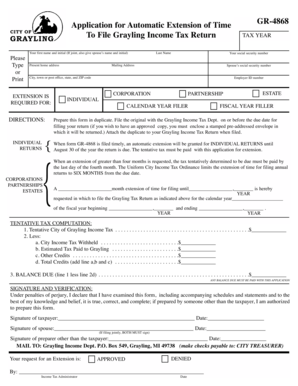

Application for Automatic Extension of Time GR 4868 Form

What is the Application For Automatic Extension Of Time GR 4868

The Application For Automatic Extension Of Time GR 4868 is a form used by taxpayers in the United States to request an extension for filing their federal income tax returns. This form allows individuals and businesses to extend their filing deadline by six months, providing additional time to prepare their tax documents without incurring penalties for late filing. It is essential to note that while the form grants an extension for filing, it does not extend the time to pay any taxes owed. Taxpayers must estimate their tax liability and pay any amount due by the original filing deadline to avoid interest and penalties.

Steps to complete the Application For Automatic Extension Of Time GR 4868

Completing the Application For Automatic Extension Of Time GR 4868 involves several straightforward steps:

- Obtain the form from the IRS website or other reliable sources.

- Fill in your personal information, including your name, address, and Social Security number or Employer Identification Number.

- Estimate your total tax liability for the year, including any payments made throughout the year.

- Calculate the amount you are paying with the application, if applicable.

- Sign and date the form to certify the information provided is accurate.

- Submit the completed form by the original due date of your tax return.

IRS Guidelines

The IRS provides specific guidelines regarding the Application For Automatic Extension Of Time GR 4868. Taxpayers must ensure they file the application by the original due date of their tax return to qualify for the extension. The IRS allows electronic filing of the form, which can expedite the process. It is crucial to follow the instructions carefully, as any errors may lead to denial of the extension. Additionally, taxpayers should retain a copy of the submitted form for their records, as it serves as proof of the extension request.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the Application For Automatic Extension Of Time GR 4868 is vital for compliance. The form must be submitted by the original due date of the tax return, typically April 15 for individual taxpayers. If the deadline falls on a weekend or holiday, it is extended to the next business day. The extended filing deadline, if the application is approved, is usually October 15. Taxpayers should mark these dates on their calendars to ensure timely submission and avoid penalties.

Eligibility Criteria

To be eligible to use the Application For Automatic Extension Of Time GR 4868, taxpayers must be filing a federal income tax return. This includes individuals, corporations, partnerships, and trusts. There are no specific income or filing status restrictions; however, taxpayers must ensure they are in good standing with the IRS. If a taxpayer has filed for an extension in previous years, they should also check for any outstanding issues that could affect their eligibility for the current year.

Form Submission Methods

Taxpayers can submit the Application For Automatic Extension Of Time GR 4868 through various methods. The form can be filed electronically using IRS-approved e-filing software, which is often the quickest option. Alternatively, taxpayers can mail a paper version of the form to the appropriate IRS address, depending on their location. In some cases, individuals may also choose to deliver the form in person to their local IRS office. Regardless of the method chosen, it is essential to ensure the form is submitted by the original due date to secure the extension.

Quick guide on how to complete application for automatic extension of time gr 4868

Easily prepare Application For Automatic Extension Of Time GR 4868 on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your files quickly without any holdups. Manage Application For Automatic Extension Of Time GR 4868 on any device through airSlate SignNow’s Android or iOS applications and simplify your document processes today.

How to modify and electronically sign Application For Automatic Extension Of Time GR 4868 effortlessly

- Obtain Application For Automatic Extension Of Time GR 4868 and click on Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Mark important sections of the documents or obscure confidential information using tools specifically designed by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to share your form: via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and electronically sign Application For Automatic Extension Of Time GR 4868 to ensure excellent communication throughout every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for automatic extension of time gr 4868

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Application For Automatic Extension Of Time GR 4868?

The Application For Automatic Extension Of Time GR 4868 is a form that allows taxpayers to request an extension for filing their tax returns. This application helps individuals and businesses manage their tax deadlines more effectively and avoid penalties for late submissions.

-

How can airSlate SignNow help with the Application For Automatic Extension Of Time GR 4868?

airSlate SignNow simplifies the process of completing and submitting the Application For Automatic Extension Of Time GR 4868 by providing an intuitive eSigning interface. Users can easily fill out the necessary fields and send the application securely to the IRS, ensuring compliance and efficiency.

-

What are the costs associated with using airSlate SignNow for the Application For Automatic Extension Of Time GR 4868?

airSlate SignNow offers competitive pricing plans that cater to various business needs. While specific costs depend on the chosen plan, the platform provides a cost-effective solution for managing documents, including the Application For Automatic Extension Of Time GR 4868, without hidden fees.

-

Are there any integrations available for the Application For Automatic Extension Of Time GR 4868 with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, enabling users to streamline their workflow when handling the Application For Automatic Extension Of Time GR 4868. Integrations with popular tools like Google Drive, Salesforce, and Dropbox make it easy to manage documents.

-

What are the main benefits of using airSlate SignNow for filing the Application For Automatic Extension Of Time GR 4868?

Utilizing airSlate SignNow for the Application For Automatic Extension Of Time GR 4868 offers several benefits, including enhanced security, efficient document management, and easy access to your files. Additionally, the ability to eSign documents quickly increases overall productivity.

-

How secure is the handling of my Application For Automatic Extension Of Time GR 4868 with airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including the Application For Automatic Extension Of Time GR 4868. The platform uses advanced encryption and compliance measures, safeguarding your sensitive information from unauthorized access.

-

Can I track the status of my Application For Automatic Extension Of Time GR 4868 in airSlate SignNow?

Yes, airSlate SignNow allows users to track the status of their documents in real time, including the Application For Automatic Extension Of Time GR 4868. You will receive notifications when the application is viewed or signed, keeping you informed throughout the process.

Get more for Application For Automatic Extension Of Time GR 4868

Find out other Application For Automatic Extension Of Time GR 4868

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template