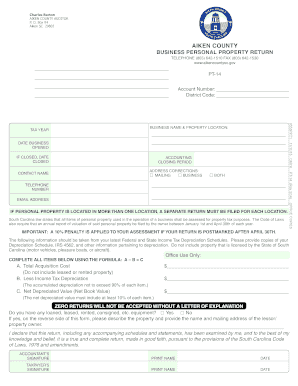

Business Personal Property Return Aiken County Aikencountysc Form

What is the Business Personal Property Return Aiken County Aikencountysc

The Business Personal Property Return in Aiken County, South Carolina, is a crucial document that businesses must file to report their personal property for tax purposes. This form is essential for local tax assessments and helps determine the tax liability of a business based on its assets. Personal property typically includes items such as machinery, equipment, and furniture that are used in the operation of a business. Filing this return ensures compliance with local tax regulations and helps maintain accurate records for both the business and the county.

Steps to complete the Business Personal Property Return Aiken County Aikencountysc

Completing the Business Personal Property Return involves several key steps to ensure accuracy and compliance. First, gather all necessary information about your business assets, including descriptions, acquisition dates, and values. Next, access the form, which can often be found on the Aiken County tax assessor's website or obtained directly from their office. Fill out the form with the gathered information, ensuring that all details are accurate. After completing the form, review it for any errors or omissions before submission. Finally, submit the form by the designated deadline to avoid penalties.

Legal use of the Business Personal Property Return Aiken County Aikencountysc

The legal use of the Business Personal Property Return is governed by local tax laws and regulations. This form serves as an official declaration of a business's personal property, which is necessary for tax assessment purposes. Accurate and timely filing of this return helps businesses avoid legal issues related to non-compliance. Furthermore, the information provided on this form may be subject to audits by tax authorities, making it imperative that all entries are truthful and complete. Understanding the legal implications of this form can help businesses navigate their tax responsibilities effectively.

Filing Deadlines / Important Dates

Filing deadlines for the Business Personal Property Return in Aiken County are typically set by the local tax authority. It is crucial for businesses to be aware of these deadlines to avoid late fees or penalties. Generally, the return must be filed annually, and specific dates may vary from year to year. Checking with the Aiken County tax assessor's office for the most current deadlines is advisable. Keeping a calendar reminder can help ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

Businesses in Aiken County have several options for submitting the Business Personal Property Return. The form can often be submitted online through the Aiken County tax assessor's website, which is a convenient option for many. Alternatively, businesses may choose to mail the completed form to the tax assessor's office or deliver it in person. Each submission method has its own advantages, and businesses should select the one that best fits their needs while ensuring that they adhere to submission guidelines and deadlines.

Penalties for Non-Compliance

Failing to file the Business Personal Property Return by the deadline can result in significant penalties for businesses in Aiken County. These penalties may include late fees, increased tax assessments, or even legal action in severe cases. Understanding the consequences of non-compliance emphasizes the importance of timely and accurate filing. Businesses are encouraged to familiarize themselves with the specific penalties outlined by the Aiken County tax authority to avoid unnecessary financial burdens.

Eligibility Criteria

Eligibility to file the Business Personal Property Return in Aiken County generally applies to all businesses that own personal property used for commercial purposes. This includes various business entity types, such as sole proprietorships, partnerships, corporations, and limited liability companies (LLCs). It is essential for businesses to assess their property holdings and determine if they meet the criteria for filing this return. Consulting with a tax professional can provide clarity on eligibility and compliance requirements.

Quick guide on how to complete business personal property return aiken county aikencountysc

Complete Business Personal Property Return Aiken County Aikencountysc easily on any gadget

Web-based document organization has gained traction among companies and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without interruptions. Manage Business Personal Property Return Aiken County Aikencountysc on any gadget with airSlate SignNow Android or iOS applications and enhance any document-driven procedure today.

The simplest way to modify and eSign Business Personal Property Return Aiken County Aikencountysc effortlessly

- Locate Business Personal Property Return Aiken County Aikencountysc and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure confidential information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to store your modifications.

- Choose how you wish to deliver your form, via email, SMS, or invite link, or download it to your computer.

Wave goodbye to lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Business Personal Property Return Aiken County Aikencountysc and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the business personal property return aiken county aikencountysc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Business Personal Property Return in Aiken County, Aiken County SC?

The Business Personal Property Return in Aiken County, Aiken County SC, is a tax document that businesses must file to report personal property used in their operations. This return helps the county assess property taxes accurately and ensures compliance with local tax laws. Filings generally include details about equipment, machinery, and other assets.

-

How do I file the Business Personal Property Return in Aiken County, SC?

To file the Business Personal Property Return in Aiken County, Aiken County SC, you can utilize airSlate SignNow to eSign and submit your documents easily. The process involves filling out the necessary information about your business assets, signing electronically, and submitting the form through the platform. This streamlined approach saves time and ensures accuracy in your filing.

-

What are the benefits of using airSlate SignNow for the Business Personal Property Return?

Using airSlate SignNow for your Business Personal Property Return in Aiken County, Aiken County SC, offers numerous benefits, including efficiency and security. The platform allows businesses to send, sign, and store documents securely online, minimizing the risk of loss or misplacement. Additionally, you can track the status of your return, ensuring that you meet deadlines.

-

Are there any costs associated with filing the Business Personal Property Return in Aiken County, SC?

Filing the Business Personal Property Return in Aiken County, Aiken County SC, may involve fees or taxes based on the assessed value of your property. However, using airSlate SignNow provides a cost-effective solution for managing documentation, reducing other traditional filing expenses. Always check with your local tax office for current rates and fees.

-

Can I integrate airSlate SignNow with other business software for filing?

Yes, airSlate SignNow offers integrations with various business software tools, making it easy to handle the Business Personal Property Return in Aiken County, Aiken County SC. By linking to accounting systems or document management software, you can streamline the filing process and ensure accurate data is transferred. Integration enhances efficiency and reduces errors.

-

Is my data secure when using airSlate SignNow for my Business Personal Property Return?

Absolutely! When you use airSlate SignNow for your Business Personal Property Return in Aiken County, Aiken County SC, your data is protected with top-tier encryption and security protocols. The platform complies with industry standards to ensure that your sensitive information remains confidential and secure, giving you peace of mind while filing.

-

What if I need help with the Business Personal Property Return process?

If you require assistance with your Business Personal Property Return in Aiken County, Aiken County SC, airSlate SignNow offers various support options. You can access online tutorials, FAQs, and customer support for guidance throughout the filing process. Our team is dedicated to helping you navigate any challenges you encounter.

Get more for Business Personal Property Return Aiken County Aikencountysc

- Tsofi recommdation form 1212 members peotexas

- Role of textbooks form

- Cgi autoplus form

- Student exploration stoichiometry form

- Good clinical data management practices draft guidance exculpatory language in informed consent

- Commonwealth of virginia department of taxation letter form

- Paper application department of children amp family services dcfs louisiana form

- Charitable gift agreement template form

Find out other Business Personal Property Return Aiken County Aikencountysc

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template