Loan Application Form for Agricultural Credit

What is the loan application form for agricultural credit?

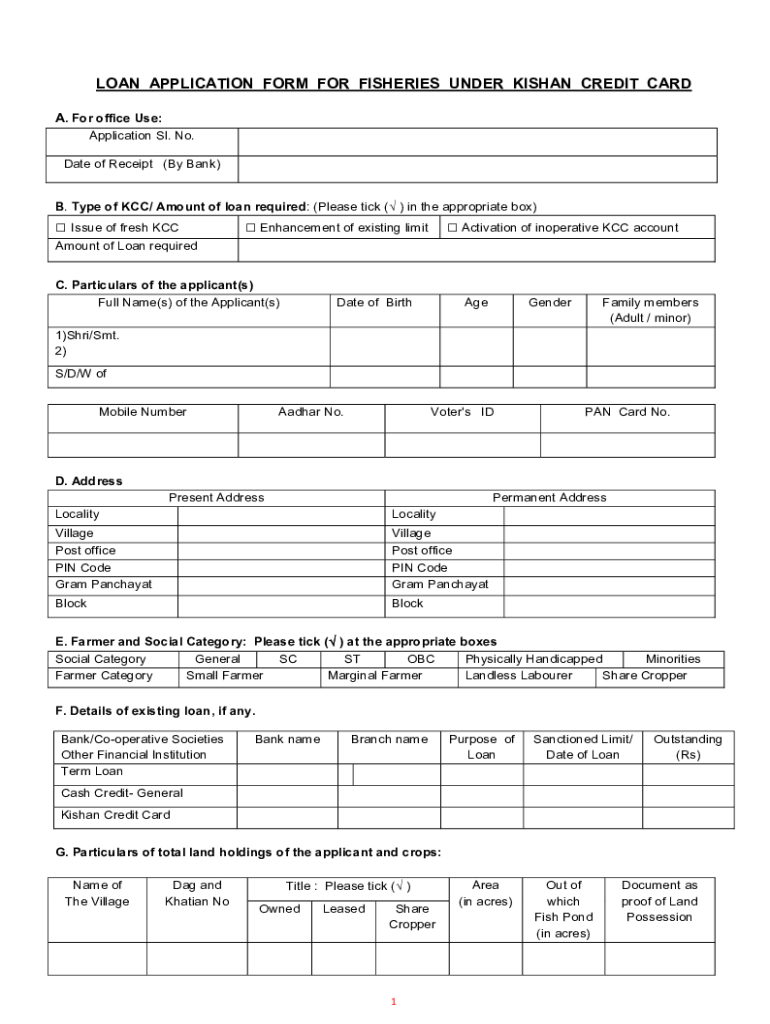

The loan application form for agricultural credit is a standardized document used by individuals or businesses seeking financial assistance for agricultural purposes. This form collects essential information about the applicant, including personal details, financial status, and the specific purpose of the loan. It is designed to streamline the application process and ensure that all necessary information is provided to lenders, facilitating a quicker review and approval process.

Steps to complete the loan application form for agricultural credit

Completing the loan application form for agricultural credit involves several key steps to ensure accuracy and compliance. Begin by gathering all required documentation, such as proof of identity, financial statements, and details about the agricultural project. Next, fill out the application form carefully, providing complete and truthful information. Pay special attention to sections that require financial disclosures and project descriptions. Once the form is completed, review it for any errors or omissions before submitting it to the lender.

Eligibility criteria for the loan application form for agricultural credit

Eligibility for agricultural credit typically depends on several factors, including the applicant's credit history, income level, and the viability of the agricultural project. Lenders may require proof of farming experience or a business plan outlining the intended use of the funds. Additionally, applicants must demonstrate their ability to repay the loan, which may involve providing financial statements or tax returns. Understanding these criteria is essential for a successful application.

Required documents for the loan application form for agricultural credit

When applying for agricultural credit, specific documents are commonly required to support the loan application. These may include:

- Proof of identity, such as a driver's license or passport

- Financial statements, including income statements and balance sheets

- Tax returns for the past two years

- A business plan detailing the agricultural project

- Collateral documentation, if applicable

Providing these documents helps lenders assess the applicant's financial situation and the feasibility of the proposed project.

How to obtain the loan application form for agricultural credit

The loan application form for agricultural credit can typically be obtained from various sources, including banks, credit unions, and agricultural lending institutions. Many lenders offer the form online for easy access, allowing applicants to download and print it. Additionally, some government agencies may provide the form as part of their agricultural financing programs. It is advisable to check with multiple lenders to find the most suitable option for your needs.

Legal use of the loan application form for agricultural credit

The legal use of the loan application form for agricultural credit is governed by federal and state regulations. It is essential for applicants to ensure that the information provided is accurate and truthful, as any misrepresentation can lead to legal consequences, including denial of the loan or potential fraud charges. Additionally, lenders must comply with lending laws, ensuring that the application process is fair and transparent.

Quick guide on how to complete loan application form for agricultural credit

Complete Loan Application Form For Agricultural Credit effortlessly on any device

Online document administration has increased in popularity among businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, as you can easily find the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage Loan Application Form For Agricultural Credit on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest method to alter and eSign Loan Application Form For Agricultural Credit with ease

- Find Loan Application Form For Agricultural Credit and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important portions of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Loan Application Form For Agricultural Credit and guarantee exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loan application form for agricultural credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the cup loan program application?

The cup loan program application is a streamlined process that allows businesses to apply for loans efficiently. By utilizing airSlate SignNow, applicants can easily fill out, sign, and submit their loan applications electronically, simplifying the entire experience.

-

How does the cup loan program application benefit businesses?

The cup loan program application offers numerous benefits, including faster processing times and reduced paperwork. With airSlate SignNow, businesses can ensure that their applications are completed accurately and submitted promptly, helping them secure funding more quickly.

-

What features are included in the cup loan program application?

The cup loan program application includes features such as electronic signature capabilities, document templates, and real-time tracking. These features enhance efficiency and make it easier for users to manage their applications from start to finish.

-

Is the cup loan program application easy to use?

Yes, the cup loan program application is designed to be user-friendly and intuitive. airSlate SignNow empowers users to navigate the application process with ease, ensuring they can focus on their business goals without getting bogged down by complicated forms.

-

What is the pricing for the cup loan program application?

The pricing for the cup loan program application varies based on the selected plan. airSlate SignNow offers competitive pricing options, allowing businesses to choose a solution that fits their budget while still accessing powerful features to enhance their loan application experience.

-

Can I integrate the cup loan program application with other software?

Absolutely! The cup loan program application supports several integrations with popular software and CRM systems. This allows businesses to streamline their processes and ensure that their applications are seamlessly connected with existing workflows.

-

Is my data secure with the cup loan program application?

Yes, airSlate SignNow prioritizes data security for all users of the cup loan program application. With advanced encryption and compliance with industry standards, businesses can confidently manage sensitive loan information knowing it is protected.

Get more for Loan Application Form For Agricultural Credit

Find out other Loan Application Form For Agricultural Credit

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF