Nil Income Form Dwp

What is the Nil Income Form DWP

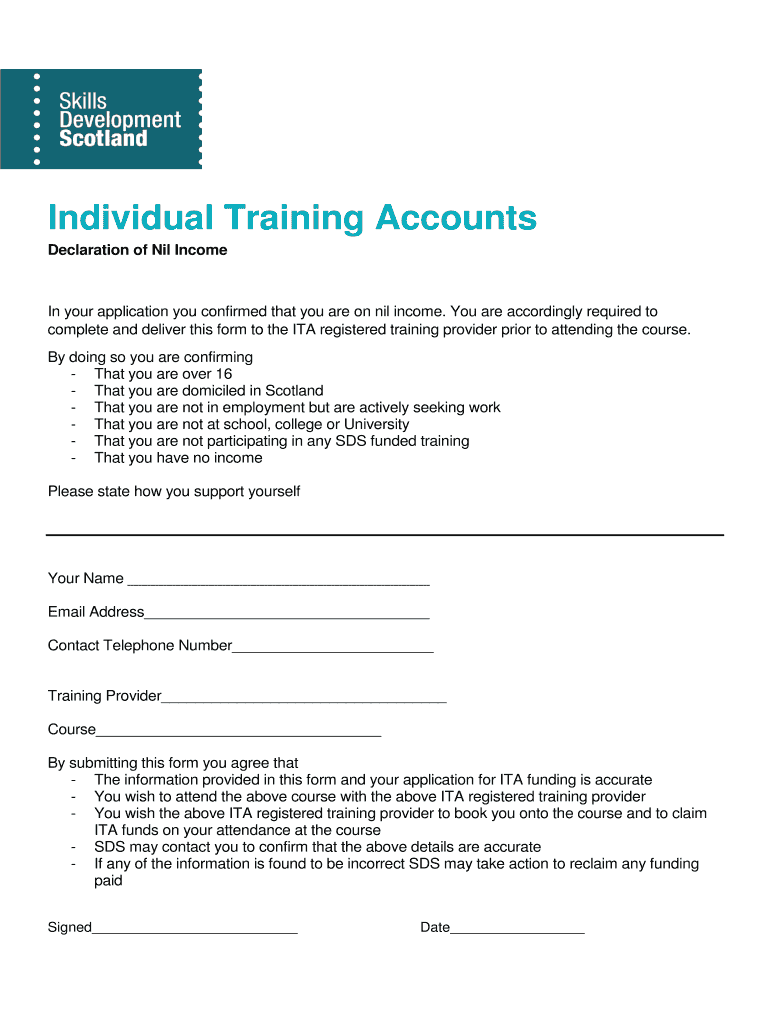

The Nil Income Form DWP is a document used by individuals to declare that they have no income for a specific period. This form is often required for various purposes, including applying for benefits or financial assistance from the Department for Work and Pensions (DWP) in the United Kingdom. By submitting this form, individuals can provide official confirmation of their income status, which is essential for assessing eligibility for support programs.

How to use the Nil Income Form DWP

Using the Nil Income Form DWP involves several straightforward steps. First, individuals must obtain the form, which can typically be downloaded from the DWP's official website or requested directly from their local office. Once the form is acquired, users should fill it out with accurate personal details, ensuring that all required fields are completed. After filling out the form, it must be submitted to the appropriate DWP office, either online, by mail, or in person, depending on the submission options available.

Steps to complete the Nil Income Form DWP

Completing the Nil Income Form DWP requires careful attention to detail. Here are the steps to follow:

- Download or request the Nil Income Form from the DWP.

- Fill in your personal information, including your name, address, and contact details.

- Clearly indicate that you have no income for the specified period.

- Review the form for accuracy, ensuring all sections are completed.

- Submit the form through the preferred method: online, by mail, or in person.

Legal use of the Nil Income Form DWP

The Nil Income Form DWP serves a legal purpose by providing a formal declaration of an individual's income status. This declaration is important for various legal and administrative processes, such as applying for government assistance. It is crucial to ensure that the information provided on the form is truthful and accurate, as submitting false information can lead to legal penalties or disqualification from receiving benefits.

Eligibility Criteria

To use the Nil Income Form DWP, individuals must meet certain eligibility criteria. Typically, this form is intended for those who are unemployed, on a low income, or otherwise unable to earn income during a specified period. Eligibility may also depend on the specific benefits or programs for which the individual is applying, so it is important to review the requirements associated with those programs before submitting the form.

Form Submission Methods

The Nil Income Form DWP can be submitted through various methods, depending on the individual's preference and the options provided by the DWP. Common submission methods include:

- Online submission through the DWP's official portal.

- Mailing the completed form to the designated DWP office.

- Delivering the form in person to a local DWP office.

Each method may have different processing times and requirements, so individuals should choose the one that best suits their needs.

Quick guide on how to complete declaration of nil income

A brief manual on how to create your Nil Income Form Dwp

Finding the appropriate template can pose a difficulty when you are required to submit official international documentation. Even if you possess the necessary form, it might be tedious to efficiently fill it out in accordance with all the specifications if you rely on printed versions instead of handling everything digitally. airSlate SignNow is the web-based electronic signature platform that assists you in navigating these challenges. It enables you to select your Nil Income Form Dwp and swiftly fill it out and sign it on the spot without needing to reprint documents if you make an error.

Here are the actions you need to follow to set up your Nil Income Form Dwp with airSlate SignNow:

- Hit the Get Form button to immediately bring your document into our editor.

- Begin with the first blank field, enter the details, and proceed using the Next function.

- Complete the empty spaces utilizing the Cross and Check tools found in the toolbar above.

- Select the Highlight or Line options to emphasize the most important information.

- Click on Image and upload one if your Nil Income Form Dwp requires it.

- Utilize the right-side panel to add extra fields for yourself or others to fill in if needed.

- Review your responses and validate the form by clicking Date, Initials, and Sign.

- Create, type, upload your eSignature, or capture it with a camera or QR code.

- Complete your modifications to the form by hitting the Done button and selecting your file-sharing preferences.

Once your Nil Income Form Dwp is ready, you can distribute it in whichever way you choose - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely save all your completed documents in your account, organized into folders according to your preferences. Don’t squander time on manual form filling; give airSlate SignNow a try!

Create this form in 5 minutes or less

FAQs

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

Do I have to file (nil) income tax return if I fill Form15G?

Income is not the only criteria which sets the requirement for filing of Income Tax Return. If any of the following situation is applicable to you than it is mandatory for you to file your return.Your Gross total income (before allowing section 80 deduction) exceeds Rs. 2,50,000* in the financial year (1st April 2015 to 31st March 2016) *In case of senior citizens (between the age group of 60 to 80 years) the limit will be Rs. 3,00,000. and in case of super senior citizens (aged 80 years or above) the limit will be Rs. 5,00,000In case of a company or a firm irrespective of income whether it is profit or lossIf any refund is to be claimed from the income tax departmentIf you want to carry forward the losses, to be set off against income in futureIn case of Resident Individual, return filing is mandatory if he/she has any assets or financial interest in an entity located outside IndiaIn case of Resident Individual who is having signing authority in a foreign accountIf you are applying for a home loan or even appearing for a visa interview, Income Tax returns may become a requirement as proof of income.Form 15G is basically a declaration that your total income is below the basic exemption limit and that your TDS should not be deducted for the same reason.It is also observed that notices for non filing have been received by those who had filed tax returns in past but have stopped filing recently since their total income is no longer taxable or for any other reason whatsoever.You will find plenty of advantages for filing the income tax return even if your income is not taxable. Not to forget that you can e-file your income tax return in a matter of few minutes.

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

Do I need to fill out the self-declaration form in the NEET 2018 application form since I have a domicile of J&K?

since you’re a domicile of J&K & are eligible for J&K counselling process - you’re not required to put self declaration.self declaration is for the students who’re not domicile of J&K but presently are there & unable to avail the domicile benefit .source- http://cbseneet.nic.in

Create this form in 5 minutes!

How to create an eSignature for the declaration of nil income

How to make an eSignature for your Declaration Of Nil Income in the online mode

How to make an electronic signature for the Declaration Of Nil Income in Google Chrome

How to create an eSignature for putting it on the Declaration Of Nil Income in Gmail

How to generate an eSignature for the Declaration Of Nil Income straight from your mobile device

How to generate an eSignature for the Declaration Of Nil Income on iOS

How to make an electronic signature for the Declaration Of Nil Income on Android OS

People also ask

-

What is airSlate SignNow and how can it benefit my business?

airSlate SignNow is a digital signature platform that empowers businesses to send and eSign documents seamlessly. With its easy-to-use interface, it helps organizations streamline their document workflows, reducing the time and cost associated with traditional signing methods. Choosing airSlate SignNow means opting for a cost-effective solution that enhances productivity and boosts overall efficiency.

-

How much does airSlate SignNow cost?

airSlate SignNow offers flexible pricing plans designed to fit businesses of all sizes. You can choose from a variety of options, starting at an affordable rate that allows you to benefit from eSigning without a heavy financial commitment. This makes airSlate SignNow a cost-effective choice, especially if you aim to minimize expenses related to document management.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow is equipped with robust features that include customizable templates, automated workflows, and real-time tracking of document status. These features enable users to easily manage their eSigning processes and ensure that important documents are completed efficiently. With airSlate SignNow, you can experience enhanced document control and collaboration at nil complications.

-

Can airSlate SignNow integrate with other applications I use?

Yes, airSlate SignNow seamlessly integrates with various applications such as Google Drive, Salesforce, and Microsoft Office to enhance your workflow. These integrations allow you to streamline your operations and ensure you can send and sign documents within your existing platforms. By using airSlate SignNow, you can enjoy these integrations with minimal hassle and nil disruptions.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely. airSlate SignNow employs industry-standard security protocols to ensure that your documents remain safe and private. With features like encrypted signing, secure cloud storage, and user authentication in place, you can trust that your sensitive information is protected at nil risk of unauthorized access.

-

What support options are available for airSlate SignNow users?

airSlate SignNow provides comprehensive support options to assist users with any questions or technical issues they may encounter. Users can access live chat, email support, and extensive online resources, including tutorials and FAQs, at nil cost. This commitment to customer service ensures that you never feel lost while using the platform.

-

How does using airSlate SignNow improve team collaboration?

Using airSlate SignNow enhances team collaboration by allowing multiple users to work on documents simultaneously and track their progress in real-time. This collaborative environment ensures that everyone stays informed and engaged in the document signing process. With airSlate SignNow, your team can achieve efficient collaboration with nil delays, signNowly speeding up project timelines.

Get more for Nil Income Form Dwp

- Sane exam forms for oregon

- Zpd hamburg formulare

- Proof of residency poway unified school district form

- Example of motion to set hearing texas form

- Loan application form for agricultural credit

- Alea gov cdl self certification form

- Who39s the fairest of them all dattner consulting llc form

- Vehicle purchase with monthly payments agreement template form

Find out other Nil Income Form Dwp

- How To Sign New Jersey Non-Disturbance Agreement

- How To Sign Illinois Sales Invoice Template

- How Do I Sign Indiana Sales Invoice Template

- Sign North Carolina Equipment Sales Agreement Online

- Sign South Dakota Sales Invoice Template Free

- How Can I Sign Nevada Sales Proposal Template

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer