Crummey Righ Withdrawal Primary Form

Understanding the Crummey Right Withdrawal Primary

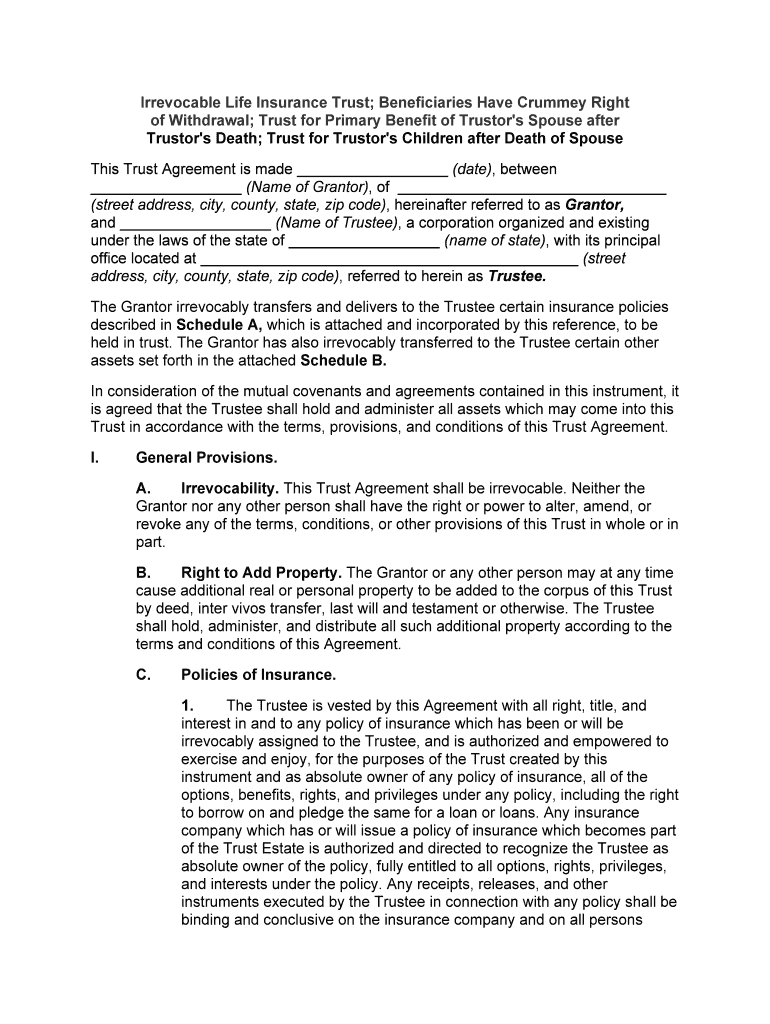

The Crummey Right Withdrawal Primary is a crucial concept in estate planning, particularly for life insurance beneficiaries. This right allows beneficiaries to withdraw contributions made to a trust, typically within a specified period. This withdrawal capability is essential for ensuring that the contributions qualify for the annual gift tax exclusion, which can help minimize tax liabilities. Understanding how this right works can significantly impact the financial planning of families, especially when a spouse is the designated beneficiary.

Steps to Complete the Crummey Right Withdrawal Primary

Completing the Crummey Right Withdrawal Primary involves several key steps to ensure compliance with legal requirements. First, the trustee must notify the beneficiaries of their right to withdraw funds. This notice should clearly outline the amount available for withdrawal and the time frame in which they can exercise this right. Next, beneficiaries must formally indicate their decision to withdraw the funds, typically through a written request. Finally, the trustee must document this transaction to maintain accurate records for tax purposes.

Legal Use of the Crummey Right Withdrawal Primary

The legal framework surrounding the Crummey Right Withdrawal Primary is designed to protect both the grantor and the beneficiaries. To ensure compliance, the withdrawal rights must be clearly stated in the trust document. This legal clarity helps prevent disputes and ensures that the contributions qualify for the annual gift tax exclusion. Additionally, it is essential to follow state-specific regulations, as these can vary and may impact the execution of the withdrawal rights.

Required Documents for the Crummey Right Withdrawal Primary

When processing a Crummey Right Withdrawal Primary, specific documents are necessary to ensure a smooth transaction. These typically include the trust document, which outlines the beneficiaries' rights, and any notices sent to the beneficiaries regarding their withdrawal options. Additionally, a written request from the beneficiary who wishes to exercise their withdrawal right is essential. Keeping these documents organized and accessible is vital for compliance and future reference.

Examples of Using the Crummey Right Withdrawal Primary

Practical examples of utilizing the Crummey Right Withdrawal Primary can illustrate its benefits. For instance, if a spouse is named as the beneficiary of a life insurance policy held in trust, they may receive a notification allowing them to withdraw a portion of the contributions made to the trust. By exercising this right, they can access funds without incurring gift tax liabilities, thus maximizing their financial benefits. Such examples highlight the importance of understanding and effectively using this right in estate planning.

IRS Guidelines on the Crummey Right Withdrawal Primary

The Internal Revenue Service (IRS) provides specific guidelines regarding the Crummey Right Withdrawal Primary, particularly concerning gift tax exclusions. According to IRS regulations, contributions to a trust that grants beneficiaries the right to withdraw funds within a specified period can qualify for the annual gift tax exclusion. It is crucial for trustees and beneficiaries to adhere to these guidelines to ensure compliance and avoid potential tax penalties.

Quick guide on how to complete crummey righ withdrawal primary

Effortlessly prepare Crummey Righ Withdrawal Primary on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without any hold-ups. Manage Crummey Righ Withdrawal Primary on any platform with the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

Easily modify and eSign Crummey Righ Withdrawal Primary without hassle

- Find Crummey Righ Withdrawal Primary and click Get Form to begin.

- Use the tools we provide to complete your form.

- Spotlight important sections of your documents or redact sensitive details with tools specially designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional signature.

- Review all the details and click the Done button to save your modifications.

- Select how you'd like to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tiresome document searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Crummey Righ Withdrawal Primary and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the crummey righ withdrawal primary

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the role of a spouse as a life insurance beneficiary?

In life insurance policies, a spouse typically serves as the primary beneficiary, meaning they will receive the death benefit when the insured passes away. Designating your spouse ensures that financial protection is prioritized for your family. It is crucial to keep your beneficiary designation updated, especially during major life events.

-

Can I designate multiple life insurance beneficiaries including my spouse?

Yes, you can designate multiple life insurance beneficiaries, including your spouse, to ensure that your assets are distributed according to your wishes. For example, you might split the benefit between your spouse and children. Make sure to specify the percentage each beneficiary receives to avoid confusion.

-

What happens if my spouse is no longer alive when the policy pays out?

If your spouse, who is designated as a life insurance beneficiary, passes away before you, you can update your policy to name a new beneficiary. Many insurance companies allow you to choose contingent beneficiaries in case the primary beneficiary is no longer available. It's important to review your policy regularly to make necessary adjustments.

-

How does naming a spouse as a beneficiary affect life insurance premiums?

Naming a spouse as a life insurance beneficiary does not directly affect the policy premiums. However, premiums may vary based on factors such as age, health, and the amount of coverage you select. Maintaining a healthy lifestyle could potentially help lower your life insurance premiums over time.

-

Are there tax implications for life insurance beneficiaries, including my spouse?

Generally, life insurance death benefits received by a spouse are tax-free, which is a signNow advantage. However, if the policyholder's estate is subject to estate taxes, it could impact the overall inheritance received by the spouse. It's advisable to consult a tax professional to navigate specific situations related to your life insurance beneficiaries, spouse included.

-

How does airSlate SignNow facilitate the process of designating a life insurance beneficiary?

AirSlate SignNow makes the process of designating or updating a life insurance beneficiary simple and efficient. You can electronically sign and send documents securely, ensuring that your beneficiary information is processed quickly and accurately. This streamlines the entire lifecycle of managing your life insurance policy.

-

What features does airSlate SignNow offer for life insurance documentation?

AirSlate SignNow offers robust features for life insurance documentation including eSignature, secure cloud storage, and automated workflows. These features allow you to manage beneficiary designations, claims, and policy updates efficiently. The user-friendly interface helps ensure a smooth experience in handling important life insurance documents.

Get more for Crummey Righ Withdrawal Primary

Find out other Crummey Righ Withdrawal Primary

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile