State Tax Adjustments Efficient January 1, 2022TAX LAW 2022

Understanding the Berkeley Business License Renewal Process

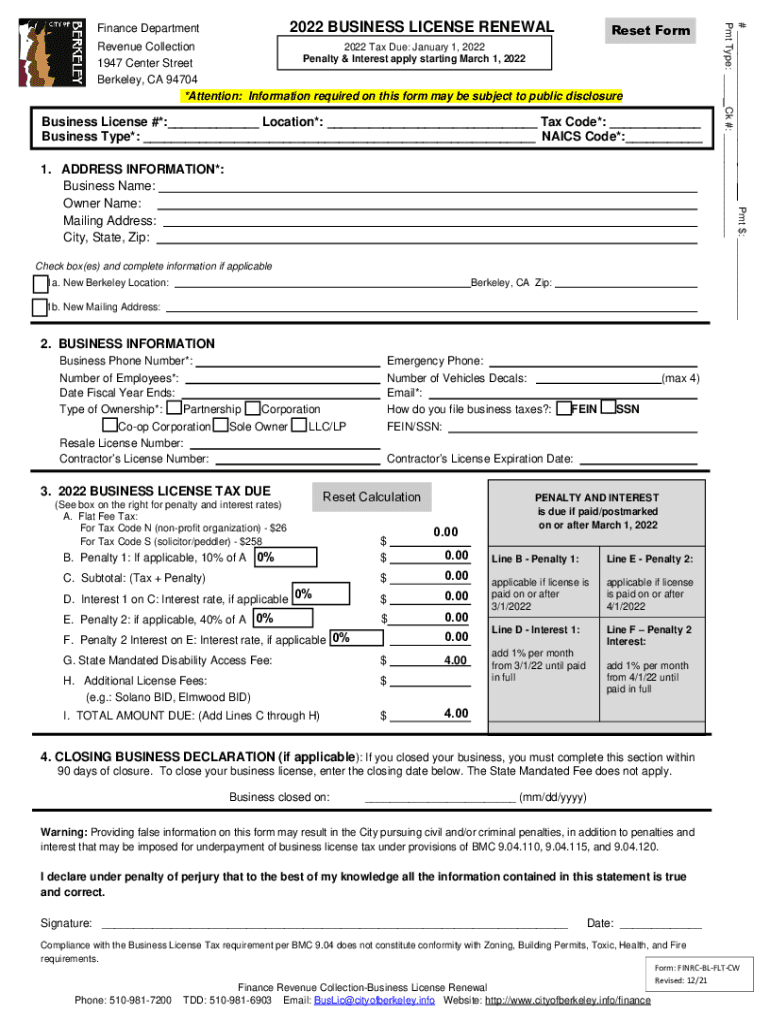

The Berkeley business license renewal process is essential for maintaining compliance with local regulations. Businesses operating in Berkeley must renew their licenses annually to continue their operations legally. The renewal process typically involves submitting a renewal application, paying the necessary fees, and ensuring that all business information is up to date. This ensures that the city has accurate records of all active businesses and their compliance with local laws.

Steps to Renew Your Berkeley Business License

Renewing your Berkeley business license involves several key steps:

- Gather necessary documents, including your current business license and any updated business information.

- Complete the renewal application form, which can often be found on the city’s official website.

- Pay the renewal fee, which varies depending on your business type and size.

- Submit the application and payment through the designated submission method, which may include online submission or in-person delivery.

Required Documents for Renewal

When renewing your Berkeley business license, you will need to provide specific documents to support your application. These may include:

- Your current business license.

- Proof of any changes to your business structure, such as partnership agreements or articles of incorporation.

- Any permits or certifications required for your specific business type.

Penalties for Non-Compliance

Failing to renew your Berkeley business license on time can result in penalties. These may include:

- Late fees added to your renewal cost.

- Potential legal action from the city for operating without a valid license.

- Increased scrutiny during future renewals or inspections.

Form Submission Methods

Businesses can submit their Berkeley business license renewal applications through various methods:

- Online submission via the city’s official portal, which is often the fastest option.

- Mailing the completed application and payment to the city’s business licensing department.

- In-person submission at designated city offices, which may also allow for immediate processing.

Application Process & Approval Time

The application process for renewing your Berkeley business license is generally straightforward. After submission, the city will review your application for completeness and compliance. The approval time can vary but typically takes a few weeks. It is advisable to submit your renewal application well in advance of your license expiration date to avoid any interruptions in your business operations.

Quick guide on how to complete state tax adjustments efficient january 1 2022tax law

Complete State Tax Adjustments Efficient January 1, 2022TAX LAW effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents promptly without any hold-ups. Manage State Tax Adjustments Efficient January 1, 2022TAX LAW on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign State Tax Adjustments Efficient January 1, 2022TAX LAW seamlessly

- Locate State Tax Adjustments Efficient January 1, 2022TAX LAW and click Get Form to begin.

- Make use of the tools available to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your modifications.

- Select your preferred method for sending your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign State Tax Adjustments Efficient January 1, 2022TAX LAW and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state tax adjustments efficient january 1 2022tax law

Create this form in 5 minutes!

How to create an eSignature for the state tax adjustments efficient january 1 2022tax law

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for Berkeley business license renewal?

The process for Berkeley business license renewal typically involves submitting a renewal application and paying the necessary fees. airSlate SignNow simplifies this process by allowing you to eSign and send documents electronically, ensuring that you have everything properly submitted on time.

-

How much does the Berkeley business license renewal cost?

The cost of Berkeley business license renewal varies depending on your business type and size. By using airSlate SignNow, you can streamline the payment process for your renewal, ensuring you're always aware of associated costs and fees.

-

Can airSlate SignNow help with the documentation for Berkeley business license renewal?

Absolutely! airSlate SignNow provides templates and tools to help you compile and manage the documentation needed for Berkeley business license renewal. This ease of use can speed up your submission process and reduce errors.

-

What are the benefits of using airSlate SignNow for Berkeley business license renewal?

Using airSlate SignNow for Berkeley business license renewal offers numerous benefits including a streamlined eSigning process, improved document tracking, and enhanced compliance. These features save businesses time and reduce the risk of missed deadlines.

-

Is airSlate SignNow compliant with legal requirements for Berkeley business license renewal?

Yes, airSlate SignNow is designed to comply with electronic signature laws, ensuring that all your documents for Berkeley business license renewal are legally valid. This compliance gives you peace of mind when handling sensitive business transactions.

-

How can airSlate SignNow integrate with my existing systems for Berkeley business license renewal?

airSlate SignNow offers various integrations with popular business tools and platforms, making it easy to connect your workflow for Berkeley business license renewal. This seamless integration helps you manage your documents more effectively within your existing systems.

-

What features does airSlate SignNow offer for managing Berkeley business license renewals?

airSlate SignNow includes features like customizable templates, multi-party signing, and document tracking to assist with Berkeley business license renewals. These tools help enhance efficiency and ensure that all renewals are handled promptly.

Get more for State Tax Adjustments Efficient January 1, 2022TAX LAW

- Va rtg 30 no cause notice month to month rentegration form

- Eagle scout workbook form

- Pre nuptial enquiry form pdf

- Viewers choice caltex card form

- Business sale agreement template form

- Business sale confidentiality agreement template form

- Business sale non disclosure agreement template form

- Business sale and purchase agreement template form

Find out other State Tax Adjustments Efficient January 1, 2022TAX LAW

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement