Money Market Account Application and Agreement Form

What is the Money Market Account Application And Agreement

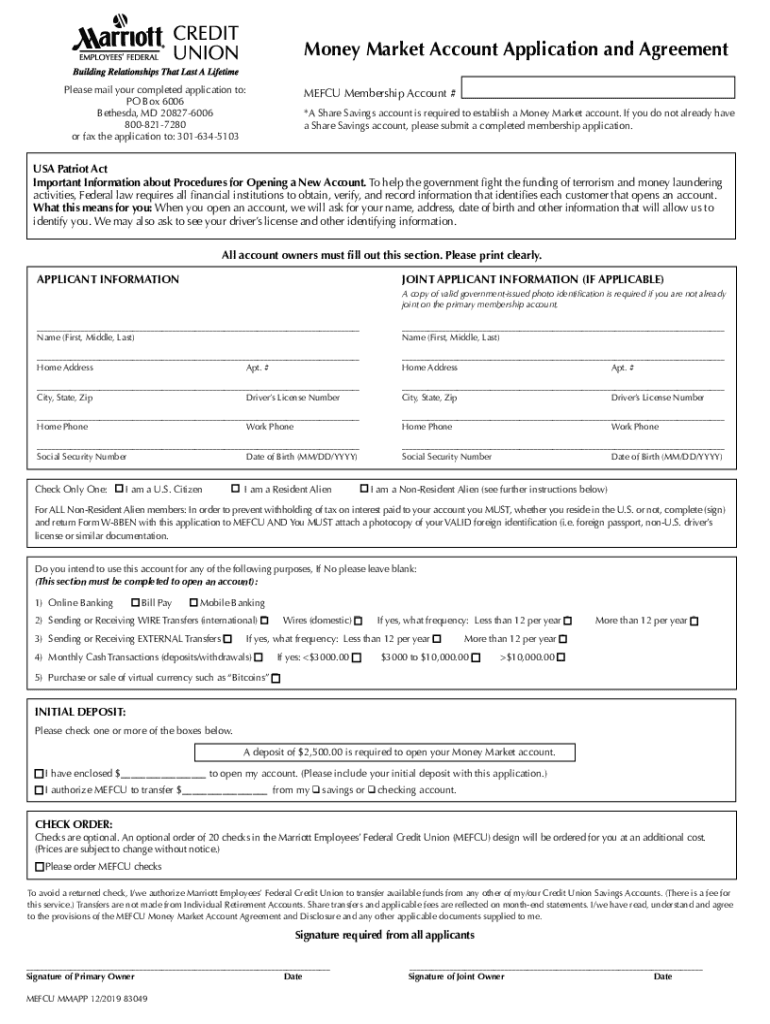

The Money Market Account Application and Agreement is a formal document that allows individuals or businesses to open a money market account with a financial institution. This account type typically offers higher interest rates than traditional savings accounts while providing limited check-writing privileges. The application includes personal or business information, account preferences, and terms of the agreement, which outlines the rights and responsibilities of both the account holder and the institution.

Steps to complete the Money Market Account Application And Agreement

Completing the Money Market Account Application and Agreement involves several key steps to ensure accuracy and compliance. First, gather necessary personal or business information, including identification, Social Security number, and contact details. Next, fill out the application form, providing details about the account type and initial deposit. Review the terms and conditions carefully, ensuring you understand fees, interest rates, and withdrawal limits. Finally, sign the agreement electronically or physically, depending on the submission method chosen.

Legal use of the Money Market Account Application And Agreement

The legal use of the Money Market Account Application and Agreement is governed by various laws and regulations, including the Electronic Signatures in Global and National Commerce (ESIGN) Act. This legislation ensures that electronic signatures and documents hold the same legal weight as traditional paper documents, provided specific criteria are met. It is essential for users to understand their rights and obligations under this agreement to avoid potential disputes with the financial institution.

Key elements of the Money Market Account Application And Agreement

Key elements of the Money Market Account Application and Agreement include personal identification information, account type selection, initial deposit requirements, and terms of use. Additionally, the agreement outlines interest rates, fees associated with account maintenance, withdrawal limits, and the process for closing the account. Understanding these elements is crucial for account holders to manage their finances effectively and ensure compliance with the institution's policies.

Required Documents

To successfully complete the Money Market Account Application and Agreement, several documents may be required. These typically include a government-issued photo ID, such as a driver's license or passport, proof of address, such as a utility bill, and Social Security number or Employer Identification Number (EIN) for businesses. Having these documents ready can streamline the application process and help avoid delays.

Form Submission Methods (Online / Mail / In-Person)

The Money Market Account Application and Agreement can generally be submitted through various methods. Many financial institutions offer an online application process, allowing users to complete and sign the document digitally. Alternatively, applicants may choose to print the form and submit it via mail or deliver it in person at a branch location. Each submission method may have different processing times and requirements, so it is advisable to check with the specific institution for details.

Eligibility Criteria

Eligibility criteria for opening a Money Market Account typically include age requirements, residency status, and minimum deposit amounts. Most institutions require applicants to be at least eighteen years old and a U.S. resident. Additionally, there may be specific financial thresholds that must be met, such as a minimum initial deposit or maintaining a certain balance to avoid fees. Understanding these criteria is essential for prospective account holders to ensure they qualify for the account type they desire.

Quick guide on how to complete money market account application and agreement

Fill out Money Market Account Application And Agreement effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and electronically sign your documents swiftly without any delays. Manage Money Market Account Application And Agreement on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related tasks today.

How to alter and electronically sign Money Market Account Application And Agreement with ease

- Find Money Market Account Application And Agreement and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive information using tools that airSlate SignNow specifically offers for that reason.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Money Market Account Application And Agreement and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the money market account application and agreement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Money Market Account Application And Agreement?

A Money Market Account Application And Agreement is a document that outlines the terms and conditions of opening a money market account. This account typically offers higher interest rates than traditional savings accounts and allows limited transactions. Reviewing this agreement is essential for understanding the fees and restrictions associated with your account.

-

How can I submit my Money Market Account Application And Agreement?

You can submit your Money Market Account Application And Agreement easily through our secure online platform. Simply fill out the required fields in the application, attach the necessary documents, and submit them electronically. This streamlined process ensures a quick and efficient setup of your account.

-

What fees are associated with a Money Market Account Application And Agreement?

Fees related to a Money Market Account Application And Agreement vary by institution. Common charges may include monthly maintenance fees, transaction fees, or minimum balance requirements. Be sure to read the agreement carefully to understand all potential costs involved.

-

What are the benefits of a Money Market Account compared to other accounts?

The benefits of a Money Market Account include competitive interest rates, limited check-writing capabilities, and easier access to your funds. Unlike traditional savings accounts, a Money Market Account Application And Agreement often provides a higher return while still allowing you to make withdrawals. This makes it a great option for those who want to maximize their savings.

-

Are there any minimum balance requirements for a Money Market Account?

Yes, most Money Market Account Application And Agreement documents specify minimum balance requirements. Keeping a minimum balance can help you avoid monthly fees and earn the highest interest rates offered. It's important to review these requirements to manage your account effectively.

-

Can I integrate my Money Market Account with other financial tools?

Yes, many financial institutions allow you to integrate your Money Market Account with popular budgeting and financial management tools. This can provide you with better insights into your finances and facilitate easy tracking. Make sure to check the compatibility of these tools with your Money Market Account Application And Agreement.

-

How do interest rates on Money Market Accounts typically work?

Interest rates on Money Market Accounts are usually tiered based on the account balance. Higher balances typically earn higher rates, as outlined in your Money Market Account Application And Agreement. Rates can also vary based on market conditions, so it’s beneficial to regularly check for updates from your bank.

Get more for Money Market Account Application And Agreement

Find out other Money Market Account Application And Agreement

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast