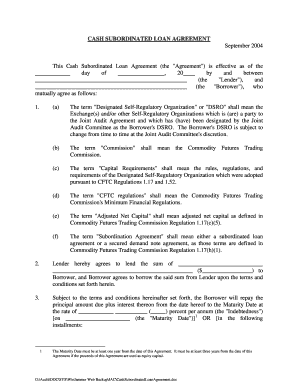

CASH SUBORDINATED LOAN AGREEMENT CME Group Form

What is the cash subordinated loan agreement CME Group

The cash subordinated loan agreement CME Group is a legal document that outlines the terms and conditions under which a subordinated loan is provided to an entity. This type of loan is characterized by its subordinate status, meaning it ranks below other debts in terms of claims on assets in the event of liquidation. The agreement typically includes details such as the loan amount, interest rate, repayment terms, and any covenants that the borrower must adhere to. It is essential for both lenders and borrowers to understand the implications of this agreement, particularly regarding the risks involved in subordinated lending.

Key elements of the cash subordinated loan agreement CME Group

Several critical elements define the cash subordinated loan agreement CME Group. These components ensure clarity and mutual understanding between the parties involved. Key elements include:

- Loan Amount: The total sum being borrowed.

- Interest Rate: The rate at which interest will accrue on the loan.

- Repayment Schedule: Specific dates and terms for repayment.

- Covenants: Conditions that the borrower must meet, which may include financial performance metrics.

- Subordination Clause: A statement that clarifies the loan's subordinate status relative to other debts.

Steps to complete the cash subordinated loan agreement CME Group

Completing the cash subordinated loan agreement CME Group involves several steps to ensure that all necessary information is accurately captured. The following steps can guide you through the process:

- Gather Information: Collect all relevant financial data and documentation required for the agreement.

- Draft the Agreement: Use a template or legal counsel to draft the agreement, ensuring all key elements are included.

- Review Terms: Both parties should carefully review the terms to ensure mutual understanding and agreement.

- Sign the Document: Utilize a secure electronic signature solution to sign the agreement, ensuring compliance with legal standards.

- Store the Agreement: Keep a copy of the signed agreement in a secure location for future reference.

Legal use of the cash subordinated loan agreement CME Group

The cash subordinated loan agreement CME Group is legally binding when executed according to the relevant laws and regulations. To ensure its legal validity, the agreement must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These frameworks establish that electronic signatures and records hold the same legal weight as traditional handwritten signatures. It is crucial for parties to understand their rights and obligations under the agreement and to seek legal advice if necessary.

How to use the cash subordinated loan agreement CME Group

Using the cash subordinated loan agreement CME Group effectively requires a clear understanding of its purpose and application. This agreement is primarily used in financial transactions where a borrower seeks funding while offering a subordinated position to the lender. It is essential to:

- Identify the need for a subordinated loan within your financial strategy.

- Ensure that all parties are informed about the terms and conditions outlined in the agreement.

- Utilize a reliable electronic signing platform to facilitate the signing process, ensuring security and compliance.

Who issues the cash subordinated loan agreement CME Group

The cash subordinated loan agreement CME Group is typically issued by financial institutions, such as banks or private lenders, that specialize in providing subordinated loans. These institutions assess the creditworthiness of the borrower and determine the terms of the loan based on various factors, including the borrower's financial health and the risk associated with the loan. It is important for borrowers to work with reputable lenders to ensure favorable terms and compliance with legal standards.

Quick guide on how to complete cash subordinated loan agreement cme group

Complete CASH SUBORDINATED LOAN AGREEMENT CME Group effortlessly across any device

Online document administration has become favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely keep it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents quickly without interruptions. Handle CASH SUBORDINATED LOAN AGREEMENT CME Group on any device with airSlate SignNow's Android or iOS applications and enhance any document-centered operation today.

How to alter and eSign CASH SUBORDINATED LOAN AGREEMENT CME Group effortlessly

- Obtain CASH SUBORDINATED LOAN AGREEMENT CME Group and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the information and click the Done button to save your modifications.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign CASH SUBORDINATED LOAN AGREEMENT CME Group and ensure outstanding communication at any stage of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cash subordinated loan agreement cme group

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CASH SUBORDINATED LOAN AGREEMENT CME Group?

A CASH SUBORDINATED LOAN AGREEMENT CME Group is a financial document that outlines the terms under which a lender provides cash to an entity, subordinated to other debt obligations. This type of agreement is crucial for businesses looking to secure funding while managing their financial structure. Understanding the terms can help you maximize the benefit of your capital.

-

How does airSlate SignNow simplify the CASH SUBORDINATED LOAN AGREEMENT CME Group process?

airSlate SignNow streamlines the creation and signing of your CASH SUBORDINATED LOAN AGREEMENT CME Group by providing an intuitive platform for document management. This allows users to send, eSign, and securely store agreements, ensuring compliance and reducing processing time. The user-friendly interface enhances the experience for both senders and signers.

-

What are the pricing options for using airSlate SignNow to manage CASH SUBORDINATED LOAN AGREEMENT CME Group documents?

airSlate SignNow offers flexible pricing plans tailored to accommodate businesses of all sizes managing CASH SUBORDINATED LOAN AGREEMENT CME Group documents. Plans typically range from basic to advanced feature sets, allowing you to choose based on your usage needs. Each plan provides value by enhancing efficiency and reducing costs associated with paper-based processing.

-

What features does airSlate SignNow offer for handling CASH SUBORDINATED LOAN AGREEMENT CME Group templates?

airSlate SignNow provides advanced features such as customizable templates, automated workflows, and bulk sending for CASH SUBORDINATED LOAN AGREEMENT CME Group documents. Additionally, real-time tracking and notifications ensure you stay informed about the status of your agreements, making the management process seamless and efficient.

-

Can I integrate other applications with airSlate SignNow for my CASH SUBORDINATED LOAN AGREEMENT CME Group workflows?

Yes, airSlate SignNow supports integration with various applications to enhance your CASH SUBORDINATED LOAN AGREEMENT CME Group workflows. You can connect it with tools like CRM systems, cloud storage, and payment processors to create a comprehensive workflow. These integrations help streamline your processes, saving time and ensuring consistency across platforms.

-

What are the security measures in place for CASH SUBORDINATED LOAN AGREEMENT CME Group documents using airSlate SignNow?

airSlate SignNow prioritizes the security of your CASH SUBORDINATED LOAN AGREEMENT CME Group documents with features such as end-to-end encryption, two-factor authentication, and secure cloud storage. These measures protect sensitive information and ensure that only authorized parties have access to your documents. Compliance with industry standards further assures users of document integrity.

-

How long does it typically take to complete a CASH SUBORDINATED LOAN AGREEMENT CME Group with airSlate SignNow?

Using airSlate SignNow, completing a CASH SUBORDINATED LOAN AGREEMENT CME Group can be done in a fraction of the time compared to traditional methods. The eSigning process can often be finalized in minutes, depending on the number of parties involved. This accelerated timeline helps businesses quickly secure needed funding and respond to market opportunities.

Get more for CASH SUBORDINATED LOAN AGREEMENT CME Group

- Statutory declaration partner visa sponsor form

- Powys child and family caf assessment form

- Michigan stfu intent to operate form

- Roof inspection report form

- Deped memorandum example form

- Consent to treat a minor ripley chiropractic clinic form

- Citibank rca account opening form

- Commission based contract template form

Find out other CASH SUBORDINATED LOAN AGREEMENT CME Group

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple