CPA Change of Status Form

What is the CPA Change Of Status

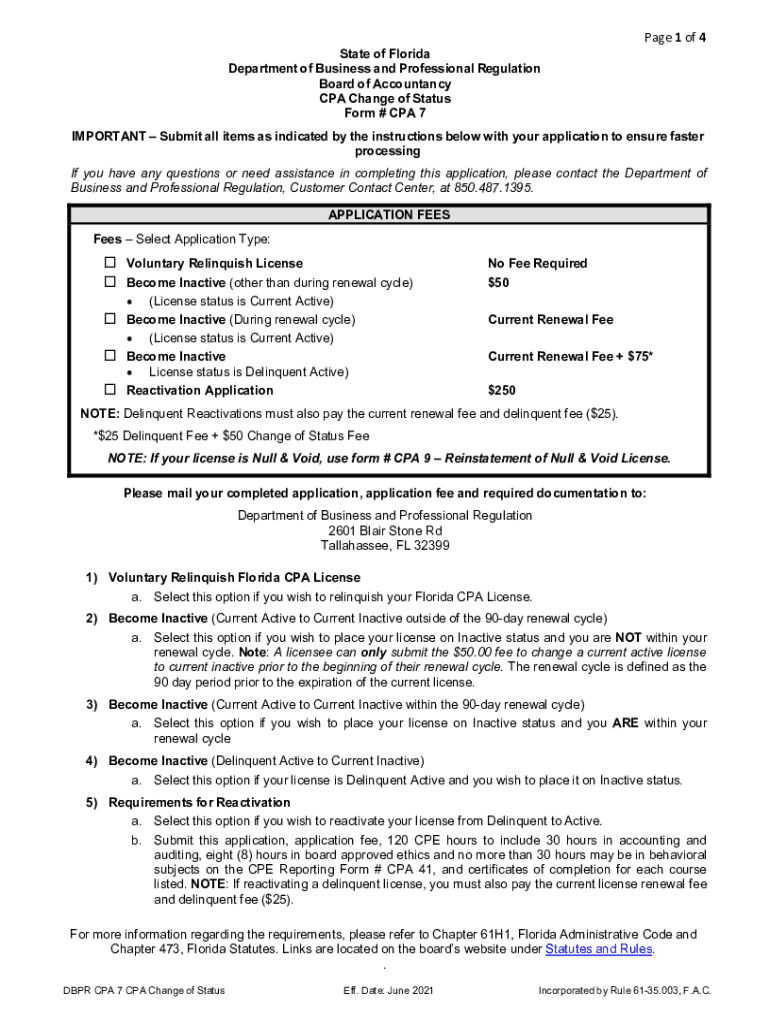

The CPA Change Of Status form is a crucial document used by Certified Public Accountants (CPAs) to formally notify relevant authorities of changes in their professional status. This may include changes in employment, address, or license status. The form ensures that all information remains current and compliant with state regulations, which is essential for maintaining licensure and professional integrity. Understanding the specifics of this form is important for CPAs to uphold their professional responsibilities.

Steps to complete the CPA Change Of Status

Completing the CPA Change Of Status form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information related to your current status, including your license number, new employment details, and any changes in personal information. Follow these steps:

- Carefully read the instructions provided with the form to understand the requirements.

- Fill out the form accurately, ensuring all sections are completed.

- Attach any required supporting documents, such as proof of new employment or address verification.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified submission method, whether online, by mail, or in person.

Legal use of the CPA Change Of Status

The CPA Change Of Status form is legally binding when completed correctly and submitted according to state regulations. It is essential for CPAs to ensure that their professional status is accurately reflected in official records. Failure to submit this form or providing false information can lead to penalties, including fines or disciplinary actions by licensing boards. Compliance with legal requirements helps maintain the integrity of the profession and protects the interests of clients.

Required Documents

To successfully complete the CPA Change Of Status form, certain documents may be required. These documents help verify your identity and the changes being reported. Commonly required documents include:

- Proof of new employment, such as an offer letter or employment contract.

- Identification documents, like a driver's license or state ID.

- Any previous licenses or certifications that may be relevant to the change.

Ensuring that all required documents are included with your submission can prevent delays in processing your change of status.

Form Submission Methods

The CPA Change Of Status form can typically be submitted through various methods, depending on the state regulations. Common submission methods include:

- Online: Many states offer an online portal for submitting the form electronically, which is often the fastest method.

- Mail: You can print the completed form and send it via postal service to the appropriate licensing board.

- In-Person: Some states allow for in-person submissions at designated offices, which can provide immediate confirmation of receipt.

Choosing the right submission method can help ensure timely processing of your change of status.

Penalties for Non-Compliance

Failing to submit the CPA Change Of Status form or providing inaccurate information can result in serious consequences. Penalties may include:

- Fines imposed by the state licensing board.

- Suspension or revocation of your CPA license.

- Legal repercussions if fraudulent information is provided.

Staying compliant with the requirements of the CPA Change Of Status form is essential for maintaining your professional standing and avoiding potential penalties.

Quick guide on how to complete cpa change of status

Prepare CPA Change Of Status effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers a fantastic eco-friendly substitute for conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents promptly and without interruptions. Handle CPA Change Of Status on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The simplest way to edit and eSign CPA Change Of Status with ease

- Find CPA Change Of Status and click Get Form to begin.

- Utilize the features we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form-finding, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in a few clicks from any device you choose. Modify and eSign CPA Change Of Status and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cpa change of status

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CPA Change Of Status?

A CPA Change Of Status refers to the process by which a Certified Public Accountant updates their professional status or designation. This could include changes in professional licensing, address, or other important updates that need to be communicated. Understanding the CPA Change Of Status is crucial for maintaining compliance with state regulations.

-

How can airSlate SignNow assist with CPA Change Of Status?

airSlate SignNow provides an efficient platform to electronically sign and send documents required for a CPA Change Of Status. Our user-friendly interface simplifies the process, allowing accountants to quickly update their status without physical paperwork. This ensures that your documents are signed promptly and securely from anywhere.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate different business needs, including options suitable for those managing a CPA Change Of Status. Our transparent pricing ensures you only pay for the features you need, making it a cost-effective solution for accountants. Explore our plans to find the best fit for your practice.

-

What features are included in airSlate SignNow for CPA Change Of Status?

Key features of airSlate SignNow that support the CPA Change Of Status include customizable templates, cloud storage, and real-time tracking. These tools allow for seamless document management and ensure that updates are accurately reflected in your records. With our platform, your CPA Change Of Status process becomes more efficient.

-

Are there any benefits to using airSlate SignNow for CPA Change Of Status?

Using airSlate SignNow for CPA Change Of Status provides several benefits, including faster processing times and reduced administrative workload. Our eSigning features eliminate the need for physical documents, streamlining updates and ensuring you stay compliant. Enjoy hassle-free management of your professional status with our platform.

-

Can I integrate airSlate SignNow with other tools for CPA Change Of Status?

Yes, airSlate SignNow seamlessly integrates with various business applications to enhance your CPA Change Of Status process. Whether you use CRM systems or document management tools, our integrations ensure your workflow is uninterrupted. This connectivity supports efficient status updates and document handling.

-

Is airSlate SignNow secure for managing CPA Change Of Status documents?

Absolutely! airSlate SignNow employs industry-standard security measures to protect documents related to your CPA Change Of Status. Our platform is compliant with all relevant regulations, ensuring your sensitive information is safeguarded throughout the signing process. Trust us to secure your professional changes effectively.

Get more for CPA Change Of Status

Find out other CPA Change Of Status

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile