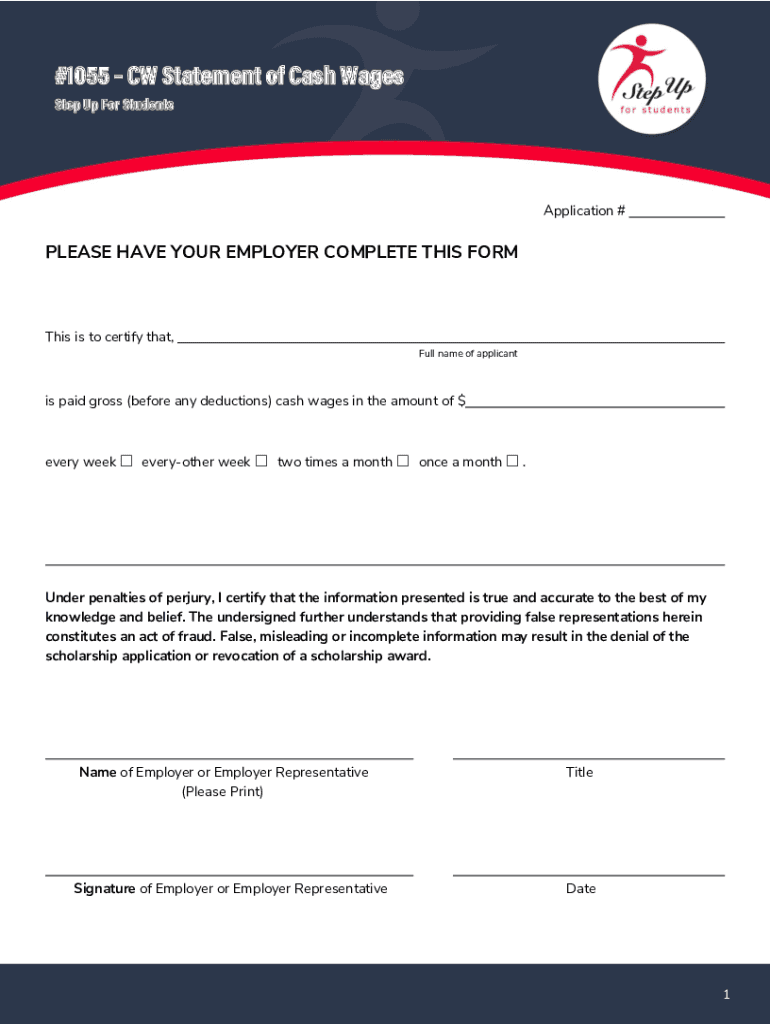

#1055CW Statement of Cash Wages 2023-2026

What is the Form 1055?

The Form 1055, also known as the Statement of Cash Wages, is a document primarily used for reporting cash wages paid to employees. This form is essential for businesses that operate in the United States and need to provide accurate wage information to the Internal Revenue Service (IRS). It helps ensure compliance with tax regulations and aids in the proper calculation of payroll taxes. Understanding its purpose is crucial for employers to maintain transparency and accountability in their financial reporting.

How to Use the Form 1055

Using the Form 1055 involves several straightforward steps. First, gather all necessary information regarding the cash wages paid to employees during the reporting period. This includes details such as employee names, Social Security numbers, and the total cash wages paid. Next, accurately fill out the form, ensuring that all figures are correct to avoid discrepancies. Once completed, the form must be submitted to the appropriate tax authority, typically the IRS, as part of your payroll tax filings. Utilizing digital tools can streamline this process, making it easier to manage and submit the form securely.

Steps to Complete the Form 1055

Completing the Form 1055 requires careful attention to detail. Follow these steps for accuracy:

- Collect all relevant employee wage data for the reporting period.

- Enter the employee's name and Social Security number in the designated fields.

- Input the total cash wages paid to each employee during the specified period.

- Review the information for accuracy, ensuring no errors are present.

- Sign and date the form to certify its accuracy.

- Submit the completed form to the IRS by the specified deadline.

Legal Use of the Form 1055

The Form 1055 is legally binding when completed and submitted according to IRS regulations. To ensure its legal validity, businesses must adhere to specific guidelines regarding the accuracy of the information provided. This includes maintaining proper records of cash wages and ensuring that all employee details are correct. Compliance with federal and state laws regarding wage reporting is essential to avoid potential penalties and legal issues.

Filing Deadlines for the Form 1055

Filing deadlines for the Form 1055 are critical for compliance. Typically, this form must be submitted along with other payroll tax documents by the end of the first quarter following the end of the tax year. For most businesses, this means that the form is due by April 30. It is important to stay informed about any changes to deadlines or requirements set forth by the IRS to avoid late filing penalties.

Examples of Using the Form 1055

Employers may encounter various scenarios where the Form 1055 is applicable. For instance, a small business owner paying cash wages to employees needs to report these payments accurately to the IRS. Another example includes a contractor who hires temporary workers and pays them in cash. In both cases, the completion and submission of the Form 1055 are necessary to comply with tax regulations and ensure proper reporting of wages.

Quick guide on how to complete 1055cw statement of cash wages

Complete #1055CW Statement Of Cash Wages seamlessly on any device

Managing documents online has grown increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed papers, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents quickly without delays. Handle #1055CW Statement Of Cash Wages on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign #1055CW Statement Of Cash Wages effortlessly

- Locate #1055CW Statement Of Cash Wages and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign #1055CW Statement Of Cash Wages and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1055cw statement of cash wages

Create this form in 5 minutes!

How to create an eSignature for the 1055cw statement of cash wages

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1055 and how does it work with airSlate SignNow?

Form 1055 is a specific document that can be easily managed and signed using airSlate SignNow. Our platform allows users to upload the form, add their electronic signatures, and send it securely. With airSlate SignNow, you can streamline the completion of Form 1055, ensuring it is both efficient and legally binding.

-

What are the key features of airSlate SignNow for managing Form 1055?

airSlate SignNow offers several features that enhance the handling of Form 1055, including customizable templates, automated workflows, and real-time tracking of document status. Users can also benefit from advanced security protocols that protect sensitive information within Form 1055. These functionalities make it easier for businesses to manage their documentation processes.

-

Is there a free trial available for using airSlate SignNow with Form 1055?

Yes, airSlate SignNow offers a free trial that allows prospective users to explore the features available for managing Form 1055. During this trial, you can test the platform's capabilities without any commitment, giving you the opportunity to see how it can benefit your business. Sign up today to start your free trial!

-

What are the pricing options for airSlate SignNow for using Form 1055?

airSlate SignNow offers flexible pricing plans that cater to various business needs, allowing you to manage Form 1055 efficiently. Pricing tiers include options for small businesses and enterprises, each with features to streamline document management. You can easily choose a plan that suits your budget and requirements.

-

Can I integrate airSlate SignNow with other applications while using Form 1055?

Absolutely! airSlate SignNow supports integrations with a range of applications, allowing you to connect workflows seamlessly while managing Form 1055. Whether you use CRM systems, cloud storage, or other productivity tools, these integrations enhance your document management experience.

-

What benefits does airSlate SignNow provide for processing Form 1055?

Using airSlate SignNow for processing Form 1055 brings numerous benefits, such as increased efficiency, reduced turnaround times, and enhanced collaboration among users. The ability to eSign documents securely reduces the need for physical paperwork, streamlining your workflows and providing a better user experience.

-

How secure is my data when using airSlate SignNow for Form 1055?

Security is a top priority at airSlate SignNow. When you use our platform for Form 1055, your data is protected through industry-standard encryption and privacy measures. We comply with regulations to ensure that your sensitive information remains secure throughout the signing process.

Get more for #1055CW Statement Of Cash Wages

Find out other #1055CW Statement Of Cash Wages

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online