4029 2011

What is the 4029

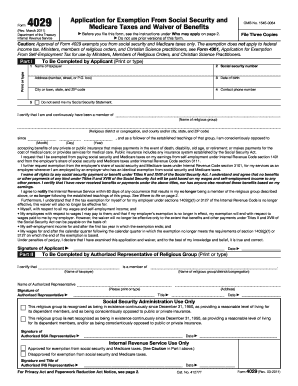

The 4029 form, officially known as the IRS Form 4029, is a document used by certain religious groups to apply for exemption from social security and Medicare taxes. This form is particularly relevant for members of religious sects that oppose these taxes on the grounds of their religious beliefs. By submitting Form 4029, individuals can affirm their eligibility for exemption, which can significantly impact their tax obligations.

How to use the 4029

Using the 4029 form involves several key steps. First, individuals must determine their eligibility based on their religious beliefs and the criteria set forth by the IRS. After confirming eligibility, they should complete the form accurately, providing all required information. Once completed, the form must be submitted to the IRS for approval. It is essential to retain a copy of the submitted form for personal records and future reference.

Steps to complete the 4029

Completing the 4029 form involves a systematic approach:

- Gather necessary information, including personal identification details and religious affiliation.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for completeness and correctness.

- Submit the form to the IRS, either online or via mail, depending on the submission guidelines.

- Keep a copy of the submitted form for your records.

Legal use of the 4029

The legal use of Form 4029 is governed by IRS regulations. To be considered valid, the form must be filled out correctly and submitted to the IRS. The exemption from social security and Medicare taxes is only granted if the IRS approves the application. It is important for applicants to understand that the approval is contingent upon meeting specific eligibility criteria, and any misrepresentation can lead to penalties.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 4029. These guidelines include detailed instructions on eligibility, required documentation, and the submission process. It is crucial for applicants to familiarize themselves with these guidelines to ensure compliance and avoid delays in processing. Following the IRS instructions closely can facilitate a smoother application process.

Eligibility Criteria

Eligibility for the 4029 form is primarily based on religious beliefs. Applicants must belong to a recognized religious sect that opposes the acceptance of social security and Medicare benefits. Additionally, the sect must have been in existence for a significant period, and its members must adhere to specific tenets that align with the exemption criteria. Understanding these eligibility requirements is essential for a successful application.

Quick guide on how to complete 4029

Complete 4029 effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily access the right form and securely archive it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly without delays. Handle 4029 on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to edit and eSign 4029 with ease

- Locate 4029 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important parts of the documents or obscure confidential details with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from a device of your choice. Edit and eSign 4029 to ensure effective communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 4029

Create this form in 5 minutes!

How to create an eSignature for the 4029

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 4029 and why is it important?

Form 4029 is a crucial document used for exemption from self-employment tax for religious purposes. Understanding how to properly fill out and submit form 4029 can help eligible individuals avoid unnecessary taxes and ensure compliance with IRS regulations.

-

How does airSlate SignNow simplify the process of filling out form 4029?

AirSlate SignNow offers an intuitive interface that makes completing form 4029 quick and easy. With our platform, users can easily fill in the necessary fields, save their progress, and access the form from any device, enhancing the overall user experience.

-

Are there any costs associated with using airSlate SignNow to complete form 4029?

AirSlate SignNow provides various pricing plans tailored to meet different business needs. Users can choose a plan that suits their budget while enjoying features that simplify the management and completion of documents like form 4029.

-

What features does airSlate SignNow offer for managing form 4029?

AirSlate SignNow offers a range of features including document templates, eSignature options, and cloud storage, making it easy to manage form 4029 efficiently. These features help streamline the document workflow, ensuring that users can focus on what's important.

-

Can airSlate SignNow integrate with other applications for form 4029 management?

Yes, airSlate SignNow provides seamless integrations with various applications such as CRM systems and document management tools, which can enhance the handling of form 4029. This connectivity allows users to automate workflows and maintain organization.

-

What are the benefits of using airSlate SignNow for form 4029 submissions?

Using airSlate SignNow for your form 4029 submissions offers benefits such as faster processing times, increased accuracy, and reduced paper waste. Our eSigning feature ensures that your document is legally binding and secure, providing peace of mind.

-

Is my data safe when using airSlate SignNow for form 4029?

Absolutely! AirSlate SignNow prioritizes data security with advanced encryption protocols and compliance with industry standards. You can trust that your personal and financial information related to form 4029 will remain protected.

Get more for 4029

- Discrimination 497323087 form

- Request reasonable accommodation form

- Oklahoma discrimination complaint form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497323091 form

- Notice written lease form

- Notice of breach of written lease for violating specific provisions of lease with no right to cure for residential property 497323093 form

- Notice of breach of written lease for violating specific provisions of lease with no right to cure for nonresidential property 497323094 form

- Business credit application oklahoma form

Find out other 4029

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online