Authorization to Obtain Consumer Credit Report PDF Authorization to Obtain Consumer Credit Report Form

What is the credit report authorization form?

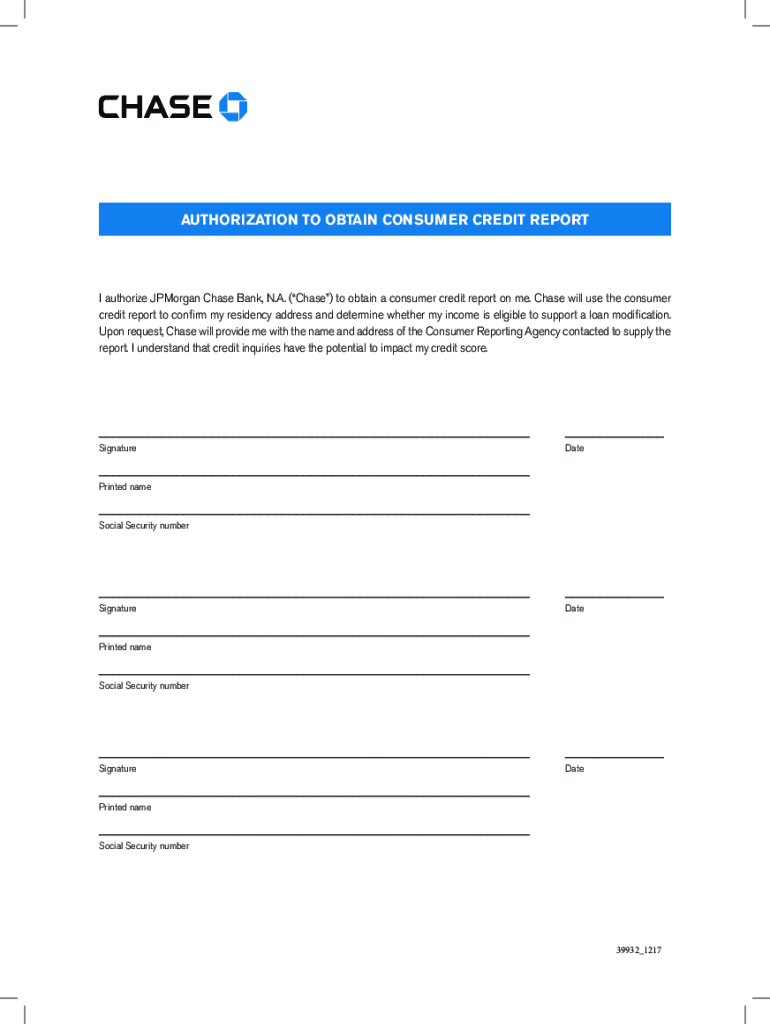

The credit report authorization form is a legal document that allows an individual to grant permission to a third party, typically a lender or employer, to access their credit report. This form is essential in various situations, such as applying for a mortgage, a car loan, or a job that requires a credit check. By signing this form, the individual acknowledges that they understand their rights regarding credit reporting and consent to the retrieval of their credit information.

Key elements of the credit report authorization form

Several critical components make up the credit report authorization form. These include:

- Personal Information: The form requires the individual's full name, address, Social Security number, and date of birth to accurately identify the credit report.

- Authorization Statement: A clear statement indicating that the individual authorizes the third party to access their credit report.

- Signature and Date: The individual must sign and date the form to validate the authorization.

- Revocation Clause: Information on how the individual can revoke their authorization if they choose to do so in the future.

Steps to complete the credit report authorization form

Completing the credit report authorization form involves a few straightforward steps:

- Obtain the Form: Acquire the credit report authorization form from the requesting party or download it from a trusted source.

- Fill Out Personal Information: Carefully enter your personal details, ensuring accuracy to avoid any issues with identification.

- Read the Authorization Statement: Review the authorization statement to understand what you are consenting to.

- Sign and Date: Sign the form and include the date to confirm your authorization.

- Submit the Form: Send the completed form to the requesting party, following their specified submission method.

Legal use of the credit report authorization form

The credit report authorization form is legally binding, provided it meets specific criteria. It must be signed voluntarily, and the individual must be informed about the purpose of the credit check. Compliance with the Fair Credit Reporting Act (FCRA) is crucial, as it protects consumers' rights regarding credit reporting. This law requires that individuals be notified when their credit report is accessed and gives them the right to dispute any inaccuracies found in their credit report.

How to use the credit report authorization form

Using the credit report authorization form is essential for various transactions. When applying for a loan, the lender will typically request this form to assess your creditworthiness. Employers may also require this form during the hiring process to evaluate potential candidates. To ensure proper usage, provide the form only to trusted entities and verify their legitimacy before sharing your personal information.

State-specific rules for the credit report authorization form

While the credit report authorization form is generally consistent across the United States, some states may have specific regulations governing its use. For example, certain states may require additional disclosures or impose restrictions on how credit information can be used. It is important to familiarize yourself with your state's laws to ensure compliance and protect your rights.

Quick guide on how to complete authorization to obtain consumer credit report pdf authorization to obtain consumer credit report

Effortlessly Prepare Authorization To Obtain Consumer Credit Report PDF Authorization To Obtain Consumer Credit Report on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the right format and securely store it online. airSlate SignNow equips you with everything necessary to create, modify, and electronically sign your files quickly without delays. Manage Authorization To Obtain Consumer Credit Report PDF Authorization To Obtain Consumer Credit Report on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The Most Efficient Way to Edit and Electronically Sign Authorization To Obtain Consumer Credit Report PDF Authorization To Obtain Consumer Credit Report Smoothly

- Find Authorization To Obtain Consumer Credit Report PDF Authorization To Obtain Consumer Credit Report and then select Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with specialized tools that airSlate SignNow provides for this purpose.

- Generate your electronic signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your desired method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Authorization To Obtain Consumer Credit Report PDF Authorization To Obtain Consumer Credit Report while ensuring seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the authorization to obtain consumer credit report pdf authorization to obtain consumer credit report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a credit report authorization form?

A credit report authorization form is a document that grants permission to a lender or entity to obtain and review your credit report. This form is crucial for the loan application process, as it allows the lender to assess your creditworthiness accurately.

-

How can I create a credit report authorization form using airSlate SignNow?

To create a credit report authorization form with airSlate SignNow, simply log in to your account and select the 'Create Document' option. You can customize the template and add necessary fields for signatures and personal information, making it easy to share and sign electronically.

-

Are there any costs associated with using the credit report authorization form through airSlate SignNow?

Yes, using the credit report authorization form through airSlate SignNow involves subscription-based pricing. However, the cost is competitive and designed to provide excellent value, given the features it includes, such as eSignature capabilities and document tracking.

-

What are the key features of airSlate SignNow for managing credit report authorization forms?

airSlate SignNow offers various features for managing credit report authorization forms, including customizable templates, secure e-signature options, and real-time document status updates. These features help streamline the process and ensure compliance with regulations.

-

How does airSlate SignNow ensure the security of my credit report authorization form?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your credit report authorization form. This ensures that sensitive information remains confidential and accessible only to authorized individuals.

-

Can I integrate airSlate SignNow with other software for my credit report authorization forms?

Absolutely! airSlate SignNow supports integrations with various CRM and document management systems, allowing you to streamline your workflow and manage your credit report authorization forms efficiently. This helps improve productivity and reduces the chances of errors.

-

What benefits does using an electronic credit report authorization form provide?

Using an electronic credit report authorization form through airSlate SignNow offers numerous benefits, including faster processing times, reduced paperwork, and a more eco-friendly approach to document management. It also simplifies the signing process, making it more convenient for both parties involved.

Get more for Authorization To Obtain Consumer Credit Report PDF Authorization To Obtain Consumer Credit Report

Find out other Authorization To Obtain Consumer Credit Report PDF Authorization To Obtain Consumer Credit Report

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online