Www Trainwithshanna ComsystemsIncomeTaxPreparationIncome Tax Preparation for Your Mary Kay Business 2021-2026

Understanding the Mary Kay Income Tax Preparation Sheet

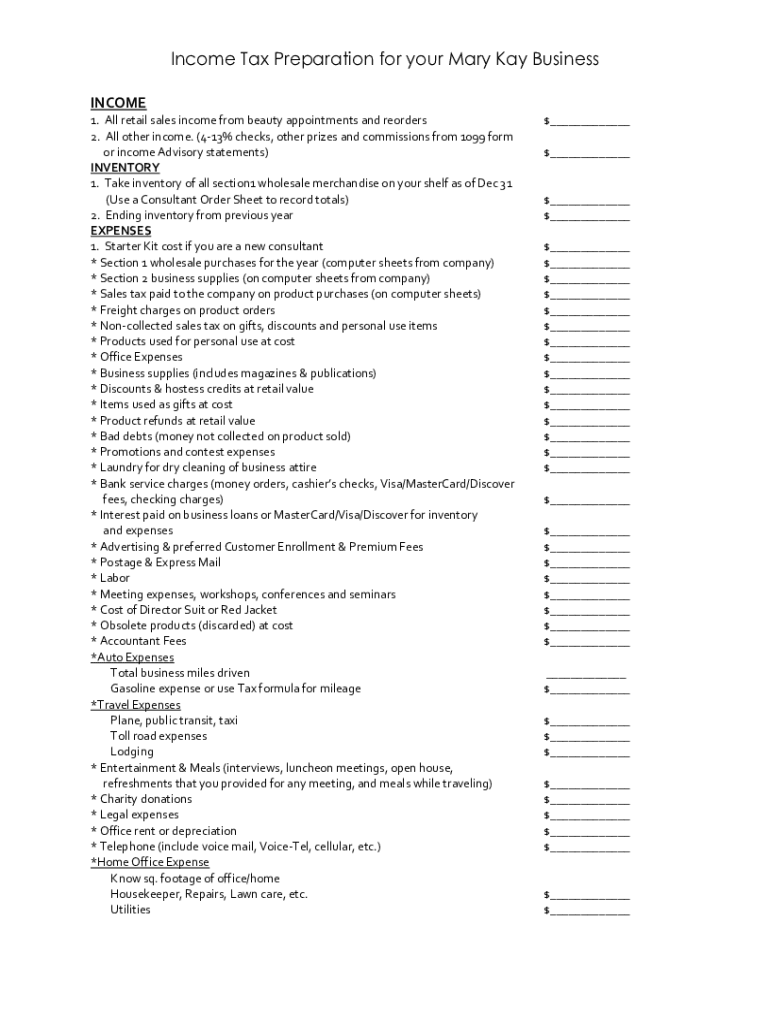

The Mary Kay income tax preparation sheet is a specialized document designed for independent beauty consultants to accurately report their earnings and expenses related to their Mary Kay business. This form helps consultants organize their financial information, ensuring compliance with IRS regulations. It typically includes sections for income from product sales, commissions, and any other business-related income. Additionally, it allows for the documentation of deductible expenses such as inventory purchases, business supplies, and vehicle expenses associated with business use.

Steps to Complete the Mary Kay Income Tax Preparation Sheet

Completing the Mary Kay income tax preparation sheet involves several key steps to ensure accuracy and compliance. First, gather all relevant financial documents, including sales receipts, commission statements, and records of expenses. Next, fill out the income section by listing all earnings from sales and commissions. After that, detail your expenses, categorizing them appropriately. Finally, review the completed sheet for accuracy before submitting it with your tax return. This thorough approach helps to minimize errors and maximize potential deductions.

Required Documents for the Mary Kay Income Tax Preparation Sheet

To effectively complete the Mary Kay income tax preparation sheet, certain documents are essential. These include:

- Sales receipts and invoices

- Commission statements from Mary Kay

- Records of business-related expenses, such as receipts for inventory and supplies

- Bank statements showing business transactions

- Any relevant tax forms, such as 1099s, if applicable

Having these documents organized will streamline the preparation process and ensure that all necessary information is accounted for.

IRS Guidelines for Mary Kay Income Tax Preparation

The IRS has specific guidelines that independent contractors, including Mary Kay consultants, must follow when preparing their taxes. It is crucial to report all income accurately and maintain detailed records of expenses. The IRS requires that any income over a certain threshold be reported, and failure to do so can result in penalties. Additionally, consultants should be aware of the business codes applicable to their activities, such as the IRS business code for Mary Kay sales, to ensure proper classification on tax forms.

Filing Deadlines for the Mary Kay Income Tax Preparation Sheet

Filing deadlines for the Mary Kay income tax preparation sheet align with the general tax filing deadlines set by the IRS. Typically, individual tax returns are due by April 15 each year. If additional time is needed, taxpayers can file for an extension, which typically grants an extra six months. However, it is important to note that any taxes owed are still due by the original deadline to avoid penalties and interest.

Penalties for Non-Compliance with Tax Regulations

Failure to comply with tax regulations can result in significant penalties for Mary Kay consultants. These penalties may include fines for late filing, underreporting income, or failing to pay taxes owed. Additionally, the IRS may impose interest on any unpaid taxes, which can accumulate quickly. To avoid these consequences, it is essential for consultants to accurately complete their income tax preparation sheet and adhere to all filing requirements.

Quick guide on how to complete www trainwithshanna comsystemsincometaxpreparationincome tax preparation for your mary kay business

Effortlessly Prepare Www trainwithshanna comsystemsIncomeTaxPreparationIncome Tax Preparation For Your Mary Kay Business on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, modify, and electronically sign your documents quickly and efficiently. Handle Www trainwithshanna comsystemsIncomeTaxPreparationIncome Tax Preparation For Your Mary Kay Business on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

How to Modify and Electronically Sign Www trainwithshanna comsystemsIncomeTaxPreparationIncome Tax Preparation For Your Mary Kay Business with Ease

- Obtain Www trainwithshanna comsystemsIncomeTaxPreparationIncome Tax Preparation For Your Mary Kay Business and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that require printing new copies of documents. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Www trainwithshanna comsystemsIncomeTaxPreparationIncome Tax Preparation For Your Mary Kay Business and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the www trainwithshanna comsystemsincometaxpreparationincome tax preparation for your mary kay business

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Mary Kay income tax preparation sheet?

A Mary Kay income tax preparation sheet is a specialized document designed to help Mary Kay consultants accurately track their income and expenses for tax purposes. It simplifies the tax reporting process by organizing financial data, ensuring you have all the necessary information at hand when filing your taxes.

-

How can the Mary Kay income tax preparation sheet benefit my business?

Using the Mary Kay income tax preparation sheet allows you to keep detailed financial records, making tax season less stressful. This sheet helps ensure you maximize your deductions by allowing you to track all business-related expenses clearly and concisely.

-

Is the Mary Kay income tax preparation sheet easy to use?

Yes, the Mary Kay income tax preparation sheet is designed to be user-friendly and intuitive. Even if you are not familiar with tax preparation, this sheet provides a straightforward format that guides you through documenting your income and expenses.

-

Where can I get a Mary Kay income tax preparation sheet?

You can access the Mary Kay income tax preparation sheet directly from the airSlate SignNow platform. This ensures you have the latest version that incorporates any changes in tax regulations relevant to Mary Kay consultants.

-

Does the Mary Kay income tax preparation sheet integrate with other financial tools?

Absolutely! The Mary Kay income tax preparation sheet is designed to seamlessly integrate with various accounting and tax preparation software. This integration allows you to import financial data easily and streamline your tax filing process.

-

What features does the Mary Kay income tax preparation sheet include?

The Mary Kay income tax preparation sheet includes features such as expense categorization, income tracking, and automatic calculations for totals. These features simplify data entry and ensure all essential information is readily available for tax time.

-

Is there a cost associated with the Mary Kay income tax preparation sheet?

The Mary Kay income tax preparation sheet is included as part of airSlate SignNow’s suite of document management solutions. This means you can benefit from it without any additional costs beyond your subscription fee.

Get more for Www trainwithshanna comsystemsIncomeTaxPreparationIncome Tax Preparation For Your Mary Kay Business

- Sysco frozen soups form

- Why did the turkey volunteer to be the drummer in the popular bird band form

- How to obtain a copy of your alfred state transcriptalfred form

- Fimco applications form

- Urban american rental application form

- Housemate agreement template form

- Housekeeping agreement template form

- Housetenancy agreement template form

Find out other Www trainwithshanna comsystemsIncomeTaxPreparationIncome Tax Preparation For Your Mary Kay Business

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template