Retail Banking Account Target 2018-2026

What is the Retail Banking Account Target

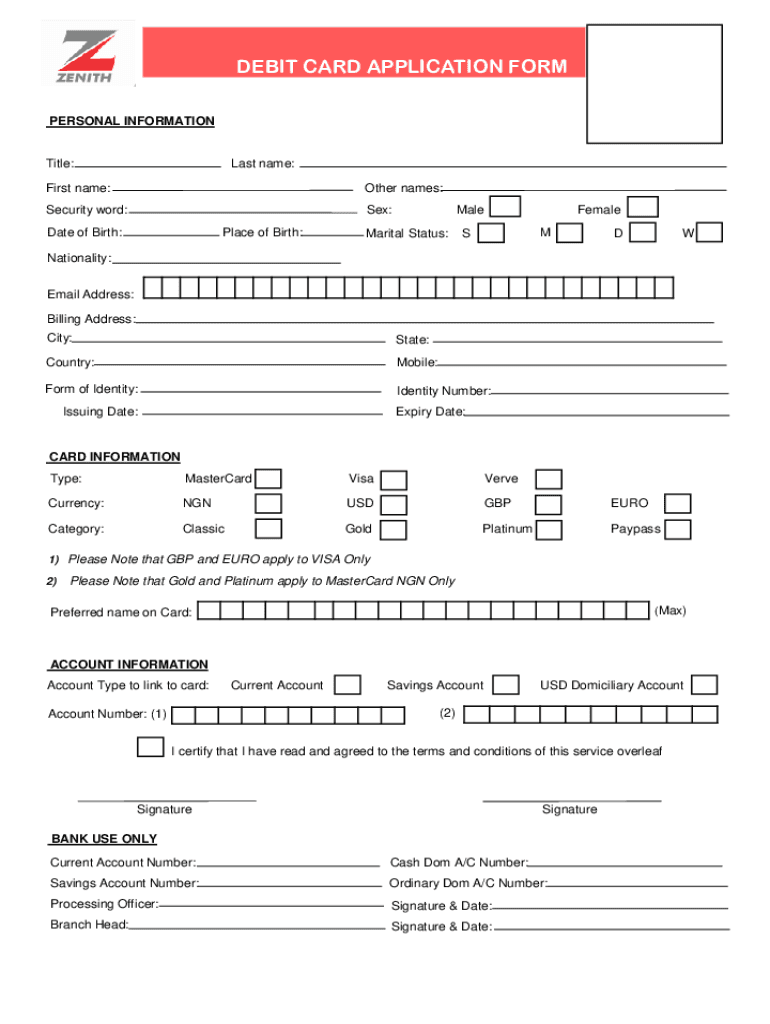

The Retail Banking Account Target refers to the specific financial products and services offered by banks to individual consumers. These accounts typically include checking accounts, savings accounts, and debit card services. The goal of these accounts is to provide customers with easy access to their funds, facilitate transactions, and help manage their finances effectively. Understanding the features and benefits of these accounts is essential for consumers looking to make informed banking choices.

How to obtain the Retail Banking Account Target

To obtain a Retail Banking Account Target, individuals typically need to follow a straightforward application process. This process often includes:

- Researching various banks to compare account offerings.

- Gathering necessary documentation, such as identification and proof of address.

- Completing the bank's application form, which may be available online or in-branch.

- Submitting the application along with required documents for verification.

Once the application is approved, customers will receive their account details and can begin using their banking services.

Steps to complete the Retail Banking Account Target

Completing the application for a Retail Banking Account Target involves several key steps:

- Choose the type of account that best suits your financial needs.

- Visit the bank's website or branch to access the application form.

- Fill out the form with accurate personal information, including your name, address, and Social Security number.

- Provide any additional information required, such as employment details or income.

- Review the application for accuracy before submission.

After submission, the bank will process the application, which may take a few days. Customers will be notified of their account status via email or postal mail.

Legal use of the Retail Banking Account Target

The legal use of a Retail Banking Account Target is governed by various regulations and laws to ensure consumer protection and financial integrity. Banks must comply with the Bank Secrecy Act, Anti-Money Laundering laws, and consumer protection regulations. Customers should also be aware of their rights regarding account usage, including privacy rights and the right to dispute unauthorized transactions. Understanding these legal frameworks helps consumers navigate their banking relationships confidently.

Required Documents

When applying for a Retail Banking Account Target, individuals typically need to provide several key documents, which may include:

- Government-issued identification, such as a driver's license or passport.

- Proof of address, such as a utility bill or lease agreement.

- Social Security number or Individual Taxpayer Identification Number (ITIN).

- Income verification documents, like pay stubs or bank statements, if required.

Having these documents ready can streamline the application process and help ensure a successful account setup.

Eligibility Criteria

Eligibility for a Retail Banking Account Target generally includes meeting certain criteria set by the bank, which may involve:

- Being at least eighteen years old, or having a parent or guardian co-sign if underage.

- Providing valid identification and proof of residency.

- Having a stable source of income or financial backing, depending on the account type.

Each bank may have specific requirements, so it is advisable to check with the institution directly for detailed eligibility criteria.

Quick guide on how to complete retail banking account target

Complete Retail Banking Account Target seamlessly on any device

Digital document management has become prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without any holdups. Manage Retail Banking Account Target on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to alter and eSign Retail Banking Account Target effortlessly

- Obtain Retail Banking Account Target and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Decide how you want to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device you prefer. Modify and eSign Retail Banking Account Target and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the retail banking account target

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a debit card application bank personal?

A debit card application bank personal is a request made to a bank to obtain a debit card linked to your personal account. This type of application typically requires personal and financial information to ensure eligibility and secure transactions. Using a debit card can simplify payments and improve your money management.

-

What are the benefits of a debit card application bank personal?

The benefits of a debit card application bank personal include easier access to your funds, the ability to make purchases without cash, and enhanced security through chip technology. Debit cards also help track spending habits, making budget management simpler. With direct access to your bank account, you can control finances more effectively.

-

How do I apply for a debit card application bank personal?

To apply for a debit card application bank personal, visit your bank's website or local branch and fill out the online or physical application form. You will need to provide identification and financial information for verification. After submission, your bank will review your application and notify you of the outcome.

-

Are there any fees associated with a debit card application bank personal?

Fees associated with a debit card application bank personal can vary from bank to bank. Some banks may charge monthly maintenance fees, while others may not. It's essential to review the fee schedule before applying to ensure it aligns with your financial needs.

-

What features should I look for in a debit card application bank personal?

When considering a debit card application bank personal, look for features such as zero liability protection, ATM access, and budgeting tools. Additionally, inquire about transaction limits, mobile banking compatibility, and reward programs that might enhance the card's value. These features can signNowly improve your banking experience.

-

Can I use my debit card for online purchases after my debit card application bank personal is approved?

Yes, once your debit card application bank personal is approved, you can use your card for online purchases immediately. Ensure that your bank account is funded and be aware of any transaction limits set by your bank. Online transactions usually require you to enter your card number, expiration date, and the security code.

-

How does a debit card application bank personal affect my credit score?

Applying for a debit card application bank personal typically does not impact your credit score as it is not a credit product. However, if the bank performs a hard inquiry, it might have a minor effect temporarily. Using a debit card responsibly can help you manage your finances without accumulating debt.

Get more for Retail Banking Account Target

- Spectrum registration form

- Td112 form 100397284

- Agreement under section 46e2 of the health insurance act 1973 complete this form to accept the terms and conditions required to

- Tceq form 20683

- Lesson 9 5 congruent figures answer key form

- Sales tax permit oklahoma form

- Drapery work order template form

- Rentalcar parking agreement template form

Find out other Retail Banking Account Target

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document