Ms Society Donation Receipt Form

What is the Ms Society Donation Receipt

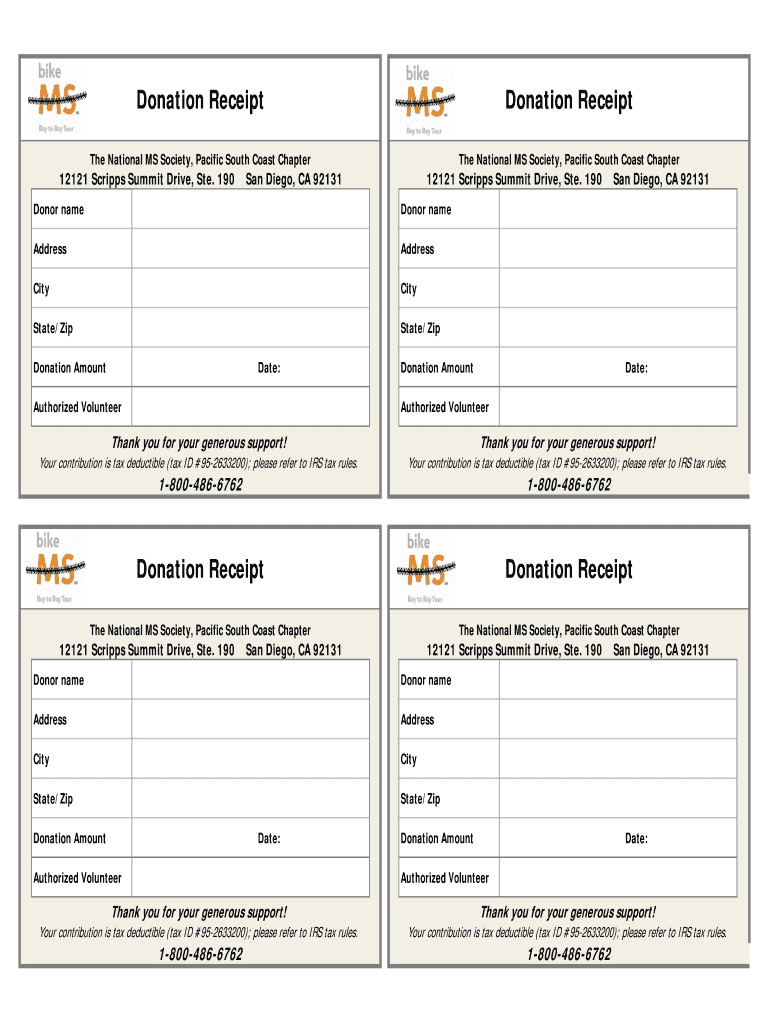

The Ms Society Donation Receipt is a formal document issued to acknowledge contributions made to the Multiple Sclerosis Society. This receipt serves as proof of the donation for both the donor and the organization, facilitating transparency and record-keeping. It is essential for donors who wish to claim tax deductions, as it provides the necessary documentation to support their charitable contributions.

Key elements of the Ms Society Donation Receipt

A comprehensive Ms Society Donation Receipt includes several key elements to ensure its validity and usefulness. These elements typically consist of:

- Donor Information: The name, address, and contact details of the donor.

- Organization Details: The name and address of the Multiple Sclerosis Society, along with its tax identification number.

- Donation Amount: The total amount donated, clearly stated.

- Date of Donation: The date when the donation was made.

- Purpose of Donation: A brief description of how the donation will be used, if applicable.

- Signature: An authorized signature from the organization to validate the receipt.

Steps to complete the Ms Society Donation Receipt

Completing the Ms Society Donation Receipt involves several straightforward steps. These steps ensure that the receipt is filled out correctly and meets all necessary requirements:

- Gather Information: Collect all relevant details, including donor information and donation specifics.

- Fill Out the Receipt: Enter the gathered information into the designated fields of the receipt format.

- Review for Accuracy: Double-check all entries to ensure accuracy and completeness.

- Obtain Signature: Ensure that an authorized representative from the Ms Society signs the receipt.

- Distribute Copies: Provide a copy of the completed receipt to the donor and retain one for organizational records.

Legal use of the Ms Society Donation Receipt

The Ms Society Donation Receipt is legally recognized as a valid document for tax purposes. To ensure its legal use, it must comply with IRS guidelines regarding charitable contributions. This includes providing accurate information about the donation and ensuring that the receipt is issued in a timely manner. Donors may use this receipt when filing their taxes to claim deductions for their charitable contributions, provided that the donation meets the IRS criteria.

How to obtain the Ms Society Donation Receipt

Obtaining the Ms Society Donation Receipt can be done through a few simple methods. Donors typically receive the receipt automatically after making a donation. However, if a receipt is not received, donors can:

- Contact the Organization: Reach out to the Ms Society directly via phone or email to request a copy.

- Visit the Website: Check the Ms Society's official website for downloadable receipt formats or additional information.

- Check Donation Confirmation Emails: Review any confirmation emails received after the donation, as they may include a digital receipt.

IRS Guidelines

The IRS provides specific guidelines for charitable donations, which are crucial for donors to understand when using the Ms Society Donation Receipt. Key points include:

- Donations must be made to qualified organizations, such as the Ms Society, to be tax-deductible.

- Donors should keep receipts for any contributions over a certain amount, typically $250, to substantiate their claims.

- Receipts must include the date of the contribution, the amount, and a statement regarding whether any goods or services were received in exchange for the donation.

Quick guide on how to complete ms society donation receipt

Manage Ms Society Donation Receipt effortlessly on any device

Digital document management has become prevalent among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the appropriate template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Ms Society Donation Receipt on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Ms Society Donation Receipt with ease

- Obtain Ms Society Donation Receipt and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your preference. Edit and eSign Ms Society Donation Receipt and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ms society donation receipt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the donation receipt format in Hindi?

The donation receipt format in Hindi is a standardized template that outlines essential details such as the donor's information, donation amount, date, and the purpose of the donation. Using this format ensures that receipts are compliant with legal requirements in India, making it essential for charitable organizations. airSlate SignNow provides customizable templates to create donation receipts in Hindi effortlessly.

-

How can I create a donation receipt format in Hindi using airSlate SignNow?

Creating a donation receipt format in Hindi with airSlate SignNow is simple and user-friendly. You can start by selecting a customizable template and filling in the necessary information such as donor details and donation specifics. The platform allows you to save and resend receipts electronically, making the whole process fast and efficient.

-

Are there any costs associated with using the donation receipt format in Hindi on airSlate SignNow?

airSlate SignNow offers various pricing plans, including a free trial that allows you to explore its features without any cost. Depending on the plan you choose, you can access additional functionalities such as unlimited document signing and advanced templates. Thus, you can utilize the donation receipt format in Hindi effectively, aligning with your budget.

-

Can I integrate airSlate SignNow with other tools for managing donations?

Yes, airSlate SignNow supports integrations with various applications to streamline the donation management process. Tools like payment processors and CRM systems can be linked to enhance functionality, making it easier to track donations and generate reports. This helps you utilize the donation receipt format in Hindi more effectively across your systems.

-

What are the benefits of using airSlate SignNow for generating donation receipts?

Using airSlate SignNow for generating donation receipts offers numerous benefits, including time savings, accuracy, and compliance with legal standards. The platform's easy-to-use interface allows you to create the donation receipt format in Hindi quickly, reducing errors associated with manual entry. Additionally, electronic signatures ensure that your receipts are legally valid and can be shared instantly.

-

Is it possible to customize the donation receipt format in Hindi?

Absolutely! airSlate SignNow allows users to fully customize the donation receipt format in Hindi to fit their branding and specific needs. You can modify logos, colors, and text to convey your organization’s identity effectively. This level of customization ensures your receipts are professional and tailored to your audience.

-

How does airSlate SignNow ensure the security of the donation receipt information?

airSlate SignNow prioritizes the security of your documents, including donation receipts in Hindi, by implementing advanced encryption and authentication measures. This means that your sensitive donor information is protected at all times. You can also set access controls to restrict who can view or edit the receipts, ensuring your data's integrity.

Get more for Ms Society Donation Receipt

- Formular g1443

- Griffith gold coast map form

- Advising appointment sign up sheet for advance registration form

- Biologic consent form charlottesville dermatology

- Fertility haspi medical anatomy physiology 16a lab activity form

- Motion to reopen uscis sample letter form

- Disability report adult form ssa 3368 bk wtriders com

- Marion farmers market application marion form

Find out other Ms Society Donation Receipt

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA