Form IC3 Tax Repayment Claim Form for Relevant Contracts Tax Tax Repayment Claim Form for Relevant Contracts Tax

What is the Ireland IC3 Form?

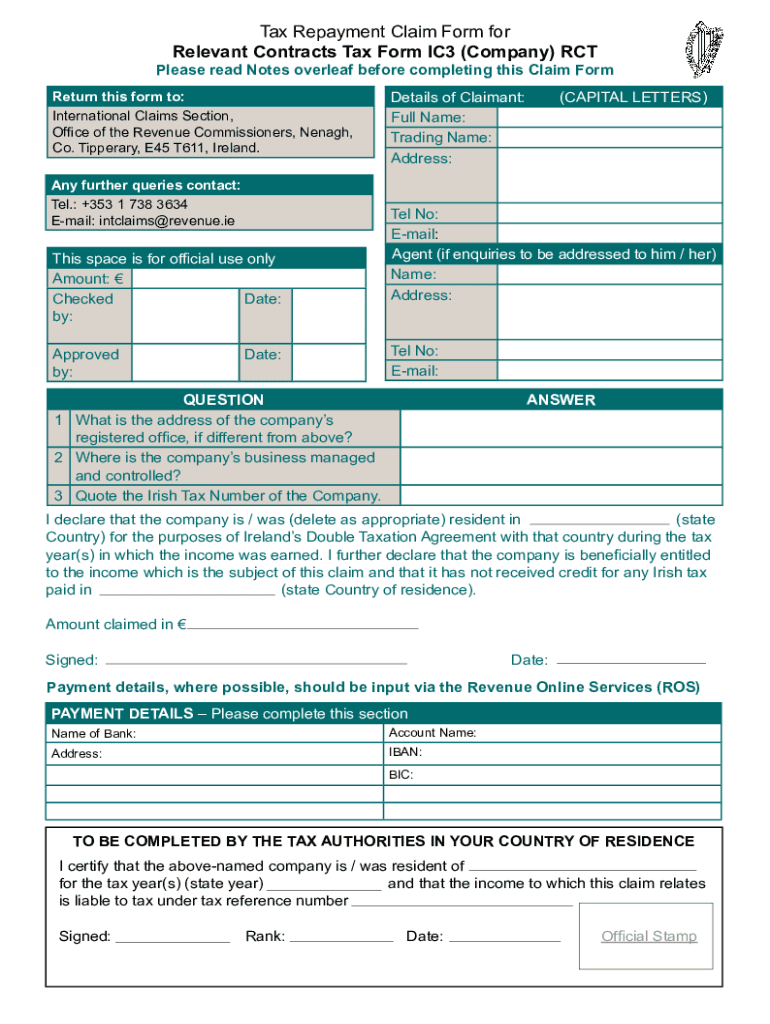

The Ireland IC3 form, also known as the Tax Repayment Claim Form for Relevant Contracts Tax, is a document used by businesses and contractors in Ireland to claim back tax that has been deducted from payments made to them. This form is particularly relevant for individuals and entities engaged in contracts that fall under the Relevant Contracts Tax (RCT) regime. The purpose of the IC3 form is to facilitate the repayment of tax withheld, ensuring that contractors receive the correct amount of compensation for their work.

How to Use the Ireland IC3 Form

Using the Ireland IC3 form involves several steps to ensure accurate completion and submission. First, gather all necessary information, including details of the payments received and the tax that was deducted. Next, fill out the form accurately, providing all required details such as your name, address, and tax identification number. After completing the form, review it for any errors before submission. Finally, submit the form to the appropriate tax authority, either online or by mail, depending on your preference and the guidelines provided.

Steps to Complete the Ireland IC3 Form

Completing the Ireland IC3 form requires careful attention to detail. Follow these steps:

- Gather necessary documentation, including payment records and tax deduction details.

- Fill out the form with accurate personal and business information.

- Specify the amounts of tax deducted and the total payments received.

- Double-check all entries for accuracy.

- Submit the completed form to the tax authority.

Key Elements of the Ireland IC3 Form

Understanding the key elements of the Ireland IC3 form is crucial for accurate completion. The form typically includes sections for:

- Your personal and business details.

- Details of the contracts under which payments were made.

- Amounts of tax deducted from payments.

- Bank details for repayment processing.

Required Documents for the Ireland IC3 Form

To successfully complete the Ireland IC3 form, you may need to provide various documents, including:

- Payment statements showing amounts received.

- Tax deduction certificates or records.

- Identification documents, such as your tax identification number.

Form Submission Methods

The Ireland IC3 form can be submitted through different methods, including:

- Online submission via the tax authority's website.

- Postal submission, where you send the completed form to the relevant tax office.

- In-person submission, if applicable, at designated tax offices.

Quick guide on how to complete form ic3 tax repayment claim form for relevant contracts tax tax repayment claim form for relevant contracts tax

Complete Form IC3 Tax Repayment Claim Form For Relevant Contracts Tax Tax Repayment Claim Form For Relevant Contracts Tax seamlessly on any device

Online document organization has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, as you can access the correct template and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form IC3 Tax Repayment Claim Form For Relevant Contracts Tax Tax Repayment Claim Form For Relevant Contracts Tax on any platform using airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to alter and eSign Form IC3 Tax Repayment Claim Form For Relevant Contracts Tax Tax Repayment Claim Form For Relevant Contracts Tax effortlessly

- Find Form IC3 Tax Repayment Claim Form For Relevant Contracts Tax Tax Repayment Claim Form For Relevant Contracts Tax and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and then click the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form IC3 Tax Repayment Claim Form For Relevant Contracts Tax Tax Repayment Claim Form For Relevant Contracts Tax and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ic3 tax repayment claim form for relevant contracts tax tax repayment claim form for relevant contracts tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form ic3 and how can it be used with airSlate SignNow?

The form ic3 is a vital document used for reporting cybercrimes to the Internet Crime Complaint Center. With airSlate SignNow, businesses can easily fill, sign, and eSend the form ic3, streamlining the reporting process and ensuring compliance with legal requirements.

-

How does airSlate SignNow simplify the submission of the form ic3?

airSlate SignNow provides an intuitive platform that allows users to populate the form ic3 quickly and efficiently. With features like drag-and-drop editing and pre-filled templates, submitting the form ic3 has never been easier, allowing users to focus on resolving issues rather than paperwork.

-

Are there any costs associated with using airSlate SignNow for the form ic3?

airSlate SignNow offers various pricing plans to accommodate different business needs. This cost-effective solution ensures that users can submit the form ic3 without exceeding their budgets while benefiting from all the features necessary for efficient document management.

-

What features does airSlate SignNow offer for managing the form ic3?

airSlate SignNow includes a range of features such as customizable templates, electronic signatures, and document tracking. These features make it easier for users to manage the form ic3, ensuring documents are completed accurately and on time.

-

Can I integrate airSlate SignNow with other applications when working with the form ic3?

Yes, airSlate SignNow supports integration with various applications, allowing users to seamlessly work with the form ic3 across different platforms. This integration facilitates a more efficient workflow, enhancing productivity in completing and submitting important documents.

-

How secure is my data when submitting the form ic3 through airSlate SignNow?

airSlate SignNow prioritizes data security with advanced encryption and compliance with industry regulations. When submitting the form ic3, users can rest assured that their information is protected and secure from unauthorized access.

-

Is there customer support available for issues related to the form ic3?

Absolutely! airSlate SignNow provides customer support to assist with any queries related to the form ic3. Whether it's troubleshooting or guidance on using the platform effectively, the support team is ready to help ensure a smooth experience.

Get more for Form IC3 Tax Repayment Claim Form For Relevant Contracts Tax Tax Repayment Claim Form For Relevant Contracts Tax

- Parade release and waiver bformb all participants riding on the float bb

- Bancorp bank statement template form

- 46234 r56 10 real estate disclosure new form

- The origins of judaism chapter 3 section 4 form

- Head start dental form 52280991

- K 4 kansas withholding allowance certificate form

- K 40h form

- Collaboration between two companies agreement template form

Find out other Form IC3 Tax Repayment Claim Form For Relevant Contracts Tax Tax Repayment Claim Form For Relevant Contracts Tax

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer

- Help Me With Electronic signature Texas Debt Settlement Agreement Template

- How Do I Electronic signature Nevada Stock Transfer Form Template

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template