Transamericaannuities Form

What is the Transamerica Annuities

Transamerica annuities are financial products designed to provide a steady income stream, typically during retirement. These annuities can be classified into various types, including fixed, variable, and indexed annuities, each offering different features and benefits. They serve as a means for individuals to invest their funds while also ensuring a level of security against market volatility. By purchasing a Transamerica annuity, individuals can benefit from tax-deferred growth, which allows their investments to grow without immediate tax implications until withdrawals are made.

How to Use the Transamerica Annuities

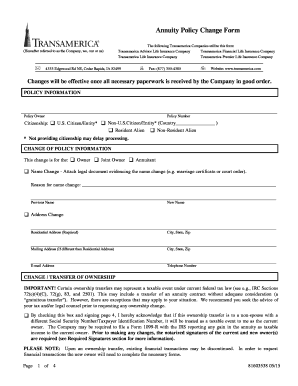

Using Transamerica annuities involves several steps to ensure that individuals maximize their benefits. First, it is essential to assess personal financial goals and retirement needs. Next, individuals should evaluate the different types of annuities offered by Transamerica to determine which aligns best with their objectives. Once a suitable option is selected, the next step is to complete the required application forms, such as the Transamerica annuity policy change form 81603538. After the application is submitted and approved, individuals can begin contributing funds and setting up their income disbursement options.

Steps to Complete the Transamerica Annuities

Completing the Transamerica annuities process involves a series of clear steps:

- Identify your retirement goals and financial needs.

- Research the various types of Transamerica annuities available.

- Fill out the necessary forms, including the Transamerica form 81603538.

- Submit the completed forms either online or via mail, ensuring all required documentation is included.

- Review and confirm the terms of the annuity contract once approved.

- Begin making contributions and set up your income distribution plan.

Legal Use of the Transamerica Annuities

The legal use of Transamerica annuities is governed by specific regulations that ensure compliance with federal and state laws. These products must adhere to the guidelines set forth by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). Additionally, the use of electronic signatures for completing forms, such as the Transamerica annuity policy change form 81603538, is recognized as legally binding under the ESIGN and UETA Acts, provided that certain conditions are met.

Key Elements of the Transamerica Annuities

Understanding the key elements of Transamerica annuities can help individuals make informed decisions. Important components include:

- Premiums: The amount paid to purchase the annuity.

- Accumulation phase: The period during which the funds grow tax-deferred.

- Distribution phase: The time when the annuity begins to pay out income.

- Fees and charges: Any costs associated with managing the annuity, which can affect overall returns.

- Beneficiary designations: Instructions on who will receive the remaining funds upon the annuitant's death.

Required Documents

When applying for Transamerica annuities, certain documents are typically required to facilitate the process. These may include:

- Proof of identity, such as a government-issued ID.

- Financial statements to demonstrate income and assets.

- Completed application forms, including the Transamerica annuity policy change form 81603538.

- Any additional documentation requested by the financial advisor or Transamerica.

Quick guide on how to complete transamericaannuities

Complete Transamericaannuities seamlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers a fantastic eco-friendly substitute for conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents quickly without delays. Manage Transamericaannuities on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to alter and eSign Transamericaannuities effortlessly

- Locate Transamericaannuities and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize crucial sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal authority as a traditional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

No more issues with lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Transamericaannuities and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the transamericaannuities

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are transamericaannuities and how do they work?

Transamericaannuities are financial products offered by Transamerica that provide guaranteed income for a specified period or for life. They work by allowing individuals to invest a lump sum and receive regular payments, typically during retirement. These products can help ensure financial stability and peace of mind.

-

What are the pricing options for transamericaannuities?

Pricing for transamericaannuities varies based on the type of annuity, investment amount, and chosen features. Generally, there may be initial fees or management charges, but these should be assessed against the benefits provided, such as guaranteed income. Be sure to contact a Transamerica representative for personalized pricing information.

-

What features do transamericaannuities offer?

Transamericaannuities come with a range of features, including flexible premium payments, death benefits, and optional riders for enhanced protection. Some options may also offer the potential for cash value accumulation. These features allow policyholders to tailor their annuity to fit their personal financial goals.

-

What benefits do transamericaannuities provide?

The benefits of transamericaannuities include steady income during retirement, potential tax-deferred growth, and the security of knowing your finances are safeguarded against market volatility. Additionally, many transamericaannuities offer features such as living benefits, which can provide extra financial support when needed.

-

Can transamericaannuities be integrated with other financial products?

Yes, transamericaannuities can often be integrated with other financial products to create a comprehensive retirement strategy. Combining them with investment accounts, insurance policies, or retirement savings plans can help in diversifying income sources. It's advisable to consult with a financial advisor to explore the best integration options.

-

How can I purchase transamericaannuities?

Purchasing transamericaannuities typically involves contacting a licensed insurance agent or financial advisor who specializes in these products. They will guide you through the selection process and help you understand the terms and conditions. Ensure you review your options on the Transamerica website for additional insights.

-

What are the tax implications of transamericaannuities?

Transamericaannuities generally offer tax-deferred growth, meaning you won't pay taxes on your earnings until you withdraw funds. This can be advantageous for retirement planning. It's important to consult a tax advisor to fully understand how these products can fit into your overall tax strategy.

Get more for Transamericaannuities

Find out other Transamericaannuities

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document