankers

Several key elements are critical to the Mortgage World Bankers form. These include:

- Borrower Information: Personal details of the borrower, including name, address, and contact information.

- Loan Details: Information about the loan amount, interest rate, and repayment terms.

- Property Information: Description of the property being financed, including its address and value.

- Signatures: Required signatures from both the borrower and lender to validate the agreement.

State-specific rules for the Mortgage World Bankers

Each state in the U.S. may have specific regulations regarding the Mortgage World Bankers form. These rules can include variations in disclosure requirements, interest rate limits, and additional documentation needed for compliance. It is essential for borrowers and lenders to familiarize themselves with their state’s laws to ensure that the form is completed and submitted in accordance with local regulations. Consulting with a legal expert or mortgage professional can provide valuable guidance in navigating these state-specific requirements.

Quick guide on how to complete mortgage world bankers

Effortlessly Prepare Mortgage World Bankers on Any Device

Managing documents online has gained immense popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Mortgage World Bankers on any device with the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The Easiest Way to Edit and eSign Mortgage World Bankers Without Stress

- Find Mortgage World Bankers and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

No more lost or misplaced documents, tedious form searches, or mistakes requiring you to print new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign Mortgage World Bankers and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mortgage world bankers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the primary benefit of using airSlate SignNow for mortgage world bankers?

AirSlate SignNow offers mortgage world bankers a streamlined solution for sending and signing documents electronically. By reducing paperwork, it enhances efficiency and signNowly speeds up the mortgage approval process. This means you can close deals faster and improve client satisfaction while maintaining compliance.

-

How does airSlate SignNow improve the workflow for mortgage world bankers?

With airSlate SignNow, mortgage world bankers can automate document workflows and manage all eSignatures in one platform. This reduces the time spent on administrative tasks, allowing bankers to focus more on client relationships and closing sales. The user-friendly design ensures that teams can adapt quickly and work more collaboratively.

-

What pricing options are available for mortgage world bankers using airSlate SignNow?

AirSlate SignNow offers flexible pricing plans that cater to mortgage world bankers of all sizes. Whether you're a solo agent or part of a larger firm, you can choose a plan that fits your budget and usage needs. Additionally, there are often promotional discounts available for new customers, making it a cost-effective choice.

-

Can airSlate SignNow integrate with other tools used by mortgage world bankers?

Yes, airSlate SignNow seamlessly integrates with various tools commonly used by mortgage world bankers, like CRM systems and document management software. This ensures you can easily incorporate eSigning into your existing processes without any disruptions. Integration can enhance functionality and improve overall productivity.

-

How secure is airSlate SignNow for mortgage world bankers handling sensitive information?

Security is a top priority for airSlate SignNow, especially for mortgage world bankers handling sensitive financial documents. The platform utilizes advanced encryption and compliance standards to protect your data. You can trust that your clients’ information is safeguarded against unauthorized access.

-

What type of customer support does airSlate SignNow offer mortgage world bankers?

AirSlate SignNow provides comprehensive customer support options for mortgage world bankers, including live chat, email support, and an extensive knowledge base. This ensures that you can get timely assistance whenever you face challenges. Their team is knowledgeable and ready to help you maximize the platform's potential.

-

Is airSlate SignNow user-friendly for mortgage world bankers new to eSigning?

Absolutely! AirSlate SignNow is designed with ease of use in mind, making it ideal for mortgage world bankers who may be new to eSigning. The intuitive interface allows users to easily navigate the platform, ensuring a smooth onboarding process and a quick learning curve for all team members.

Get more for Mortgage World Bankers

- Ua 4th step sex conduct inventory form

- Balancing your checking account worksheet answers chapter 3 form

- Stormwater management manual city of billings form

- Absa hospital claim form

- Form cc dccr 72 online

- Balloon loan agreement template form

- Bailment agreement template form

- Bank loan agreement template form

Find out other Mortgage World Bankers

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later