Limited Partnership Certificate of Revival Form LP 7 Limited Partnership Certificate of Revival

Understanding the Certificate of Limited Partnership Sample

The certificate of limited partnership is a vital legal document that establishes a limited partnership in the United States. This document outlines the partnership's existence, the names of the general and limited partners, and the nature of the business. It serves as a public record and is essential for legal recognition and protection of the partnership's interests. The sample certificate provides a template that can be customized to meet specific state requirements, ensuring compliance with local laws.

Key Elements of the Certificate of Limited Partnership Sample

When preparing a certificate of limited partnership, several key elements must be included to ensure its validity:

- Partnership Name: The official name of the limited partnership, which must be unique and compliant with state naming regulations.

- Principal Office Address: The physical address where the partnership's principal office is located.

- General Partners: Names and addresses of all general partners who manage the partnership.

- Limited Partners: Names and addresses of all limited partners, along with their contributions to the partnership.

- Purpose of the Partnership: A brief description of the business activities the partnership will engage in.

- Effective Date: The date when the partnership will officially commence operations.

Steps to Complete the Certificate of Limited Partnership Sample

Completing the certificate of limited partnership involves several steps to ensure accuracy and compliance:

- Gather all necessary information, including the names and addresses of partners and the partnership's purpose.

- Use the sample certificate as a template, filling in the required details accurately.

- Review the document for completeness and correctness, ensuring all partners have agreed to the terms.

- Obtain signatures from all general and limited partners to validate the document.

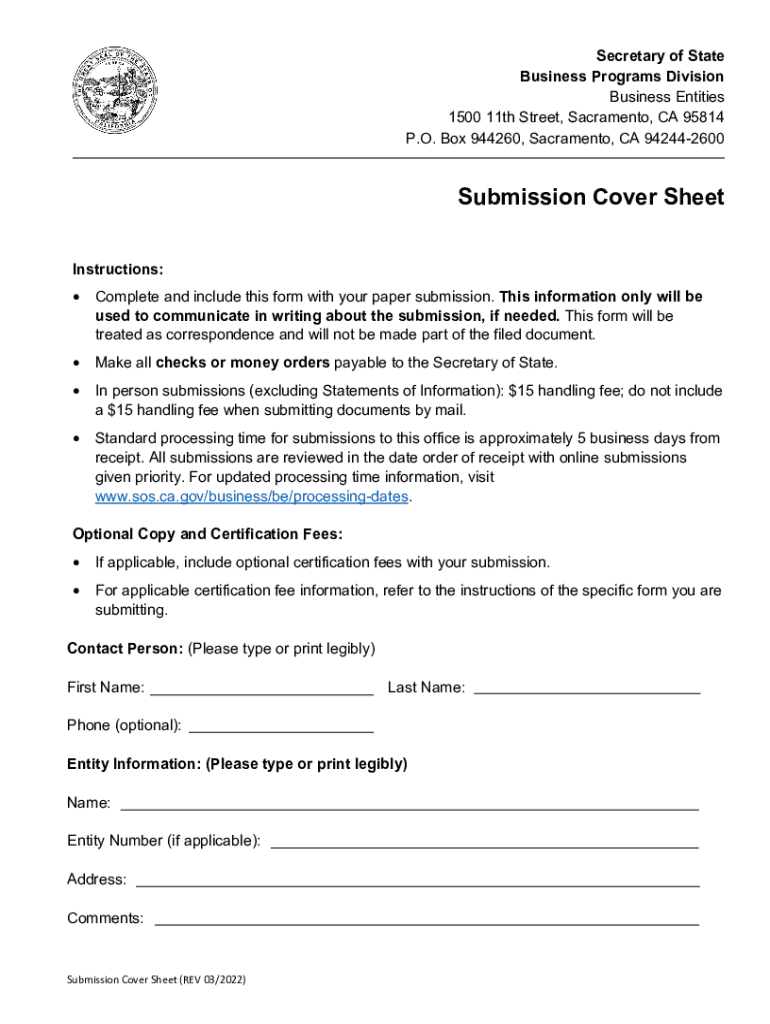

- File the completed certificate with the appropriate state authority, typically the Secretary of State.

Legal Use of the Certificate of Limited Partnership Sample

The certificate of limited partnership is legally binding once filed with the state. It provides limited partners with liability protection, meaning they are not personally responsible for the partnership's debts beyond their investment. This document also establishes the rights and obligations of each partner, ensuring clarity in the partnership's operations and governance. Adhering to state-specific regulations is crucial for the certificate to be enforceable.

Obtaining the Certificate of Limited Partnership Sample

To obtain a certificate of limited partnership sample, individuals can access templates from various legal resources or state government websites. Many states provide downloadable forms that can be customized. It is advisable to consult with a legal professional to ensure that the sample meets all state requirements and accurately reflects the partnership's intentions.

Filing Deadlines and Important Dates

Each state has specific deadlines for filing the certificate of limited partnership, which can vary based on the partnership's formation date. It is essential to check the local regulations to avoid penalties or delays in the partnership's recognition. Keeping track of these deadlines ensures compliance and helps maintain the partnership's good standing with state authorities.

Quick guide on how to complete limited partnership certificate of revival form lp 7 limited partnership certificate of revival

Easily Prepare Limited Partnership Certificate Of Revival Form LP 7 Limited Partnership Certificate Of Revival on Any Device

Managing documents online has gained traction among businesses and individuals. It serves as an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow provides all the essential tools needed to create, modify, and electronically sign your documents quickly without delays. Handle Limited Partnership Certificate Of Revival Form LP 7 Limited Partnership Certificate Of Revival on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Simplest Way to Modify and eSign Limited Partnership Certificate Of Revival Form LP 7 Limited Partnership Certificate Of Revival Effortlessly

- Find Limited Partnership Certificate Of Revival Form LP 7 Limited Partnership Certificate Of Revival and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive data with the tools that airSlate SignNow specifically features for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a customary wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your desktop.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Modify and eSign Limited Partnership Certificate Of Revival Form LP 7 Limited Partnership Certificate Of Revival and ensure outstanding communication at any point during your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the limited partnership certificate of revival form lp 7 limited partnership certificate of revival

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a certificate of limited partnership sample?

A certificate of limited partnership sample is a legal document that outlines the formation of a limited partnership. It includes essential details such as the names of the general and limited partners, the business purpose, and the duration of the partnership. Having a well-drafted sample can help ensure compliance with state regulations.

-

How can airSlate SignNow assist with creating a certificate of limited partnership?

airSlate SignNow provides an easy-to-use platform where you can create, edit, and sign a certificate of limited partnership sample. Utilizing our customizable templates can streamline the process, making it fast and efficient. With our eSigning feature, partners can review and sign documents from anywhere, enhancing collaboration.

-

Is there a cost associated with using airSlate SignNow for certificate of limited partnership samples?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that fits your budget while accessing powerful features for managing a certificate of limited partnership sample. Our plans also offer a free trial to help you evaluate the service without initial commitment.

-

What features does airSlate SignNow provide for managing legal documents?

airSlate SignNow includes features such as document templates, electronic signatures, document tracking, and secure cloud storage. These tools enhance the management of legal documents, including a certificate of limited partnership sample. Our solution is designed to simplify document workflows and enhance team collaboration.

-

Can I integrate airSlate SignNow with other business tools for better document management?

Yes, airSlate SignNow offers integrations with popular business applications such as Google Drive, Salesforce, and Microsoft Office. These integrations allow you to incorporate your document processes seamlessly, including managing your certificate of limited partnership sample. This ensures consistent and efficient workflows across platforms.

-

What are the benefits of using airSlate SignNow for my certificate of limited partnership?

Using airSlate SignNow for your certificate of limited partnership allows for fast document processing, enhanced security, and full compliance with legal standards. The platform ensures that you can easily create, edit, and sign your documents while keeping everything organized. Its user-friendly interface makes it suitable for businesses of all sizes.

-

How secure is my information when using airSlate SignNow for legal documents?

Security is a top priority at airSlate SignNow. All data is encrypted in transit and at rest, providing peace of mind when handling sensitive documents like a certificate of limited partnership sample. Additionally, our platform complies with industry standards and regulations to ensure your information remains confidential and protected.

Get more for Limited Partnership Certificate Of Revival Form LP 7 Limited Partnership Certificate Of Revival

Find out other Limited Partnership Certificate Of Revival Form LP 7 Limited Partnership Certificate Of Revival

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now